Editor’s note: Drawn from our historical data, along with the constant pulse Cogent Syndicated keeps on the market, we have tracked advisor and investor economic outlooks, sentiments, fears and investment decisions, tracing back prior to the 2020 national elections.

With the 2024 elections drawing near, many wealth management firms are facing increasingly difficult challenges in crafting effective communication that resonates with financial advisors and affluent investors. Uncertain of the electoral outcome and amid a constantly changing news cycle, advisors and affluent investors are seeking reliable sources of information to guide their investment decisions.

Cogent Syndicated has been tracking vital emotional sentiments since early 2020, including current and future views on the economy and concerns that affect investment decisions. Our aim is to provide valuable insights for wealth management firms to tailor their products, client engagement and marketing communication strategies to better resonate with their target audience(s).

The 2020 National Elections

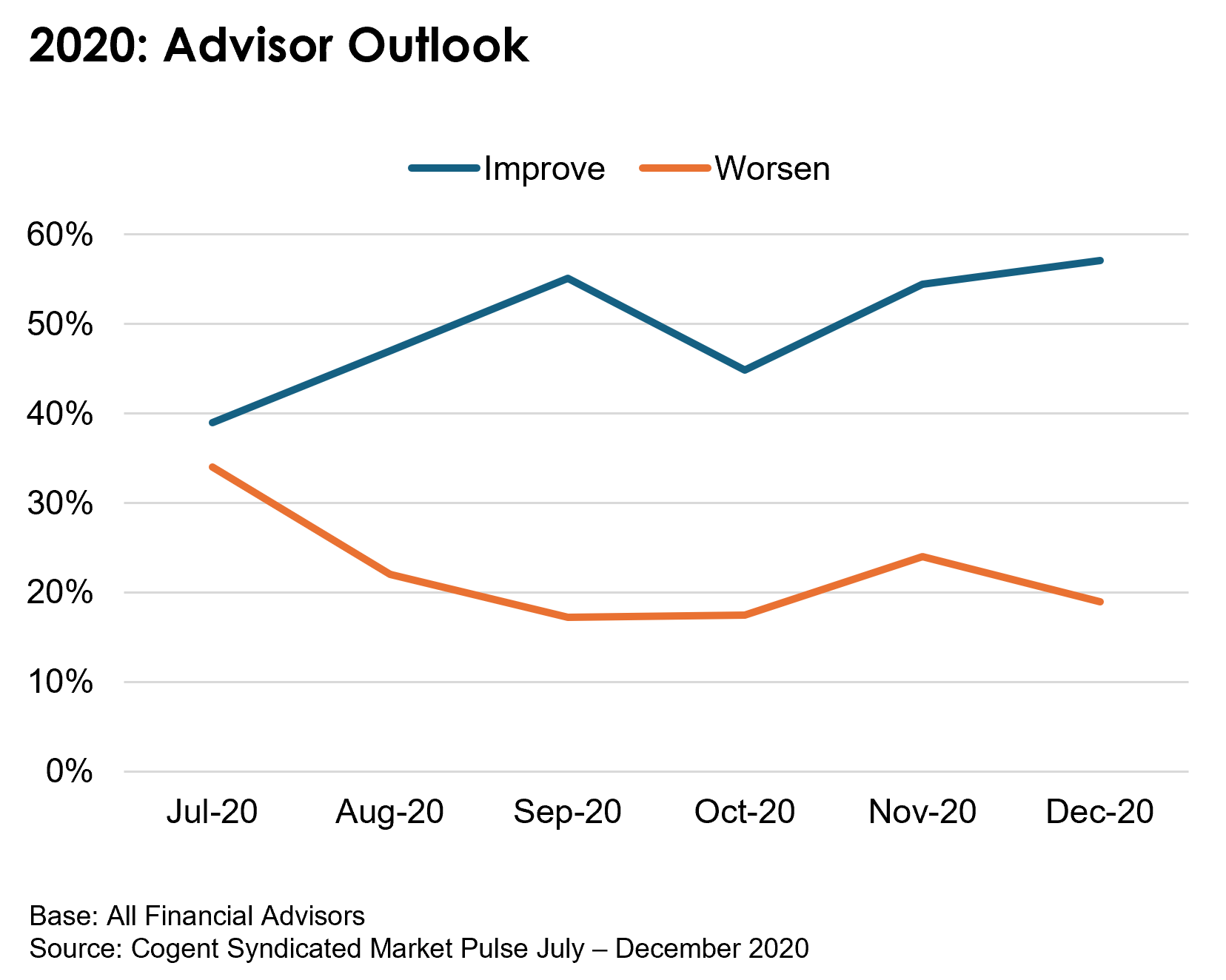

In the second half of 2020, financial advisors were increasingly optimistic about the economic conditions in the US. Despite a slight dip in October of that year, a growing majority of advisors felt conditions will improve in November and December. Advisors’ concerns over the potential impact of an economic recession and the COVID-19 pandemic outpaced their worries about the presidential election. Yet, despite these lingering fears, advisors were all in on equities, planning increases in their allocations to active US equities, emerging market equities and active international equities.

