Advisor marketing is critical to driving long-term loyalty among current producers as well as getting on the radar and building credibility with potential new prospects. In a world of continuous news feeds and real-time updates, determining the most effective way to manage marketing spend and back it up with a positive ROI is challenging for asset managers, DC plan providers and DC investment managers alike.

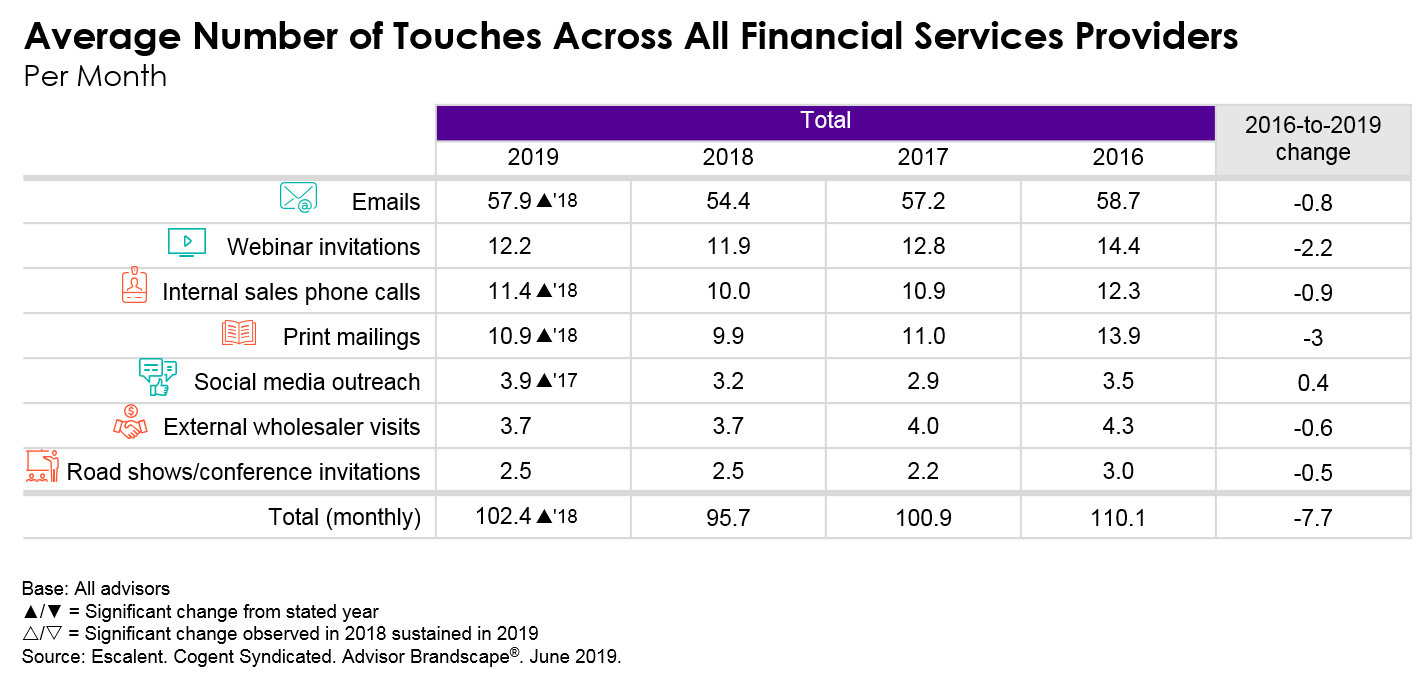

Not only that, but in contrast to previous years, advisor outreach is trending upward. Despite reporting a decline in the number of providers they work with in 2019, advisors recall an average of 102.4 marketing touches per month across financial services providers, a significant increase (6.7 more touches on average) compared with the activity reported in 2018. Even more telling: over half of these touches are emails. Advisors report an average of 57.9 emails in 2019, a significant uptick from 54.4 emails in 2018. Outside of emails, print mailings, internal sales calls and social media outreach have steadily increased from previous years.

