A pandemic problem for pre-retirees

As the pandemic has ravaged the economy, Americans of all ages have been increasingly worried about their personal finances. Not surprisingly, media coverage has been focused on the economic impact on working families who are struggling to make ends meet after losing their jobs and income. While there has been a great deal of attention paid to the health risks facing older generations during the pandemic, there’s been far less focus on the financial impact of COVID-19 on their finances.

It’s not hard to imagine how the economic turmoil fueled by COVID-19 will lead to a decline in both income and retirement savings for seniors. Additionally, given what happened to older workers after the Great Recession, those who lose their jobs in the wake of the pandemic may well find it harder than younger workers to find new jobs at a comparable rate of compensation as the economy begins to recover. This could compromise retirement savings in a number of ways, as many pre-retirees will either wind up unemployed for an extended period, accept a job with substantially less earning power, or be forced into an early retirement. These issues are of even greater concern given a key part of the Social Security benefit calculation is the Average Wage Index for the year a recipient turns 60 years old. That index is almost certain to decline in 2020, and with a prolonged recession and continued high unemployment, it will in 2021 as well. Therefore, unless Congress acts to fill the gap, pre-retirees born in 1960, and possibly 1961, face a 13% cut in lifetime benefits.

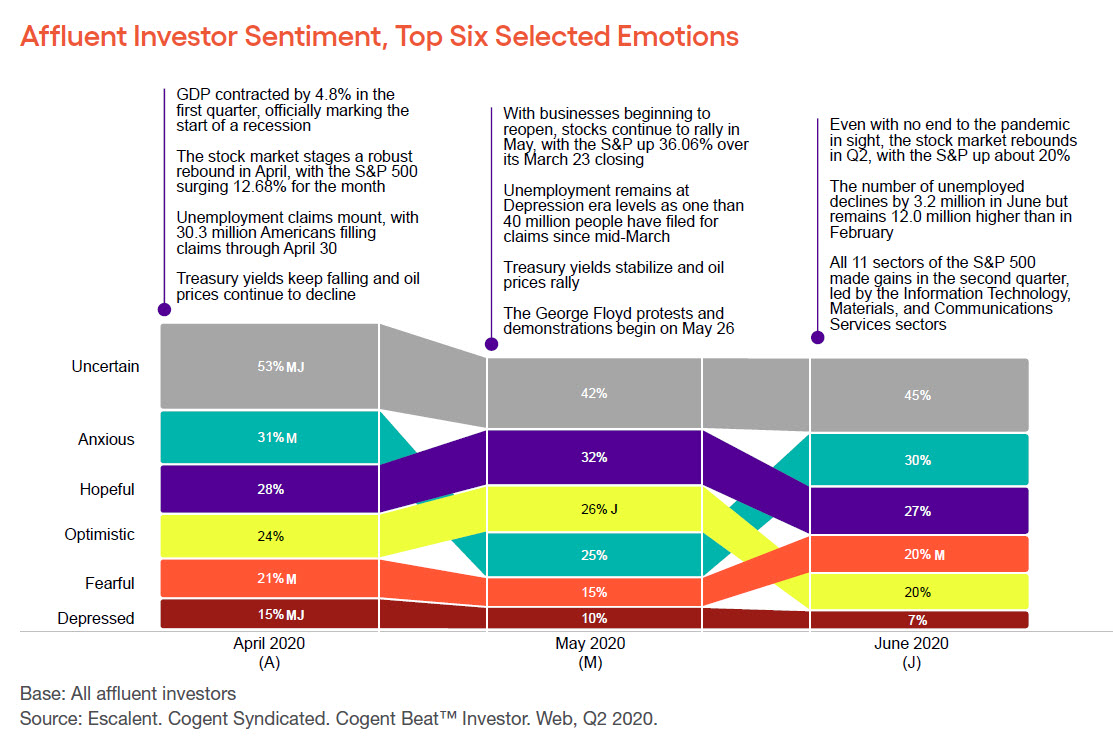

Through our Cogent Beat™ Investor portal, we measure affluent investor sentiment quarterly. As Q2 opened with the country still reeling from the abrupt economic shutdown, affluent investors were again beset with an overwhelming sense of uncertainty and anxiety, with a substantial portion feeling fearful or depressed. Conversely, while pockets of investors were still feeling hopeful and optimistic, those feelings of confidence dropped off the list of the top six dominant emotions. In May, with the CARES Act beginning to buoy the US economy and the stock market in rally mode, affluent investors cited marginally more hope and optimism, while at the same time feeling slightly less uncertain and anxious. As the quarter drew to a close, with no end to the pandemic in sight (despite a continued upturn in the markets and a modest decline in unemployment), uncertainty was once again the dominant emotion. Additionally, investors were both anxious and hopeful in equal measure (as well as fearful and optimistic).