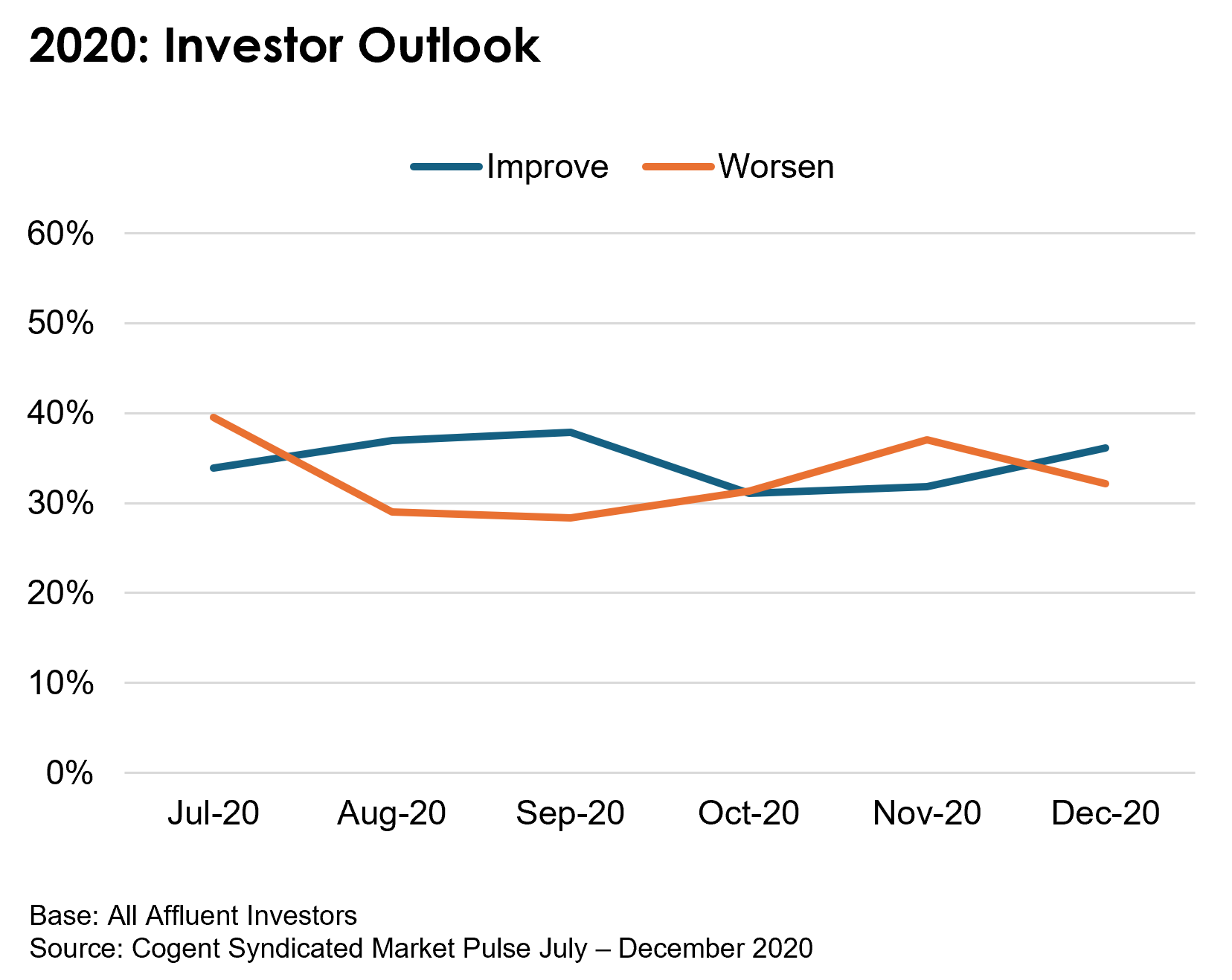

However, feelings of uncertainty reigned supreme among affluent investors in the second half of 2020. In fact, in November, an increasing number of affluent investors felt economic conditions in the US will worsen. Investors’ top concerns included fears of a recession, the presidential election and stock market volatility. As the year came to a close and the market reached an all-time high, affluent investors breathed a sigh of relief, expressing more hopefulness along with uncertainty.

