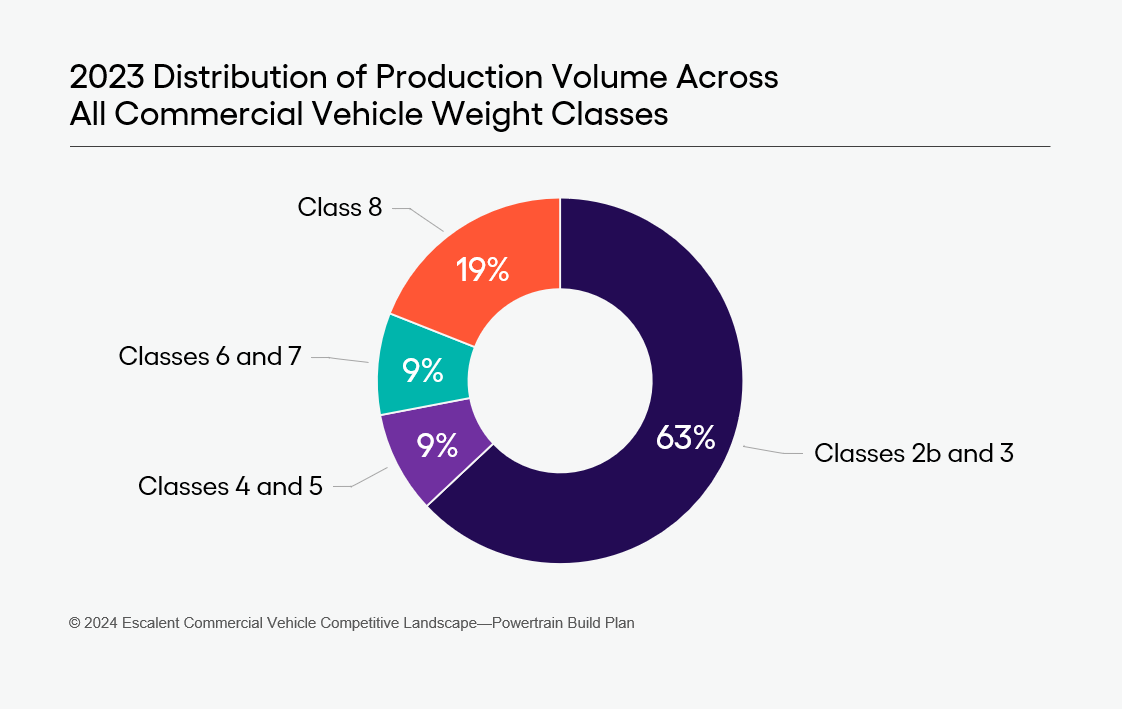

Classes 4 and 5 commercial vehicles are an important segment in the North American commercial vehicle market, capturing 9% of the overall market (classes 2b through 8). While this percentage might seem small, this segment offers much value and opportunity due to the essential industries it serves, as well as the diversified applications of these vehicles.

In part 1 of this two-part miniblog series, original equipment manufacturers (OEMs), body companies and suppliers will learn the current state of the overall classes 4 and 5 commercial vehicle market. You’ll also get to know the most common use cases, top players and market outlooks for conventional and low cab forward (LCF) trucks.

In part 2, you’ll learn more about stripped chassis and cutaways as well as take away strategic recommendations for success in this segment.

Where We Are Now With Classes 4 and 5 Commercial Vehicles

Although classes 4 and 5 commercial vehicles have a smaller market share compared with other weight classes, they play crucial roles in industries such as construction, utilities, delivery and logistics, landscaping, and municipal and government services.

To uncover the top use cases and vehicle types, Escalent, in collaboration with Work Truck Solutions, analyzed data from Work Truck Solutions’ Comvoy.com, a searchable online marketplace for work-ready trucks. These data and insights make up our Commercial Vehicle Truck Insights offering, a first-of-its-kind solution that brings together current and future commercial vehicle supply, demand, inventory and sales data into a comprehensive view that enables OEMs, body manufacturers and suppliers to produce vehicles that help end users work more efficiently.

Classes 4 and 5 commercial vehicles are used to transport materials and supplies as well as carry tools and perform work with on-board equipment, such as cranes. Ford, GM and Stellantis have trucks with conventional cabs, which account for the largest share of classes 4 and 5 trucks, while Japanese OEMs, such as Isuzu and Hino, offer their LCF products in the segment.

