Further spurred by the pandemic and social distancing, forging and maintaining nearly all types of relationships is increasingly about utilizing a range of digital capabilities. And that’s no different when it comes to affluent investors and their financial providers. In fact, when affluent investors have questions about their investment accounts, their first instinct is to visit provider websites, followed most often by contacting their financial advisor, calling their provider’s customer service line, emailing their primary account provider and using their primary account provider’s mobile app. This means that investors’ first choice when they have a question—and three of their top five choices—are digital.

The need for strong digital engagement is clear.

With that in mind, in this year’s Investor Brand Builder report, we dug into why affluent investors turn to these specific digital options as well as what might be stopping some from using digital tools and approaches to encourage their usage.

Provider Websites

- Why do investors use the website? Approximately three in four affluent investors have logged into their primary investment account provider’s website within the past year, primarily to check account balances (70%) and review investment options (35%)—with eight in ten being “very satisfied” with the experience. While still at relatively low levels, younger investors (particularly Millennials) are more likely to log in to roll over/consolidate assets and to access a video, webinar or podcast.

- Why don’t investors use the website? Affluent investors who haven’t logged in say their account statements are sufficient (32%), they spoke to their advisor instead (27%) or they find it quicker to speak with a person to get their questions answered (26%). It is important to note that more than one in ten (13%) indicate they used their provider’s mobile app over the website, a figure which spikes to 30% among Millennials given the latter group’s greater digital savvy. Additionally, 18% of Millennials also think the website is too complicated.

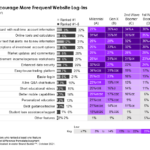

- How can providers drive greater website utilization? Investors recommend providing an online dashboard with real-time account information, online tools and calculators, simplified descriptions of investment account options as well as sending email/text alerts. Younger investors are also looking for a range of additional functionality, including easy-to-use trading platforms, live Q&A chats, better mobile capabilities and personalized education.

Provider Mobile Apps

- Why do investors use the mobile app? While just two in ten affluent investors have logged into their primary provider’s mobile app in the past year, their reasons for doing so mirror those for website logins. They’re checking account balances (64%) and reviewing investment options (34%). Approximately three in four (72%) are “very satisfied” with the experience. While mobile app log-in rates decrease with age, Millennial investors are less satisfied with the experience than their older counterparts.

- Why don’t investors use the mobile app? Barriers to mobile app use include a preference for using the website (40%), feeling statements are sufficient (20%), speaking to a person is faster (17%) and/or investors would prefer to speak with their advisor to have their questions answered (15%). Younger investors are more likely to cite a range of other reasons for not using the mobile app including they didn’t know about it, the app is too complicated, app content isn’t interesting/relevant and an inability to find answers to questions.

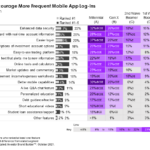

- How can providers drive greater mobile app utilization? Approaches to spark more frequent mobile app logins include enhanced data security, an online dashboard, easier log-in process, simplified account option descriptions and an easy-to-use trading platform. Given they are pre-disposed to using a mobile app, younger investors more likely than their older peers to welcome virtually any mobile app enhancements.

It is encouraging for investment account providers that similar enhancements to websites and mobile apps will drive greater levels of use among affluent investors. That said, digital savvy Millennials have higher expectations for these and other enhancements. To truly be successful, providers must build out their digital toolkits to fully satisfy the requirements of even this most demanding digital-first generation.

To learn more about how your firm can leverage our Investor Brand Builder report to boost profitability, identify new affluent investor targets and track your competitors, send us a note or click below.