Financial wellness programs were greeted with great hopes when they first debuted. But is the prognosis for their long-term success starting to flag? Amid signs that such programs have not been as impactful as expected, our latest white paper takes a 360-degree look at three sets of stakeholders—plan sponsors, plan participants and retirement plan advisors—to construct a clearer picture of the state of financial wellness initiatives. Here’s a sneak peek!

The Employer View: Enthusiastic Adopters

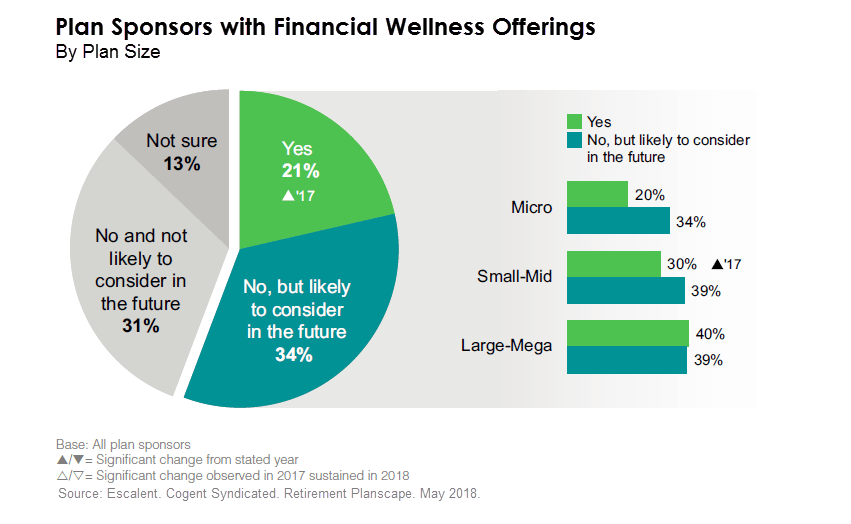

Preparing employees for retirement is a high priority for plan sponsors. Indeed, 40% rank it as one of their top three priorities for the year. It’s no wonder then that employers embrace financial wellness programs with enthusiasm. Adoption rates among plan sponsors jumped from 16% in 2017 to 21% in 2018. And interest in offering a financial wellness program is strong, with over one-third of plan sponsors likely to consider implementing a program in the future.

What Is a Financial Wellness Program?

Cogent Syndicated defines it as a program designed to educate employees about personal financial risks (which may include loss of income due to premature death or illness, unexpected out-of-pocket medical expenses, etc.) and provide tools to manage those risks.

Adoption is highest among Large-Mega plan sponsors, but Micro and Small-Mid employers are increasingly expressing interest. Larger institutions typically have very specific expectations and demand better service from the asset managers they employ. In a phrase, they are harder to please. This year’s Retirement Planscape® report found that among the largest asset holders, just 48% of pensions and 59% of non-profits express satisfaction, yet 76% of smaller pensions and 64% of smaller non-profits are satisfied with their current asset manager relationships.

The unique demands of the largest institutions often drive asset managers to create bespoke strategies to meet the institutions’ specialized needs. This leaves a rich vein of opportunity for innovative firms to target the mid-sized sector with more efficient solutions that offer broader appeal.

Before financial wellness programs die on the vine, providers need to take a closer look at what’s working and what’s not. Poor Prognosis? How to Save a Struggling Financial Wellness Program focuses on the issues for key stakeholders (plan sponsors, plan participants and plan advisors) and offers strategic recommendations for how to improve the prognosis of struggling financial wellness programs.

Interested in learning more about our research on financial wellness? Send us a note and let’s chat!