At Cogent Syndicated, I’ve dedicated a decade of my career to helping financial services providers understand their unique brand positioning in the marketplace and recommending which levers to pull to increase their brand consideration, satisfaction and loyalty within their target customer segments.

However, as powerful as one or two individual attributes such as brand trustworthiness can be in boosting brand consideration, we often hear clients asking, what are the relationships between all the different brand attributes? How do they work together to build consideration, and how can we tell a more cohesive brand story?

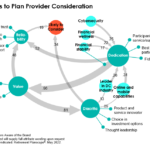

In this year’s Retirement Planscape study, we are excited to introduce a new “Paths to Consideration” analysis designed to help DC plan providers and DC investment managers understand how individual attributes function together and help predict aided brand consideration.

Using a structural equation model (SEM), we found the most direct pathways to consideration for DC plan providers are being Diacritic (a combination of product and service innovation, choice in investment options and thought leadership) and demonstrating Reliability (through brand trustworthiness, being easy to do business with, and plan sponsor service and support).

Meanwhile, the most efficient way for DC investment managers to build consideration is by strengthening perceptions of Reliability (brand trustworthiness and style purity) and Expertise (target date solutions, investment philosophy, investment research, portfolio/risk management, and investment performance).

Let’s take a closer look at the DC plan provider market. An analysis of the 17 different brand attributes tracked in our research reveals four distinct clusters—Reliability, Value, Diacritic and Dedication—and five individual variables: cybersecurity, financial wellness, financial stability, DC industry leadership, and online and mobile capabilities. The arrows indicate the casual relationships or pathways with each other and, ultimately, to the “likely to consider” outcome variable.

Here, we can see Diacritic and Reliability are the two distinct predictors of consideration, with Diacritic offering the strongest pathway (0.34 vs. 0.19). For DC plan providers, this means the quickest way to boost consideration is via stronger perceptions of product and service innovation, choice in investment options and thought leadership (Diacritic) and brand trustworthiness, being easy to do business with, and plan sponsor service and support (Reliability).

Like it or not, oftentimes “a brand’s perception is a brand’s reality.”

Depending on the degree in which plan providers can effectively differentiate themselves, not every firm will be able to pursue each pathway—the key is choosing the right path based on an informed understanding of your current brand perceptions and the most pressing issues your target customers face.

That said, it’s also beneficial to examine the indirect pathways providers can use as secondary levers and help fortify their brand marketing efforts. Dedication, for example, has a direct link to Reliability but also plays an instrumental role in creating Value (good value and fee transparency), which ladders up to both Diacritic and Reliability. Cybersecurity, financial wellness and financial stability each individually feed into Dedication, which comprises participant service and support, acting in the best interest of participants, fiduciary support, and dedication to retirement goals. Meanwhile, DC industry leadership and online and mobile capabilities are clear conduits to Dedication and funnel into Diacritic.

We also ran this SEM analysis by plan size segments and found the models are generally consistent in overall structure. The only exception can be found among Large-Mega plan sponsors with $100M+ in plan assets, in which there is no pathway between online and mobile capabilities and Diacritic, but it remains linked with Dedication.

Once again, it’s critical for DC plan providers to understand their current plan sponsor perceptions before trying to forge a reality that just might not be there yet. Our goal is for firms to use this analysis as a blueprint for understanding the various conduits to success and making an educated decision on which pathway makes the most sense to pursue.

Want to know more? Send us a note to learn which brand attributes your firm is best associated with and which pathway is best suited to maximize your future recordkeeper consideration.

Or, click below for more about the full report.