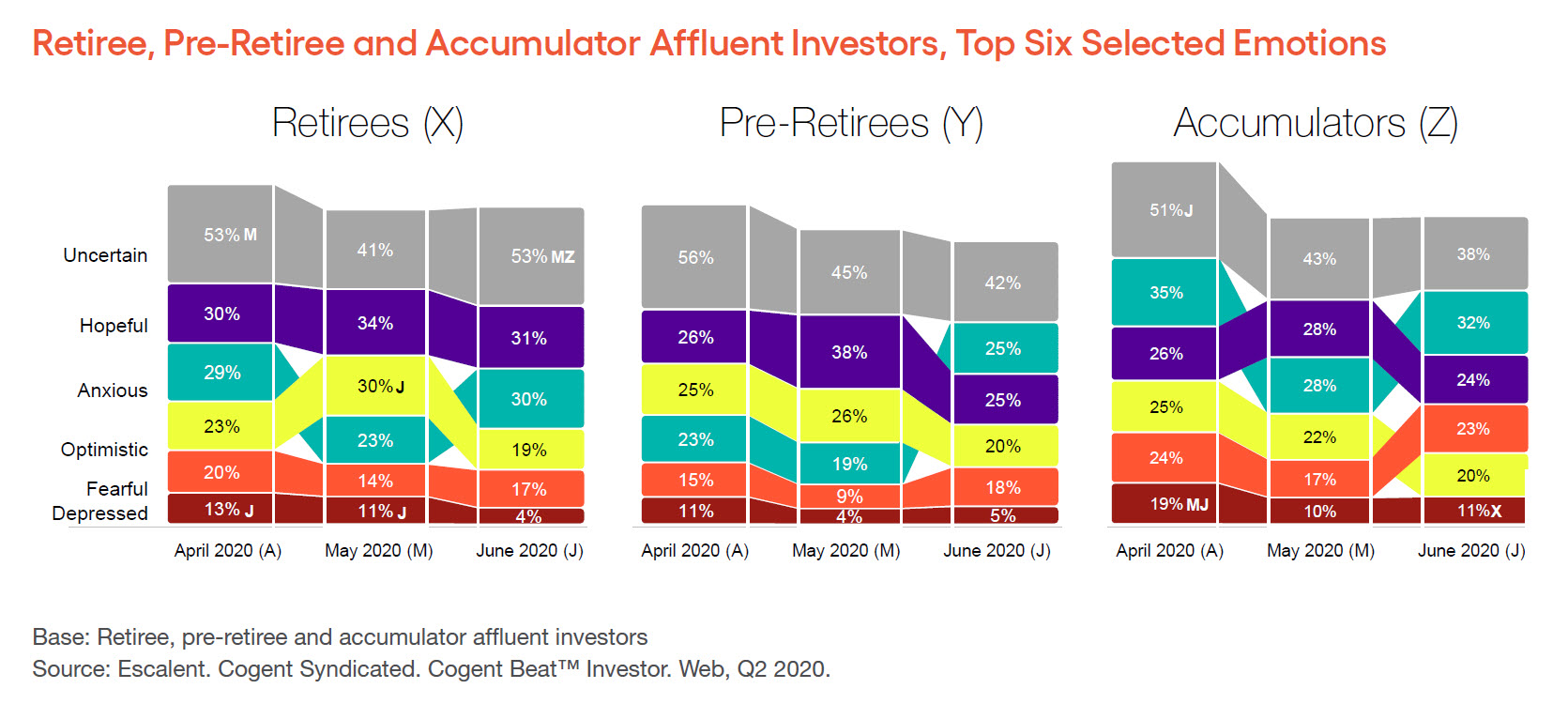

While there are similarities in affluent investor sentiment by retiree status—retirees (fully retired), pre-retirees (five years or fewer until retirement) and accumulators (more than five years to retirement)—there are also differences during the pandemic.

- With a relatively short runway to retirement limiting their ability to adapt to changing circumstances, pre-retirees express the most instability in their emotional reaction to the ever-evolving pandemic landscape. As the quarter began, pre-retirees were dealing with overwhelming feelings of uncertainty, followed most closely by a mix of hopefulness, optimism and anxiety. That said, at quarter’s end, while uncertainly was still the dominant emotion (despite at a diminished level), levels of anxiety were at parity with those of hopefulness and fear with optimism.

- The emotional profile of affluent investors already in retirement is little changed in June versus April, with retirees evidencing a high degree of uncertainty, followed most closely by levels of hope and anxiety. That said, as businesses began to reopen, optimism peaked briefly in May before falling back in June.

- With more time than pre-retirees to make course corrections in their retirement planning, the emotional profile of accumulators is moderately more stable. As was true across all three groups, April found accumulators feeling largely uncertain about the investment environment, as well as anxious (to a lesser degree), followed by a mix of hope, optimism and fear. By the end of Q2, accumulators were still feeling uncertain, hopeful and anxious, with fear edging out optimism.

Given the distinct issues facing investors already in retirement as well as those with shorter- and longer-term retirement horizons, it isn’t surprising that the emotional response of each group to the pandemic differs. Consequently, distributors and product providers need to be sensitive to the greater emotional volatility in how pre-retirees respond. For retirees, it is important to note that while they generally maintain a more positive and stable emotional outlook, they are still grappling with feelings of uncertainty and would benefit from reassurance that their portfolios are still well positioned to provide them with a solid retirement income stream. Finally, while accumulators still have the benefit of time to adapt their investment strategy to changing conditions, asset managers and advice providers still need to provide support and guidance to address the mix of uncertainty, anxiety—and even fear—these investors are dealing with as they plan for the future.

We’ll continue to monitor the impact of the COVID-19 pandemic and global recession on the sentiment of affluent investors over the coming months. For more information on what we track monthly in Cogent Beat Investor, click below.