Market volatility and rising inflation are creating widespread anxiety among retirement plan participants—and in some cases, impacting their ability to invest wisely.

As the cost of living continues to soar, fears of increased inflation are running rampant across nearly three-quarters of plan participants, according to our most recent DC Plan Participant study from Cogent Syndicated. More than half of all participants are also concerned about facing another market recession and the rising cost of healthcare, and many appear to be bracing for economic conditions to worsen.

As two participants put it: “It’s hard to survive in this climate and still try to save when you see accounts shrinking everywhere.” … “It’s the idea of trusting the process and not reacting to the day-to-day volatility of the current status of the market.”

Even more alarming, six in ten Millennials say they would cash money out of their retirement plans in the event of a large market downturn—in which the major market indices decrease 10% or more—a clear indication firms need to quickly intervene and provide much-needed guidance on how participants should navigate market volatility and avoid knee-jerk reactions.

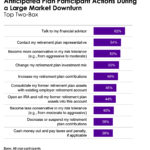

While Millennials and Gen Xers tend to be more reactive than older cohorts, on a more reassuring note, the most likely next steps in the event of a large market downturn at the aggregate level include talking with financial advisors (62%), contacting retirement plan reps (54%), and taking a more conservative stance (53%).

Retirement plan providers and investment managers play a critical role in providing guidance and reassurance. In particular, assistance in quantifying retirement savings goals and access to financial wellness programs are instrumental in creating confidence and retirement readiness.

In fact, market volatility is now the primary impetus for scaling back contribution levels, edging out other factors such as having less income, having to pay down debt, and needing more money to cover day-to-day expenses.

These findings underscore the overarching need for increased education and investment guidance, particularly as it relates to navigating current market conditions and rising inflation, as well as enhanced financial wellness program offerings. Everyone from plan sponsors, to plan advisors to providers themselves should heed this call to action and ultimately reassure participants—especially younger cohorts—to resist the urge to withdraw assets from the plan and stay committed to the long game.

Click below to learn more about the report.