Pre-retirees react strongly to changing conditions

A friend of mine who is a financial advisor recently shared some observations with me regarding the evolution in retirement philosophies over the past fifteen to twenty years. Earlier in his career, he saw retirees and pre-retirees emphasizing debt-free living in their golden years, able to survive comfortably on the interest and appreciation of their investments. They were conservative, frugal and disciplined. They established a retirement plan early on and stayed with it, and many were fortunate to have worked in an era where defined-benefit (DB) pension plans were commonplace.

Now, my friend noted that guaranteed pensions are rapidly disappearing, with the risk of outliving your savings shifting from employers to retirees. Additionally, those now approaching retirement—as well as those who are recently retired—are carrying a higher cost of living into their non-working years, creating a new set of challenges and triggering a mixed bag of emotions even during relatively robust economic times.

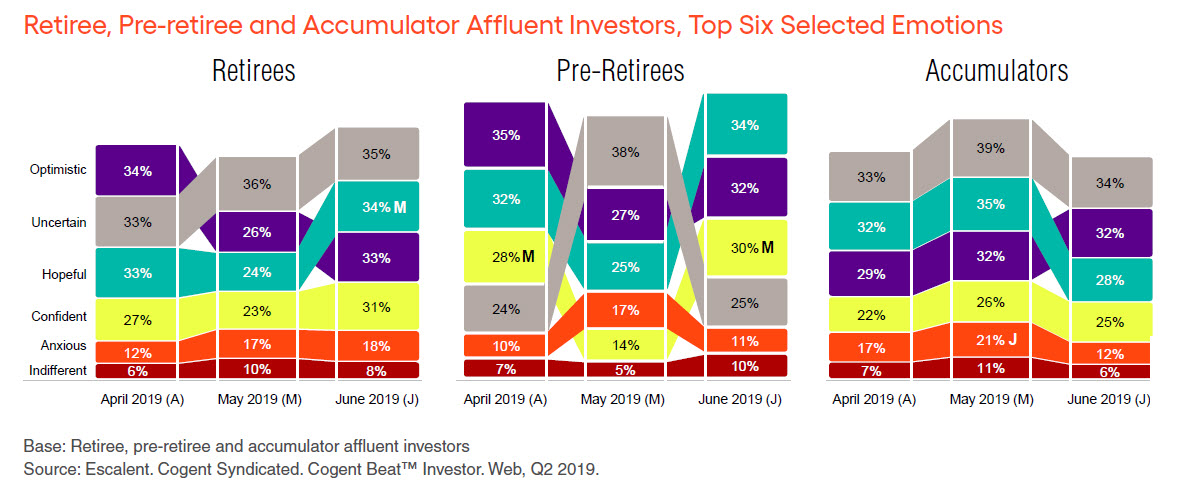

While there are many similarities in affluent investor’s feeling about the investment environment by retiree status—retirees (fully retired), pre-retirees (5 or fewer years to retirement) and accumulators (more than 5 years to retirement)—there are also distinct differences that are important for financial services firms to recognize in order to develop and offer products and services that speak to their needs.

Most notably, with their relatively short time horizon to retirement limiting their ability to adapt, pre-retirees express greater volatility in their emotional reaction to changing economic conditions. As Q2 began, pre-retirees were generally optimistic, hopeful and confident, with the same holding true at quarter’s end. However, the mid-quarter downturn greatly impacted pre-retiree sentiment, with a big spike in uncertainty (anxiety to a lesser degree). At the same time, optimism, hope and confidence waned substantially.

By way of contrast, those already in retirement exhibit a more consistent pattern of optimism, hope, uncertainty and confidence. That said, the May market downturn adversely impacted retirees’ optimism and confidence, with the June market rebound again finding these positive emotions on the ascent.

With more time than pre-retirees to adjust their retirement plan and investment strategy, accumulators exhibit the most stable emotional profile. April found accumulators generally feeling a mix of uncertainly, hope, optimism and confidence, with the same holding true even during the May downturn. As conditions improved in June, accumulators ended the quarter feeling less uncertain and anxious, but also a little less hopeful.

So how can distributors and product providers be most effective in responding to investors already in retirement, as well as those with shorter- and longer-term retirement horizons? For pre-retirees, it’s critical to focus on investment strategies that take into account the greater emotional swings these investors have in response to fluctuating market conditions. For accumulators and retirees, it’s important to note that while they generally maintain a more positive and stable emotional outlook, they also exhibit a consistent feeling of uncertainty. In response, providers should proactively remind and reassure these investors of the factors they can control with respect to managing their assets—particularly in these changing times.

We track investor sentiment on a monthly basis through Cogent Beat Investor and share these findings each quarter through our newsletter. Click below to subscribe and get on our distribution list!