I did something dangerous this past week: I went to the grocery store. Emerging from quarantine in my home, I ventured out, mask-clad, into a public space that is rife with a virus that has already killed tens of thousands of Americans. I risked my well-being for some milk, bread and elusive toilet rolls. But I wasn’t the only one at risk. Dozens of grocery store workers have died from COVID-19, and some experts say it may be time for grocery stores to ban customers from coming inside altogether.

The risk of COVID-19 to all involved has led to an explosive growth in online grocery shopping. Increasingly, consumers are going online or using an app to handpick and purchase groceries from their favorite grocery stores or via a third-party specialist to have groceries delivered to their front doorstep. This is significant because grocery is a segment that has historically trailed in the e-commerce stakes, with only 6% of Americans having ever used an online grocery service compared with over 70% who regularly purchase non-grocery goods online.

Anecdotally, most people I know have tried ordering groceries online since COVID-19 forced us all into lockdown, so I was curious to see how the world of online grocery shopping has changed over the past couple of months.

400% Growth in Online Grocery Shopping

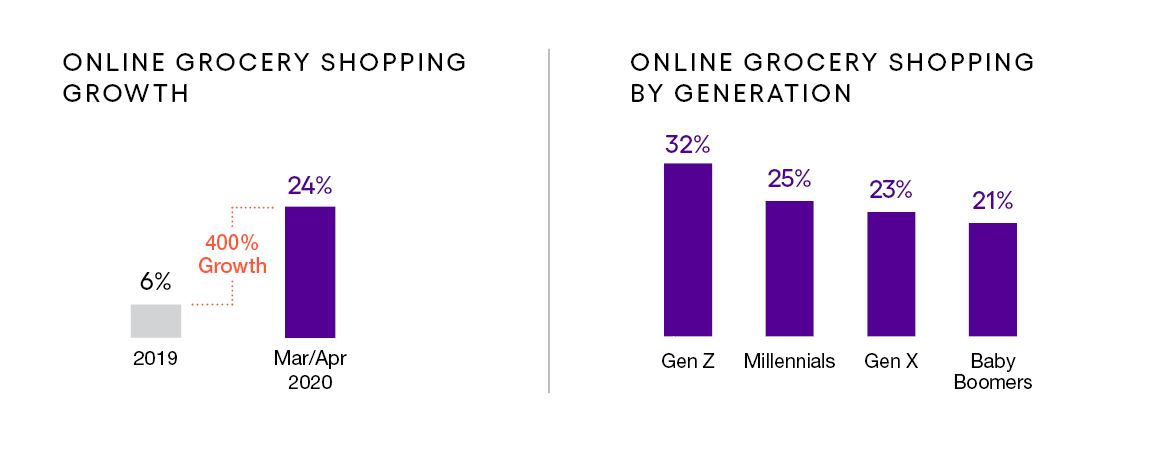

I ran a study among US shoppers who purchase groceries at least once a week to understand their changing use of online grocery services, preferred services, perceived benefits and challenges of using online grocery services and, most importantly, whether shoppers’ post-COVID-19 shopping behavior will change as a result of their current experiences. The results of the research were startling, showing that one-quarter of Americans tried online grocery shopping in the past couple of months, representing a 400% growth over last year.

While tech-savvy Gen Zers are leading the way, it is noteworthy that there is hardly any difference between Millennials and Gen Xers, and even one in five Baby Boomers has bought online groceries in the past month. Furthermore, there is no statistically significant difference between genders or regions—this is truly a national phenomenon.

Which Retailers Are Claiming This Burgeoning Market Segment?

What is equally interesting is which retailers are proving to be most successful in this fast-growing market segment. One would imagine that Amazon—the online giant that owns Whole Foods and has more e-commerce market share than all of its competitors combined—would be a major player. Walmart, despite doing the bare minimum online until its 2016 purchase of Jet.com, is still the world’s largest grocer, so it must have a strong interest in the space. And what of the independent specialists such as Instacart and Target-owned Shipt?

The data are fascinating and the learnings valuable to anyone seeking to fulfill the needs of digital consumers in a highly disrupted economy. So, take a moment to download and read our white paper, Consumers Are Going Bananas for Online Groceries: But Is It a Long-Term Love?