2022 was tough for institutional investors by multiple measures. Many institutional portfolios registered negative returns, having suffered through the worst year for the equity markets since 2008, rising interest rates that decimated the bond market, wild swings in commodities due to inflation and ongoing political discourse, and multiple cryptocurrency crashes adding to the overall volatility. While corporate pension funding levels were boosted by higher discount rates, their gains were mostly offset by losses in equity holdings. The median return for the largest endowments was in the red by year-end, and the average 401(k) retirement account balance dropped more than 20%, according to Fidelity Investments.

Institutional asset managers responded to market turmoil by ramping up their outreach to institutional clients, offering frequent access to their investment experts both virtually and in person to share perspectives and reassurance. But a lot of this activity just added to the noise. With many firms taking a similar approach, it’s difficult for any to differentiate. The key to success in this market is dependability over time, and we have the data to prove it.

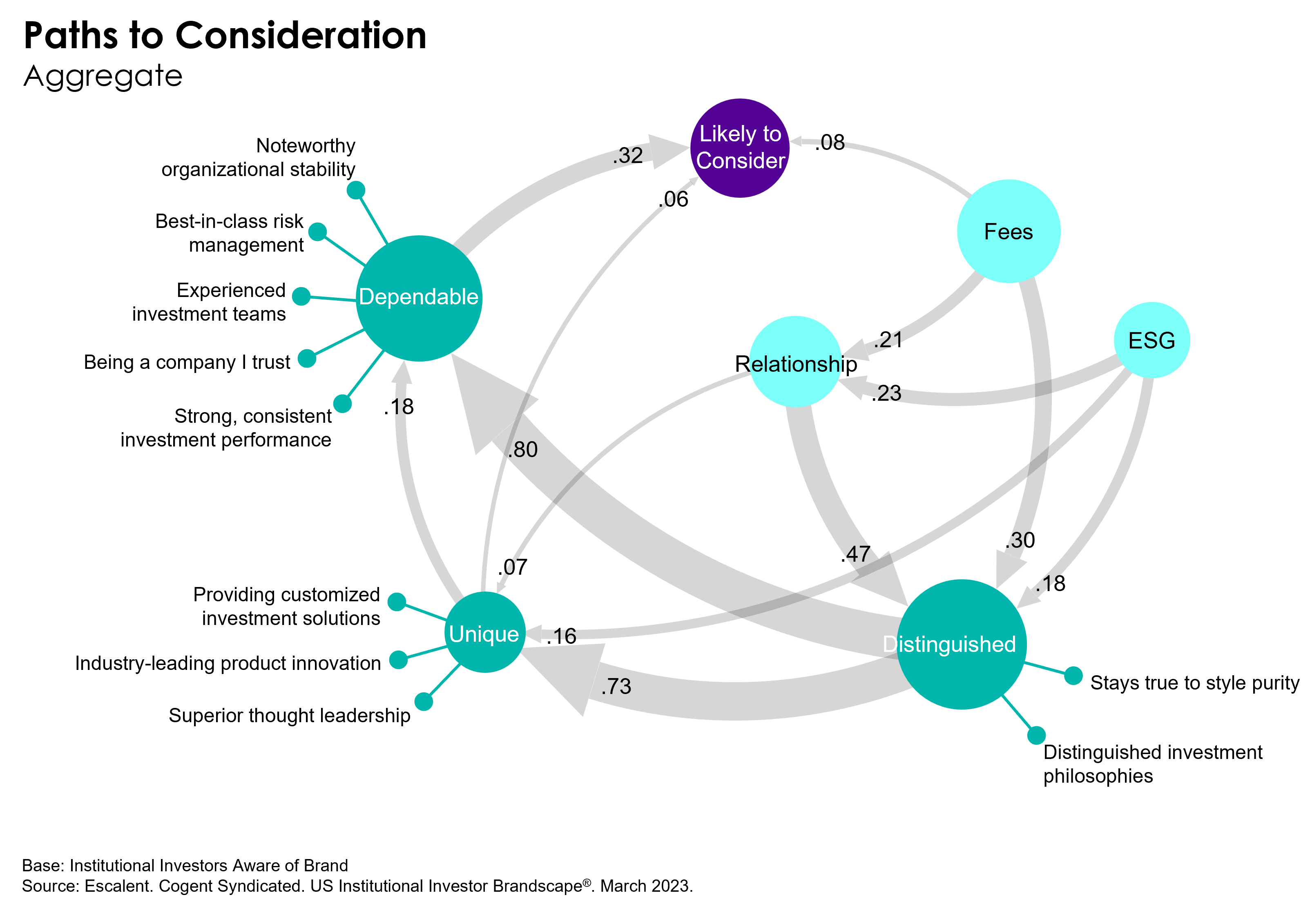

Through an analysis of the various pathways asset managers could take to enhance consideration potential and drive business growth, we determined that the most effective way to boost consideration is via stronger perceptions of dependability (a combination of noteworthy organizational stability, best-in-class risk management practices, experienced investment teams, trust, and strong, consistent investment performance). Other paths that lead directly, yet not nearly as strongly, to the likelihood to consider are optimal fees/fee structure and uniqueness (providing customized investment solutions, industry-leading product innovation, and superior thought leadership). Being distinguished (staying true to style purity and having distinguished investment philosophies) plays more of a supporting role but only proves to be effective if the approach delivers results.

Yet not every brand can pursue the same pathway—the key is to choose the right path based on an informed understanding of your current brand perceptions and the most pressing issues your target customers face. Cogent Syndicated’s US Institutional Investor Brandscape® examines the behaviors and attitudes of senior investment professionals and identifies key trends in investment strategy and asset manager selection in this critical market.

Click below to learn more about the full report.