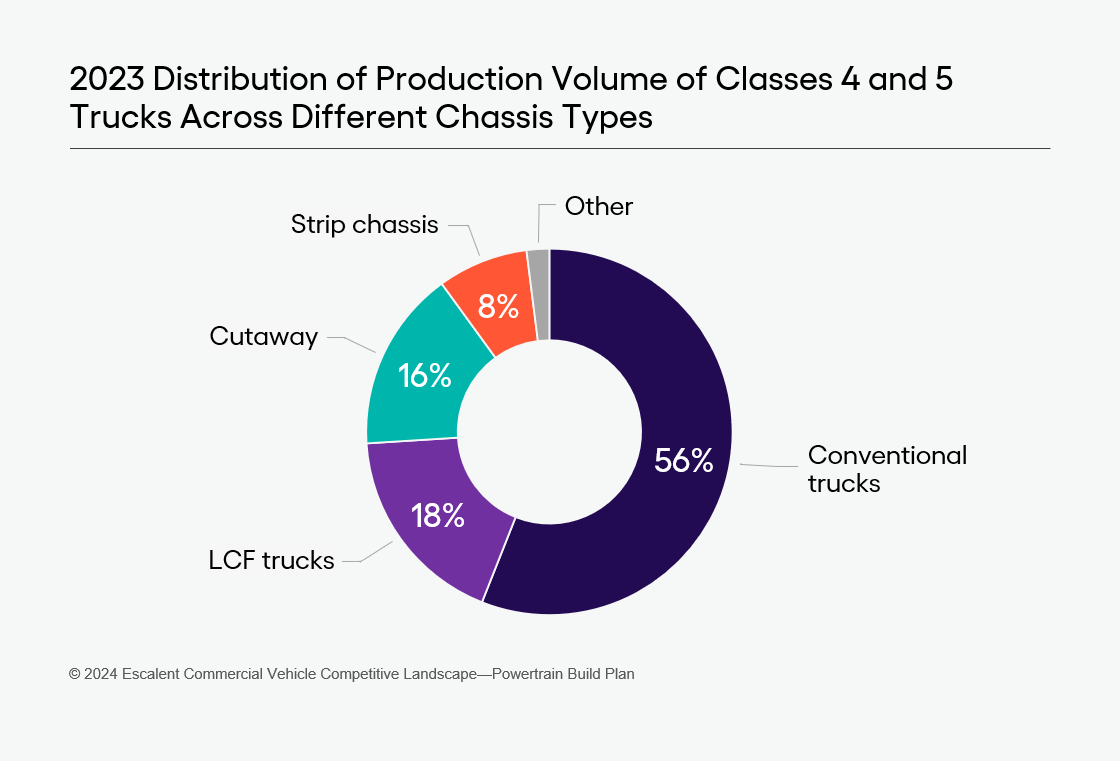

Commercial vehicles in classes 4 and 5 are categorized into four primary chassis types. Operators choose the specific chassis type to meet their operational needs:

- Conventional trucks: Used in construction, utilities and services as well as by municipalities

- LCF trucks: Used in retail and wholesale delivery services and landscaping

- Cutaways: Equipped with box vans or configured as school buses and airport shuttles

- Stripped chassis: Outfitted with step/walk-in van bodies, ideal for delivery operations

For each of these chassis types, we’ll explore offerings from OEMs, including powertrains, drivetrains, body types and use cases. We’ll also suggest future trends and advancements to provide a complete picture of the classes 4 and 5 commercial vehicle landscape.

The Current State of Conventional Cab Trucks

Conventional trucks have relatively short body lengths with the engine located in front of the cab, under the hood. Conventional trucks are the top choice of buyers and contribute the highest sales volume (56%) of classes 4 and 5 commercial vehicles. Most of the volume is now in class 5. Due to a higher gross vehicle weight rating (GVWR), buyers prefer class 5 trucks, as the cost difference between classes 4 and 5 is insignificant.

Conventional Truck OEMs and Cab Configurations

Ford leads the segment with the F-450 and F-550 Super Duty line of trucks. Both trucks come with three cab options: regular, crew and extended, available as 4×2 or 4×4 axle configurations. Ford is the only OEM to offer a factory pickup truck (F-450). All other models are upfitted with a body.

General Motors’ Silverado 4500/5500 and International CV are similar products of a joint venture between the two companies but independently distributed. Ram and GM/International offer regular and crew cab configurations, along with the options of 4×2 and 4×4. Crew cabs are very important (30%) when transport of people is required, and there’s a high penetration (63%) of 4×4 vehicles.

Conventional Truck Powertrains and Drivetrains

Diesel engines are the go-to powertrain types for conventional trucks, with 77% share, followed by gasoline, with 23% share, most of which is contributed by class 4. Conventional trucks are used in construction, landscaping, utility, service and municipal applications, where the trucks might be required for off-road use, and in northern US states and Canada for work in slippery conditions.