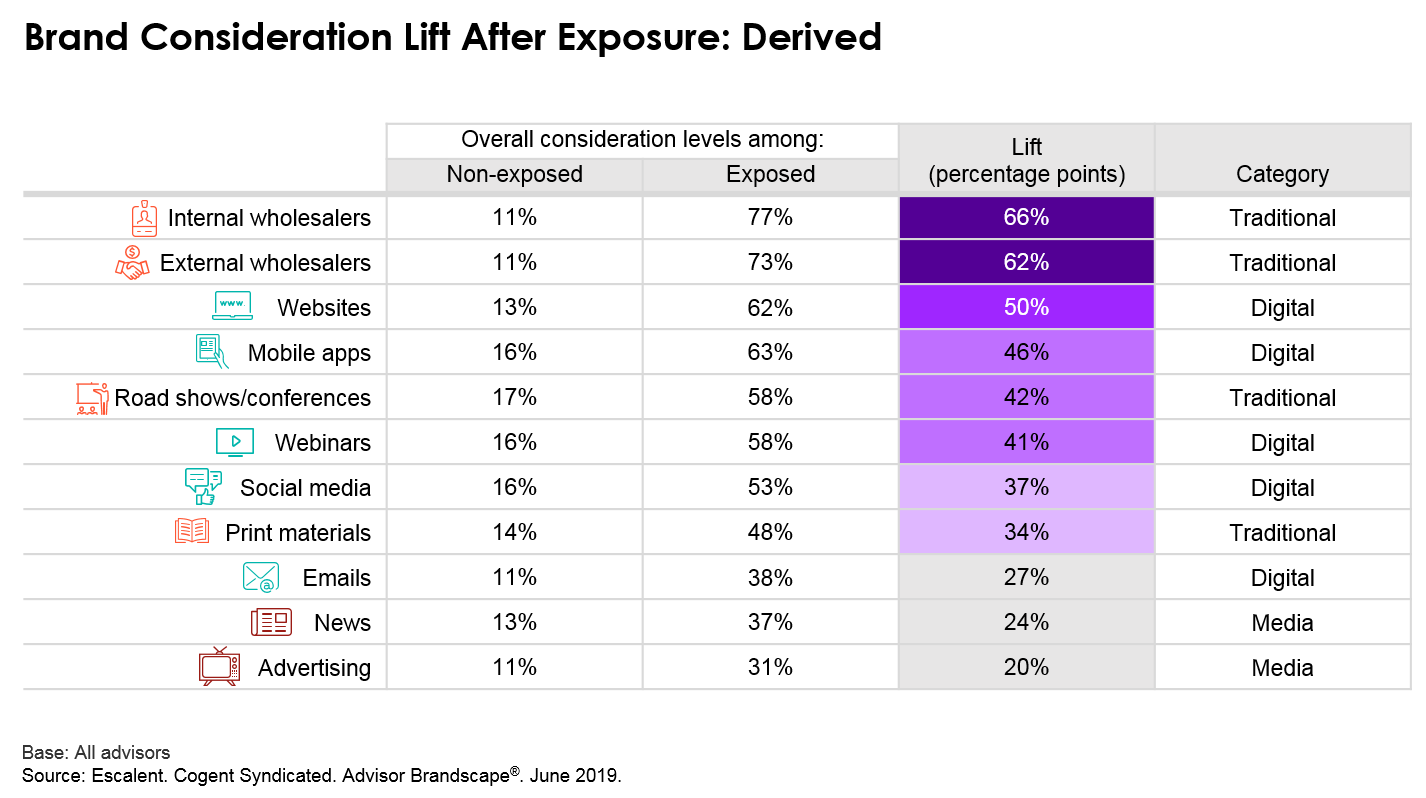

The increase in email activity begs the question: is email marketing even the most effective tool? Yes and no. On a stated basis, nearly six in ten (58%) advisors identify email as the most effective way for providers to communicate with them, a significant increase from the 51% figure in 2018. However, a derived analysis reveals that, aside from wholesaler interactions, a number of other touchpoints—including websites, mobile apps, webinars and social media—pack a more powerful punch in generating brand consideration. In fact, website exposure alone has the potential to boost advisor consideration by an average of 50 percentage points. Of course, emails play a pivotal role in directing advisors to provider websites, underscoring the importance of developing a cohesive marketing approach.

To learn more about advisor’s marketing consumption habits, click below to send us a note.