While an understanding of current asset allocation practices is always valuable for asset managers, uncovering the asset classes institutional investors will look to in the future provides key insight into potential areas of growth and opportunities to expand a firm’s share of institutional assets. This year’s US Institutional Investor Brandscape report includes an analysis of anticipated changes to asset allocation by asset class, uncovering the areas of most demand for future mandates.

Overall, demand for active fixed income and alternatives is on the rise among both pension and non-profit institutional investors. However, breaking down each group’s top three asset classes poised for growth in the next three years shows pockets of even greater opportunity. It’s important to note that these figures represent the percentage of institutional investors forecasting changes in their use of particular asset classes and NOT the percentage of assets they are likely to move.

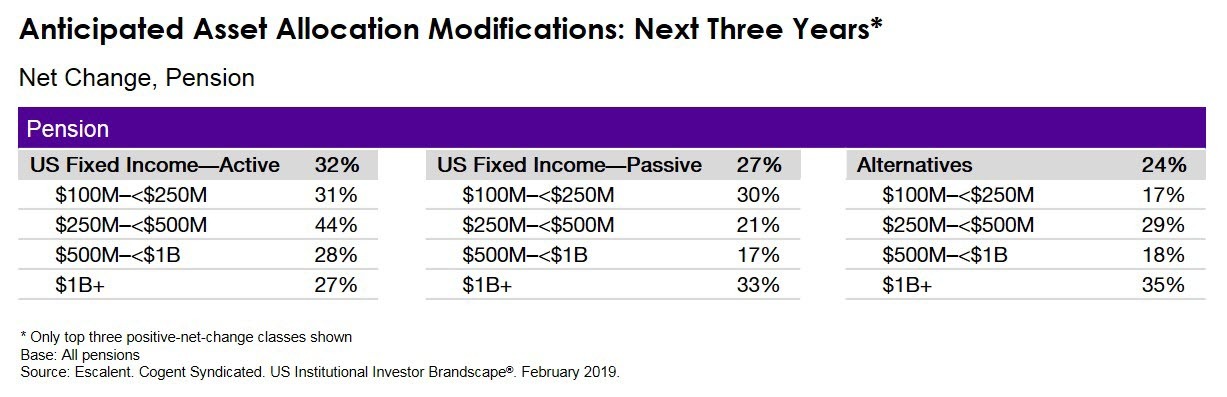

Pensions

US fixed income, both actively and passively managed, will continue to be in demand among pension investors across all asset size segments in the next three years. Notably, the use of alternatives is attracting more interest among this group this year than in the past, with an expected net increase of 24%. $1 billion-plus pensions report the highest anticipated positive net change in alternatives (35%) and passively managed US fixed income (33%), indicating rich opportunity for asset managers. An increase in one asset class inevitably leads to a decrease in another—24% of pension investors intend to draw down their allocation to US equities in the next three years, a trend from previous years.

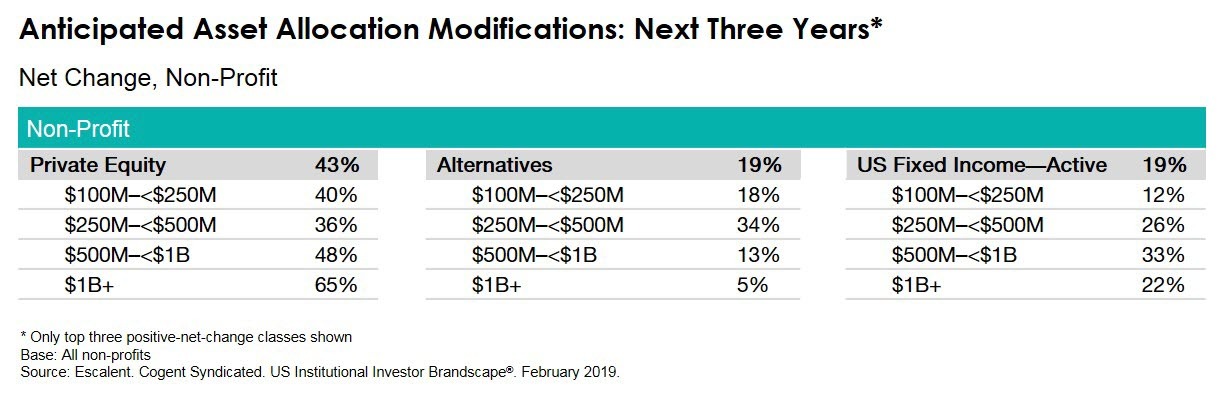

Non-Profits

Combining the results of the percentage of non-profit investors that plan to increase versus decrease their use of specific asset classes reveals the areas poised for growth. In a change from previous years, non-profits of all asset sizes express the strongest intent to increase their use of private equity—an asset class that historically drew the most demand from only the largest non-profit asset pools. While an overwhelming 65% of $1 billion-plus non-profits forecast a positive net change in private equity use, nearly 4 in 10 smaller non-profits also see this asset class as their biggest growth area. Interestingly, non-profits also express substantial interest in alternatives and actively managed US fixed income, similar to their pension peers.

Institutional investors work with an average of 22 different asset managers, and $1 billion-plus institutions often maintain relationships with upward of 50 firms. Therefore, when an institution initiates a search for a new manager, the objective is more likely to fill a niche within its portfolio rather than a complete overhaul of its investment strategy. When the opportunity to bid on a new institutional mandate arises, asset managers can effectively differentiate by highlighting their unique capabilities, touting successful aspects of their business and exhibiting confidence through the strategies they manage. In this context it’s critical for asset managers to address their competitors respectfully and articulate how their own research and investment offerings are different and a better fit for the client’s portfolio.

Click below for more information on the full report.