Conventional Truck Body Types and Vocational Applications

Conventional trucks have a longer cab, which limits the length of the body that can be upfit. This is why they’re often used in dump and service utility applications. Contractors use these trucks for construction, with contractors’ body, service body and flatbed upfits for material handling and equipment transportation.

Municipalities use conventional trucks with dump bodies for material handling and road maintenance, and conventional trucks often double as snowplows in winter. Utility companies use these vehicles for their maintenance operations with crane bodies, boom bodies and mechanics bodies. Typically deployed in crew body configurations, conventional trucks carry multiple people to the job site.

These trucks are also upfitted with wrecker body or rollback body for use in towing and wrecker applications. Finally, they’re used to tow heavy equipment, such as back hoes, and for towing heavy vehicles, such as RVs, motor homes and boats.

What Lies Ahead for Conventional Cab Trucks?

Currently, there are no classes 4 and 5 battery electric trucks outside of a few aftermarket conversions. The relatively short lengths, many times with body equipment below the frame rails, make packaging batteries a challenge. However, prompted by new and ever-changing emissions regulations in the US, Canada and worldwide, we expect battery electric vehicles (BEVs) will gradually be introduced by the three OEMs. Zeus and Xos are also promising new class 5 conventional BEVs.

Toward the end of the decade, we expect to see hydrogen fuel cells as an alternative solution to BEVs. These cells can be efficiently packaged in smaller cab-to-axle spaces. GM is working on a class 5 Silverado fuel cell using its proprietary technology.

The Current State of Low Cab Forward Trucks

Low cab forward trucks, or cabover designs, have the engine under the cab, without a hood. These trucks offer superior visibility and maneuverability compared with conventional trucks. The shorter cab also allows for longer body lengths, making them more suited to carry higher-cubic-capacity loads, such as linen and package deliveries.

LCF Truck OEMs and Cab Configurations

Isuzu comprises the most volume of LCF trucks with its N-Series trucks and Chevrolet’s LCF, which is a rebadged Isuzu product. Isuzu has introduced its N-Series electric truck, which offers multiple wheelbase and battery pack options.

Ninety percent of the trucks have regular cabs, but Isuzu and GM offer crew cabs, which are popular with landscape contractors. Hino and RIZON also offer electric vehicle (EV) trucks in this segment. Blue Arc and Bollinger are other EV-only startups that offer classes 4 and 5 LCF trucks in their product lineup.

LCF Truck Powertrains and Drivetrains

Historically, LCF trucks were powered by diesel engines, but recent trends based on Escalent’s Commercial Vehicle Competitive Landscape—Powertrain Build Plan show that more than 65% of these trucks are gasoline powered. Gasoline is favored for its ease of use and ready fuel availability and seems certain to increase in popularity vs. diesel.

LCF vehicles are rear-wheel drive (RWD) 4×2 trucks. Battery electric trucks are available or coming this year and we expect EV penetration to be higher than for conventional trucks due to LCF trucks’ use in urban delivery applications and easier mounting of batteries.

LCF Truck Body Types and Vocational Applications

LCF trucks are known for their ability to fit a longer box on their chassis—up to 24 feet—which is advantageous for wholesale and retail delivery applications as well as food and beverage deliveries, including use of refrigerated bodies.

LCF trucks are also used in landscaping applications and with long contractor bodies to carry materials, such as mulch. In addition, LCF trucks are used for home goods delivery and installation.

What Lies Ahead for Low Cab Forward Trucks?

LCF trucks make a good case for electrification as they’re primarily used in low-weight, high-volume freight applications and have low daily mileages. Startups, such as Rizon and Bollinger, are trying to gain an advantage in this space. OEMs that offer fleet management services and upfitter integration can have a competitive advantage in this space as they offer cost savings for small fleets that deploy these vehicles. Innovative upfit designs and materials, such as curb access, side doors and lift gates, are other ways to attract potential customers in this segment.

The State of Stripped Chassis and Cutaways, Plus More Insights and Recommendations

Now that you understand the overall landscape of classes 4 and 5 commercial vehicles, including conventional and LCF trucks, check out part 2 of this miniblog series where you’ll learn about:

- The market, uses and configurations for stripped chassis and cutaways

- Which brands dominate these segments and upcoming developments to watch

- Recommendations you can follow to ensure you’re offering the highest-value commercial vehicles and features to keep you at the top of the market

Reach out to us using the form below to learn more about how our commercial vehicle and fleet experts can provide you with a holistic view of current and future commercial vehicle supply, demand, inventory and sales data for more accurate and effective product and strategic planning.

Want to learn more? Let’s connect.