Reality is setting in with investors as concerns about infectious disease and its ensuing panic, recession, cost of living, financial security and employment are up significantly. And these concerns are even penetrating the lives and minds of affluent investors. In fact, more than two-thirds of affluent investors (those with $100,000 or more in investable assets) say these concerns will impact their investment decisions going forward. How that impact manifests itself remains to be seen. Overall, affluent investors are skeptical of the outlook for the US economy and uncertain about what opportunities the current situation presents, shining a spotlight on a chance for the industry to provide much needed perspective and guidance.

My Cogent Sydicated team at Escalent has been tracking the attitudes, behaviors and sentiment of affluent investors and financial advisors continuously for more than five years. We’ve always believed that it’s important for asset managers and distributors to monitor their brand perceptions as well as overall market changes on a regular basis. But in times of disruption and unprecedented change, like the COVID-19 pandemic, having a constant pulse on the markets has shifted from important to imperative.

On February 24, just days before the first COVID-19-related death in the US, we went into field with affluent investors and asked them how the ensuing pandemic was impacting their view of the economy and their investments. We have been tracking these same questions ever since, and can follow the changes in investors’ attitudes and behaviors as the pandemic rages. And some of what we’ve found may surprise you.

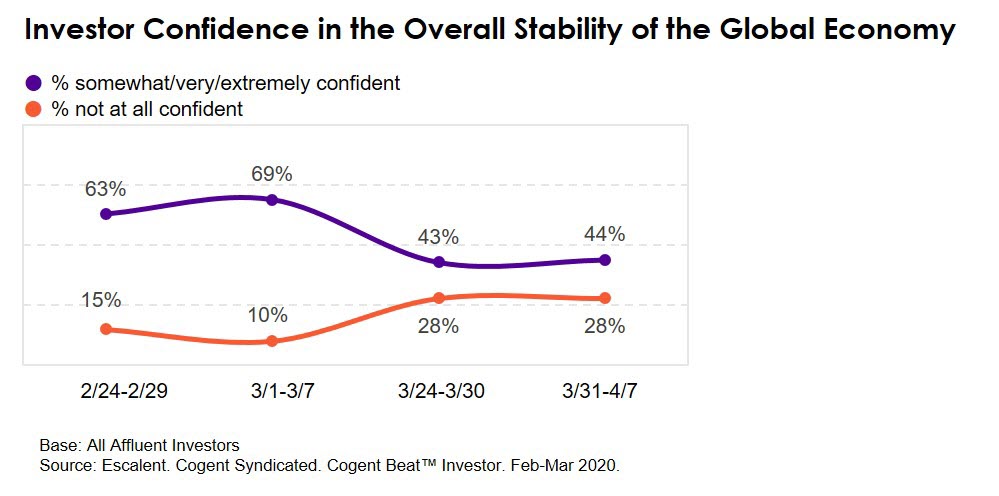

Affluent Investor Confidence Is Significantly Down

In comparison to late February (pre-pandemic), we see a significant decrease in affluent investors’ confidence in the overall stability of the global economy—in sharp contrast to financial advisors, whose confidence levels are stronger and more stable. Correspondingly, there is a significant increase in the percentage of investors who are “not at all confident.” There are differences between generations, however, with 70% of affluent Millennial investors continuing to feel at least somewhat confident in the stability of the global economy—significantly higher than their older counterparts.

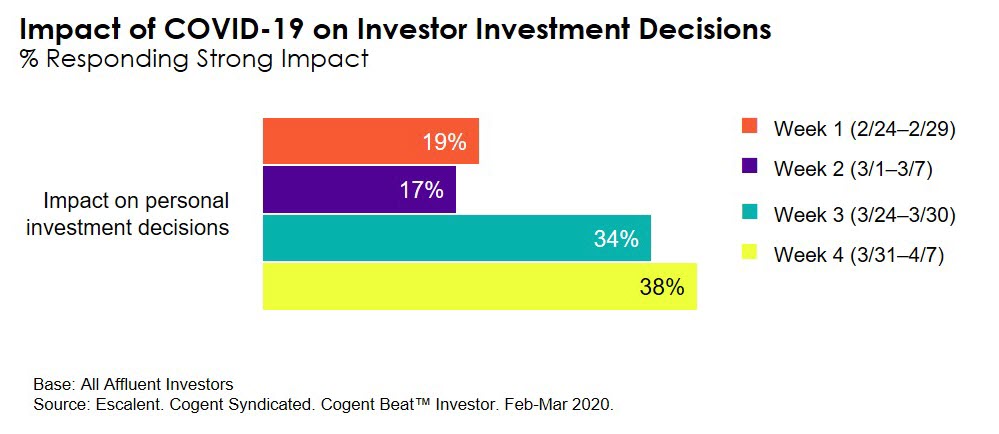

Fear Is Impacting Their Investing

More than half (52%) of affluent investors rank infectious disease as their number one fear with respect to their investments and overall financial health. And it’s clear that that fear is going to impact their investing decisions. Over the four weeks we’ve surveyed affluent investors, we’ve seen a jump in the percentage who are saying the COVID-19 pandemic will have a strong impact on their personal investing decisions. As one investor put it, “The pandemic is touching every aspect of our life. Ordinary investment challenges (growing retirement savings, generating income, etc.) may be replaced with ‘do we have enough cash to get through it all?’”

