It’s safe to say that ridesharing services like Uber and Lyft are an integral part of the automotive and mobility landscape as the global rideshare industry is projected to grow from $51B in 2017 to over $220B by 2025. Ridesharing has become a reliable and relatively safe option for out-of-town business and vacation travel, getting around locally, or simply when in a pinch. A growing number of consumers, especially in urban markets, are even opting to forego private vehicle ownership altogether given the convenience of summoning a rideshare service with the push of a button on a phone app. The appeal of no parking, insurance, fuel, maintenance and, of course, personal responsibility has won over many, even if the collective economics and other conveniences aren’t in favor of ridesharing when traveling a significant number of miles each year.

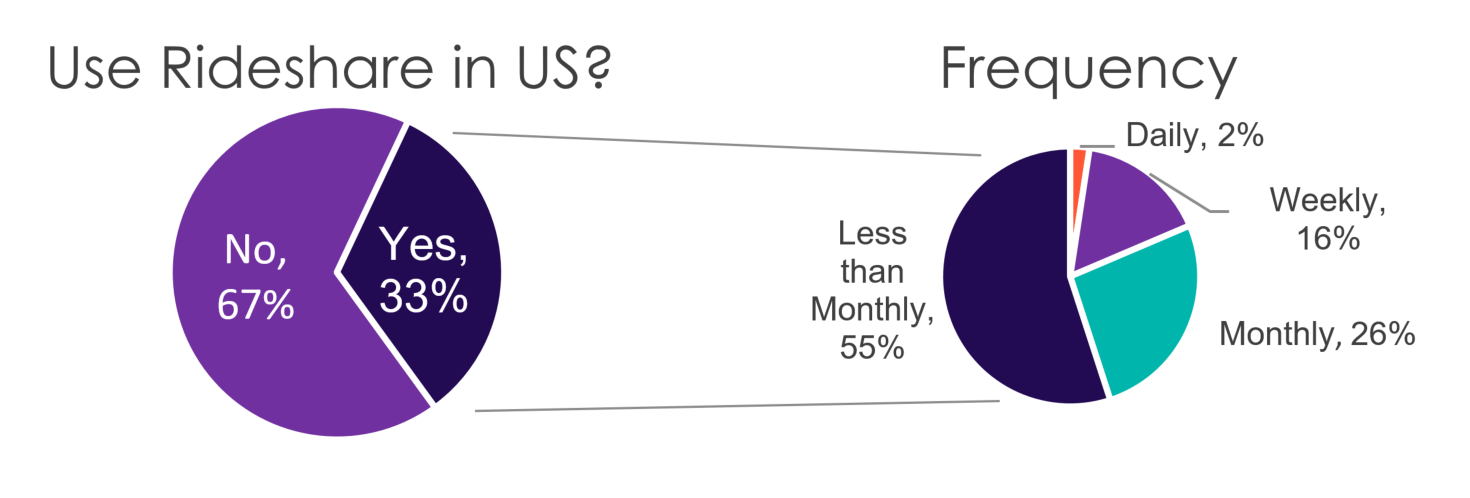

Based on our June-July 2019 Escalent Automotive Consumer Pulse Study, an online survey* conducted monthly among approximately 1,000 US adults 18 years of age and older, one-third of the US adult population are already using rideshare services to varying degrees. Nearly half of these riders have an experience with a rideshare provider at least monthly, which translates to a significant cross-section of exposure to automotive brands. But do these rides have an impact on how consumers perceive automotive brands? Or, perhaps better asked, CAN these rides have an impact on automotive brand perceptions?

Ridesharing to Increase Vehicle Sales

There’s plenty of debate around predictions of the impact of ridesharing on new vehicle sales. While an increasing number of consumers may avoid car ownership, the overall vehicle-miles traveled will likely not decline and are projected to potentially increase as new audiences–such as elderly or disabled people–have growing access to this game-changing mobility option. Therefore, given the faster rate at which miles accumulate, we expect that rideshare vehicle replacement will be on a shorter time cycle than privately-owned vehicles. The need or desire for new technology and vehicle features may also trigger rideshare vehicle owners to purchase new cars sooner, in order to avoid varying degrees of vehicle obsolescence. Rideshare volume (miles driven) is also taking away from traditional mass transit options (such as subway, bus, shuttle, light rail) and, of course, has significantly up-ended the taxi and rental car industry–all supporting the potential for increased vehicle sales.