The 2022 Mid-Term Elections

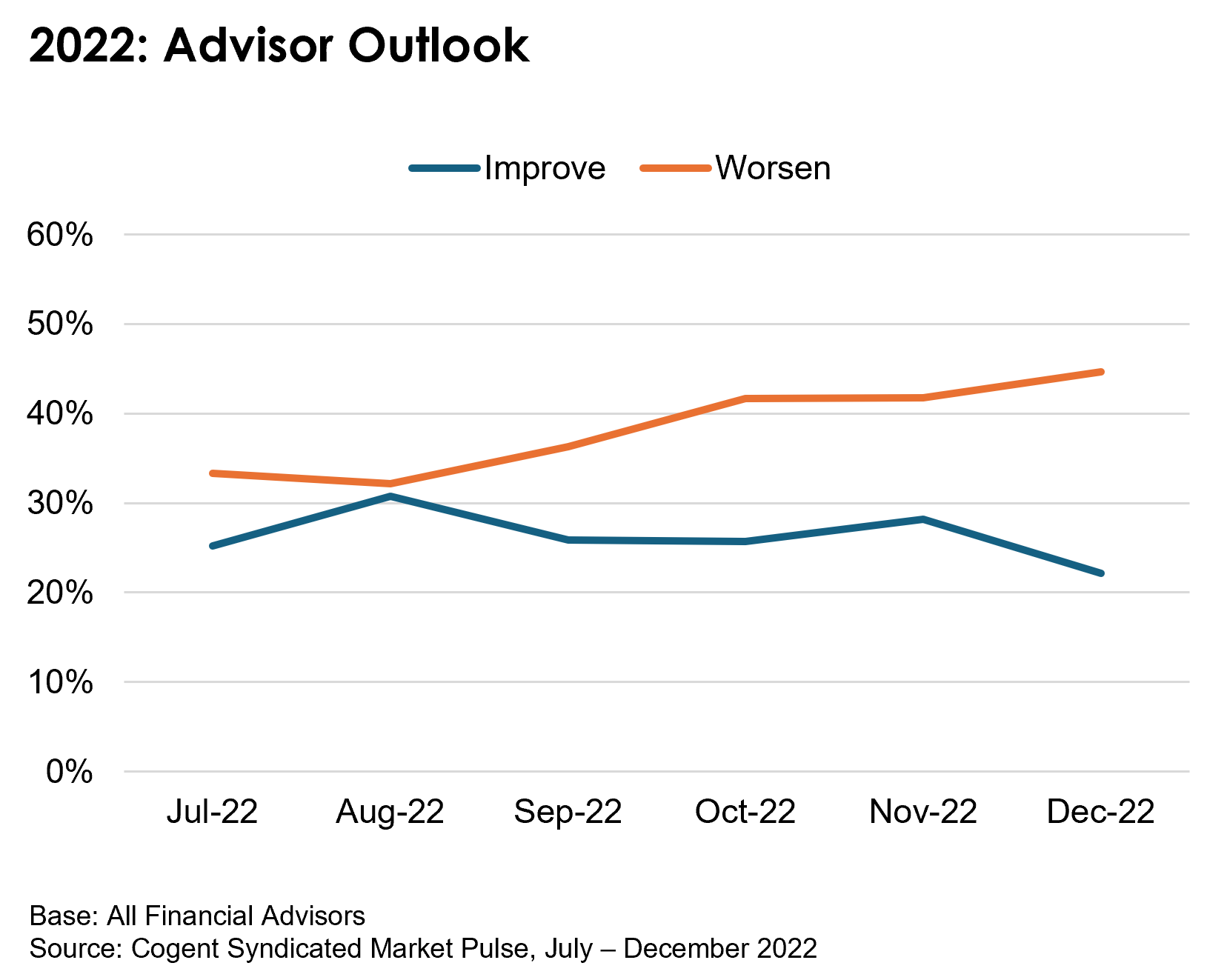

Financial advisors became increasingly bearish in the second half of 2022, with nearly half anticipating economic conditions in the US to worsen by year’s end. Advisors’ top concerns included fears of an economic recession, increasing inflation and rising interest rates. As a result, advisors switched their asset allocation strategies to active US fixed income, active US equities and cash.

