From electric vehicles to telematics, fleet decision-makers are scaling back new technology adoption in response to an uncertain economy

More than two years after the onset of the impacts of the COVID-19 pandemic, businesses around the world are grappling with continuing supply chain constraints. In technology and manufacturing, chip shortages and rising freight costs are forcing companies to come to grips with a “new normal” that shows few signs of abating—in some cases, causing business leaders to reassess their whole approach to doing business.

However, few corners of industry have been impacted by these ongoing challenges like the commercial vehicle and fleet sector. For many fleet decision-makers, daily operations have been completely flipped on their head as they struggle to find efficiencies and continue to turn a profit in a chaotic economic environment.

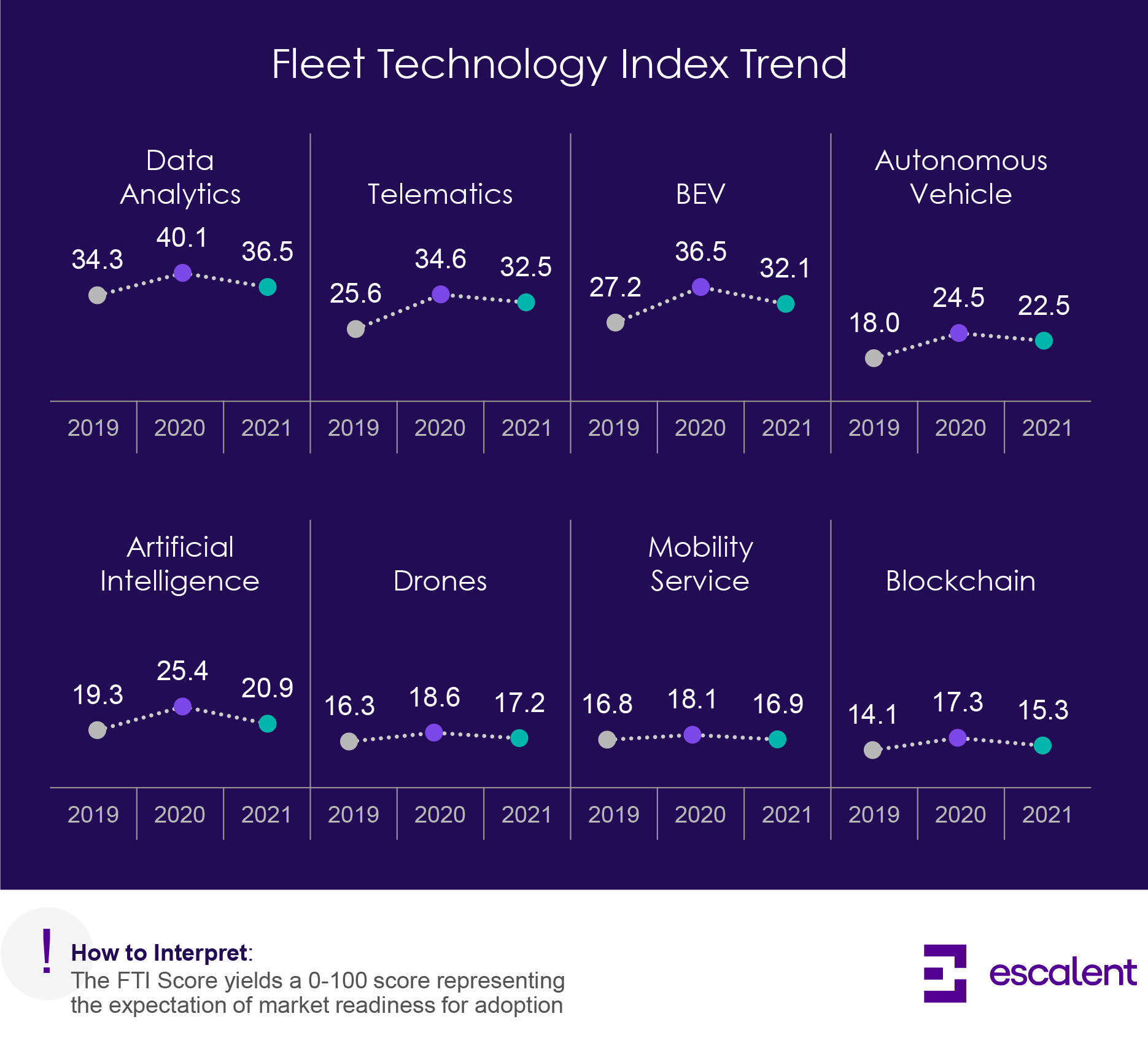

That’s why the findings of our 2022 Fleet Technology Index (FTI) report—which provides an annual snapshot of market readiness and the expectation for adoption of eight emerging and transformative technologies among our Fleet Advisory HubTM audience—are not surprising.

Across the board, fleet owners and operators are pumping the brakes on their expectations for near-term adoption of data analytics, telematics, battery electric vehicles (BEVs), autonomous vehicles (AVs), artificial intelligence, drones, mobility service, and blockchain technology. Despite the real and tangible benefits many of these technologies are already offering fleets that have integrated them, decision-makers are wary of making significant strategic investments in a business environment that requires them to focus on their profit margins near daily.

However, it’s not all bad news.

Despite the regression of index scores following significant growth in 2020, confidence remains high that each of these eight technologies has a place in the fleet of the future. For each technology, the FTI score for 2021 remained higher than what we initially recorded in 2019—before the pandemic was something we could have even imagined. This bodes well for the eventual adoption of technologies that, when fully implemented, promise to reinvent what is possible for fleets and their customers.

In the meantime, automotive manufacturers and service providers seeking to scale adoption of their offerings must first understand and acknowledge the environment they—and their desired fleet customers—currently face, and work to demonstrate the immediate benefits adopters can reap. Additionally, finding ways to offset up-front costs will be critical to convincing fleet decision-makers who are worried about their bottom line today rather than what their fleet makeup will look like three years from now.

To learn more about the Fleet Technology Index or how our team can help you better understand the landscape of commercial vehicle and fleet technology adoption, click the button below to send us a message.