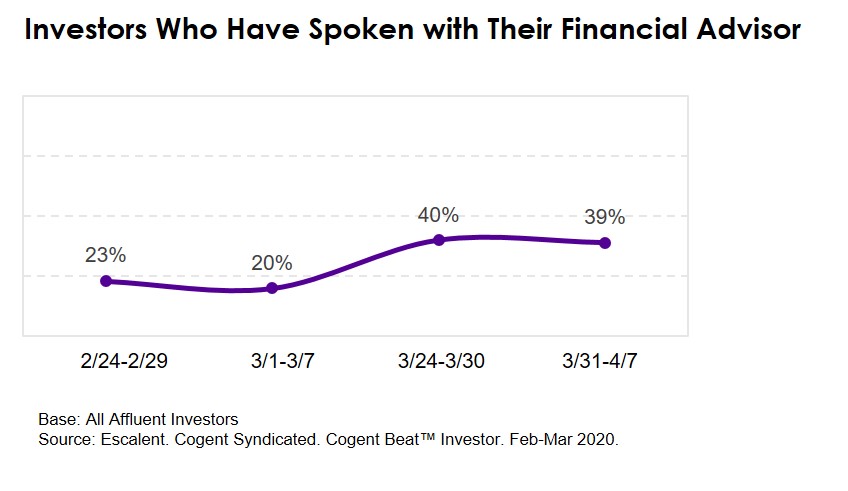

Investors Are Turning to Their Advisors

With affluent investor confidence down and fear on the rise, many are turning to their financial advisors for support. In fact, the percentage of affluent investors who spoke with their advisor in March nearly doubled from the percentage that did so in late February. This indicates that investors are seeking both perspective and guidance.

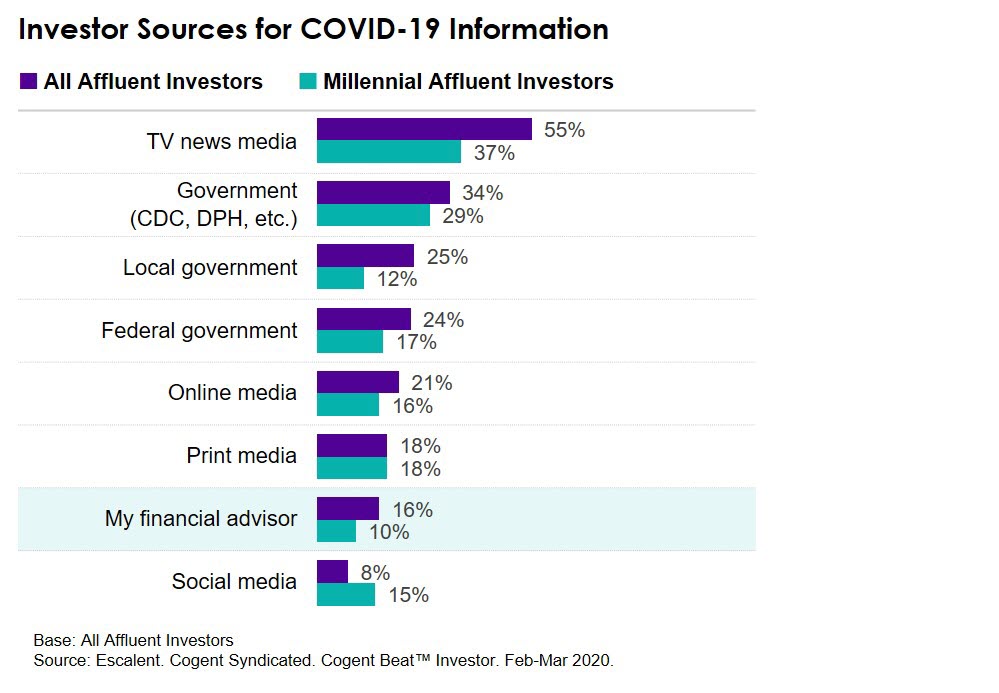

Investors Want and Need More

Although advice from their advisors is helping, investors need and want more. This represents an opportunity for asset managers and distributors to step in and become a trusted resource. Currently, more than half of affluent investors are turning to TV news media for insights regarding the COVID-19 outbreak. In contrast, just 8% are relying on social media. But again, we see differences with Millennials. Just 37% of affluent Millennial investors seek information from TV news media and 15% rely on social media sources—nearly double the proportion of affluent investors overall.

Be a Helper

It’s clear that affluent investors are losing confidence and are uncertain about their financial future. They’re unsure where to go and what to do next. As investors are turning to TV media and government sources for their information on the pandemic and its effect on the markets, affluent investors aren’t getting the level of guidance they want and need. Financial advisors are not a top source of information, at this point, and that could be fueled by the limited support advisors are receiving from the firms with whom they work. While there are a handful of asset managers that are being recognized for providing relevant and helpful content, relatively few are standing out in investors’ or advisors’ minds for providing unique and thoughtful perspective. This means there’s an opportunity for firms to fill this void and become trusted partners for both advisors and investors now and well into the future.

Cogent Syndicated: Keeping a Pulse on Critical Market Trends

We began tracking the impact of COVID-19 pre-pandemic…and we’re not stopping. Our ongoing data collection through Cogent Beat enables you to gauge the metrics that matter most at a cadence that’s right for you. Our new Market Pulse offering provides exclusive subscriber access to COVID-19 data, monthly scorecards tracking brand metrics, custom data cuts and the ability to add proprietary questions and attributes to our ongoing fielding.

Interested in learning more? Send us a note.