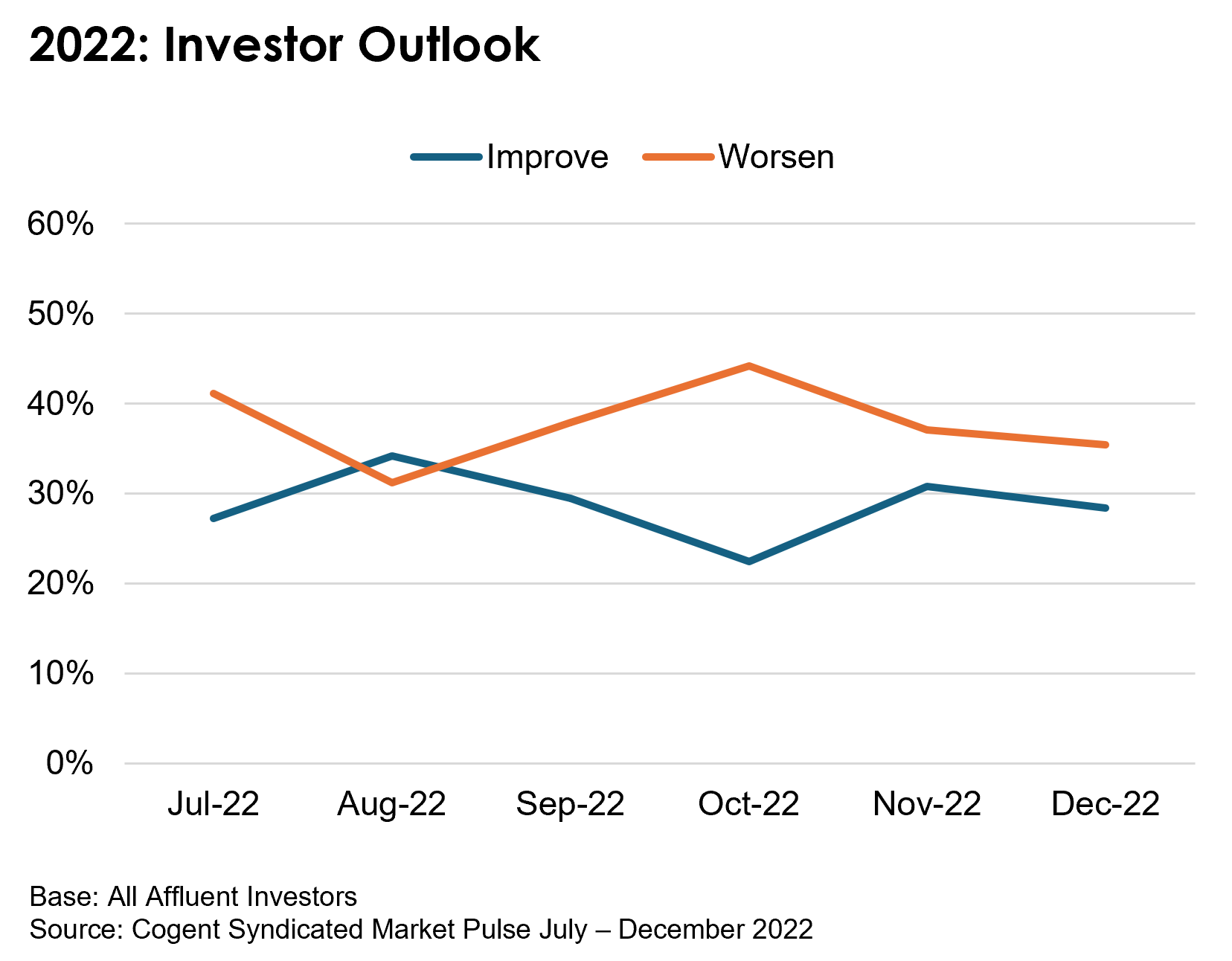

Affluent investors became increasingly pessimistic leading up to the November 2022 elections, with feelings of uncertainty and anxiety dominating. Investors’ top concerns included inflation, stock market volatility and expectations of an economic recession. By the end of the year, 28% of affluent investors felt that US economic conditions will improve, while 35% felt conditions will worsen.

What’s in Store for 2024?