Branding Opportunities with Rideshare Riders

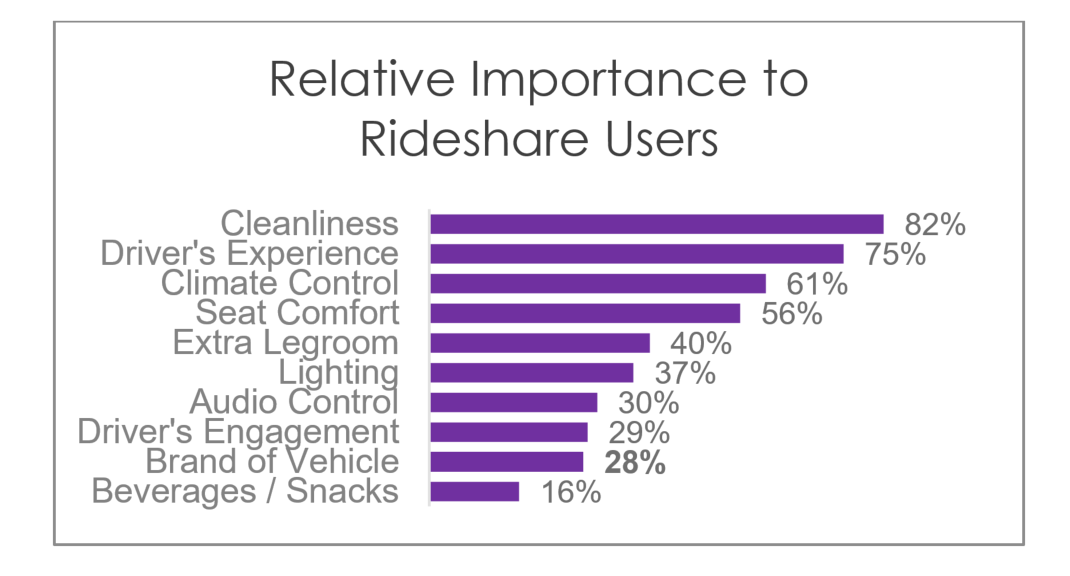

While the potential for increased new car sales due to ridesharing sounds like a windfall for OEMs, the role of the brand itself has the potential to be diluted and considered a commodity to end users of ridesharing services, especially since riders don’t typically have a choice of brand. We dug into this in our study and asked participants about the importance of various aspects of ridesharing. It turns out that the “brand” of rideshare vehicle falls low on the importance continuum for riders when asked how important which brand or model of vehicle picks them up, so long as it is on time and meets their size needs. More than 3 out of 5 people indicated they have no preference at all which brand of vehicle they ride in.

This may seem like counterbalancing bad news for carmakers. However, this can also be interpreted as an opportunity for automotive manufacturers to create a brand impression and experience with as much as one third of the population. This is a significant, captive audience to engage as future prospects and brand advocates, albeit predominantly from the back seat. Rideshare users represent a sizable and growing target audience that marketers should be clamoring to engage using both subtle and overt cues–particularly in models that lend themselves to rideshare usage.

Rideshare Branding Recommendations

Riders, of course, will have preoccupations during their ride other than observing the vehicle they’re in. However, OEMs have the opportunity to help riders take notice of the vehicle they are riding in, and create or change their brand perceptions. Delivering or conveying the highest order needs, such as safety, quality, harmony, and comfort (seat comfort, ride comfort, legroom, comfort of entry, noise, and climate) will leave riders feeling that the vehicle brand can be trusted and is a leader – and may even pleasantly surprise riders. Providing personalization, such as individual climate control, infotainment options, and other connected features, signals a brand that delivers more than expected. Perhaps the most overlooked opportunity is the presence of branding itself with placement of brand logos and naming to reinforce which brand of vehicle riders are experiencing. Having rideshare drivers who are advocates for the vehicle brand would be an added bonus, and might be had for little or no additional cost.

Admittedly, investing in rear seat appointments runs counterintuitive with typical vehicle usage patterns for some classes of privately-owned vehicles; but the stakes are high enough to make a statement with the rideshare audience. It is also noteworthy that every effort to engage rideshare riders can also be a plus for rideshare vehicle owners. Being a differentiated rideshare brand will pay dividends on all fronts. Send us a note to learn more about how your brand could engage this new and evolving pool of consumers.

*Escalent interviewed a national sample of 2,000 consumers aged 18 and up between June and July of 2019. Respondents were recruited from the Dynata and Ipsos panel of US adults and were interviewed online. Quotas were put in place to achieve a sample of age, gender, income, and ethnicity that matches the demographics of the US population. Due to its opt-in nature, this online panel (like most others) does not yield a random probability sample of the target population. As such, it is not possible to compute a margin of error or to statistically quantify the accuracy of projections. Escalent will supply the exact wording of any survey question upon request.