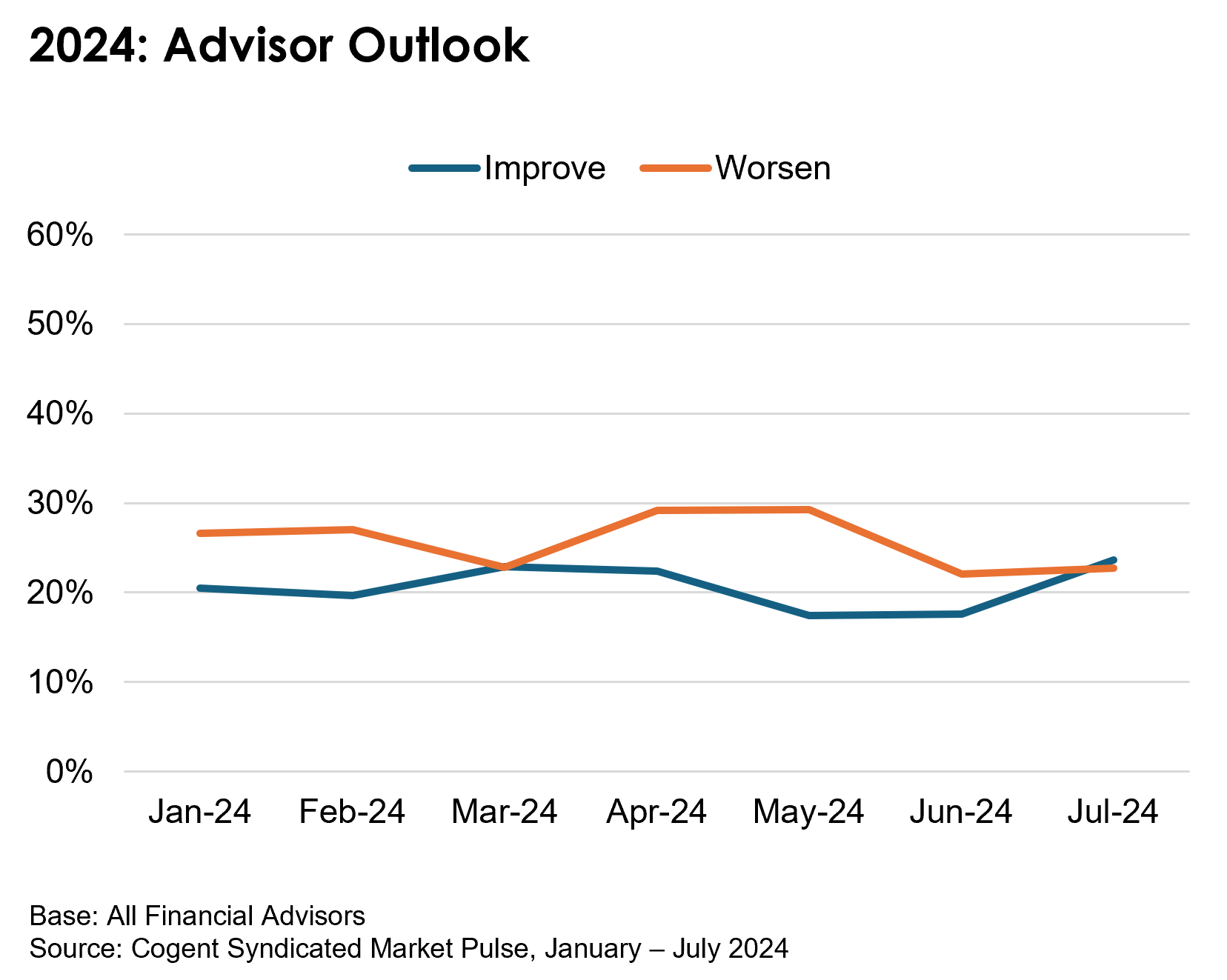

Heading into the 2024 national elections, financial advisors remain bullish, with nearly half holding a positive outlook on the market. Given the current economic environment, advisors anticipate increasing allocations to active US equities, active US fixed income and active international equities. Nearly one-quarter of advisors feel that the US economy will improve in the next three months, with an equal proportion feeling that the economy will worsen. However, concerns over government/administrative decisions now top the list of advisors’ fears for their clients’ portfolios, surpassing inflation and an economic slowdown.

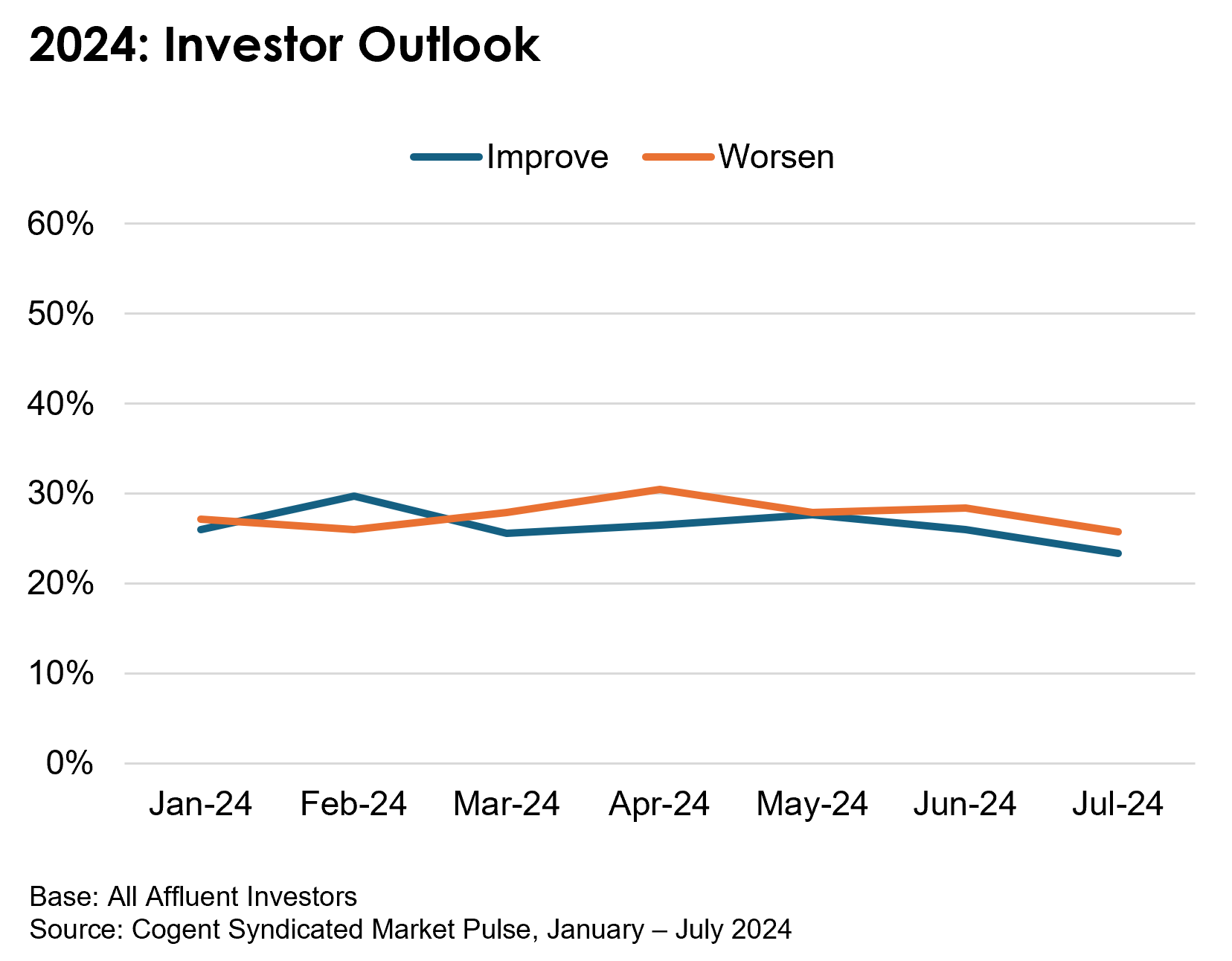

Uncertainty and hopefulness are still affluent investors’ top emotions while optimism is down significantly since the beginning of the year. Inflation remains investors’ greatest concern, while fears over government/administrative decisions outpace worries over stock market volatility and an economic slowdown. Reflecting these concerns, fewer than one-quarter of affluent investors feel the US economy will improve while slightly more than that feel the economy will worsen.

Leading up to the next US presidential election, one key difference between 2024 and 2020 is the lack of optimism among financial advisors and affluent investors. Without reassurance in long-term investment strategies, there is potential for a substantial amount of assets to remain on the sidelines until the future becomes clearer.

Regardless of the outcome, Cogent Syndicated will continue to track the sentiments of advisors and investors and how their feelings impact investment decisions and the wealth management firms they choose as partners.

Want to learn more about the Monthly Sentiment Tracker™? Click below.