Environmental, social and governance (ESG) investing, also referred to as socially responsible or impact investing, has become an increasingly divisive political issue in the US in recent months. Several state legislatures have recently enacted measures that prohibit municipal pension funds from investing in ESG investments or even investing with asset managers that offer such strategies. Meanwhile, a newly formed Freedom to Invest coalition of institutional investors and asset managers is voicing the need to protect the freedom to invest responsibly. With more than 300 signatories as of March 23, 2023, the group argues that investors need to consider all material financial risks and opportunities from climate change and other challenges, and that policies limiting such approaches would be detrimental to all.

According to Cogent Syndicated’s 2023 US Institutional Investor Brandscape® report, institutional investors appear to be acting with appropriate caution yet are continuing to evaluate ESG strategies as complements to their existing portfolio holdings. Non-profit institutions are the most likely to be already integrating ESG investing, while defined benefit (DB) pensions report the lowest current use. That said, demand is strongest among $1 billion-plus defined contribution (DC) retirement plans and insurance company general accounts. While DC plans are likely responding to participant demand, particularly from Millennial and Gen X employees, insurers are approaching from a different angle. A paper published by the Savvy Investor in October 2022 suggested that risk mitigation is a key factor in drawing insurers to ESG investing.

Demand for ESG is being fueled by younger cohorts who are particularly sensitive to environmental and social factors. These constituents take the form of Millennial DC retirement plan participants and younger investors overseeing institutional assets. Consultants and outsourced chief investment officer firms (OCIOs) are quick to point out that when the 30-somethings get to be CFOs, they’ll bring a different perspective and focus to the investment decision-making process that will be dramatically more ESG-centric.

Often, determining the suitability of ESG depends on plan demographics including the organization’s industry and whether the ESG strategy is congruous with the organization’s mission and philosophy. For example, organizations in the oil and gas industry have radically different opinions and approaches compared with technology companies on the West Coast.

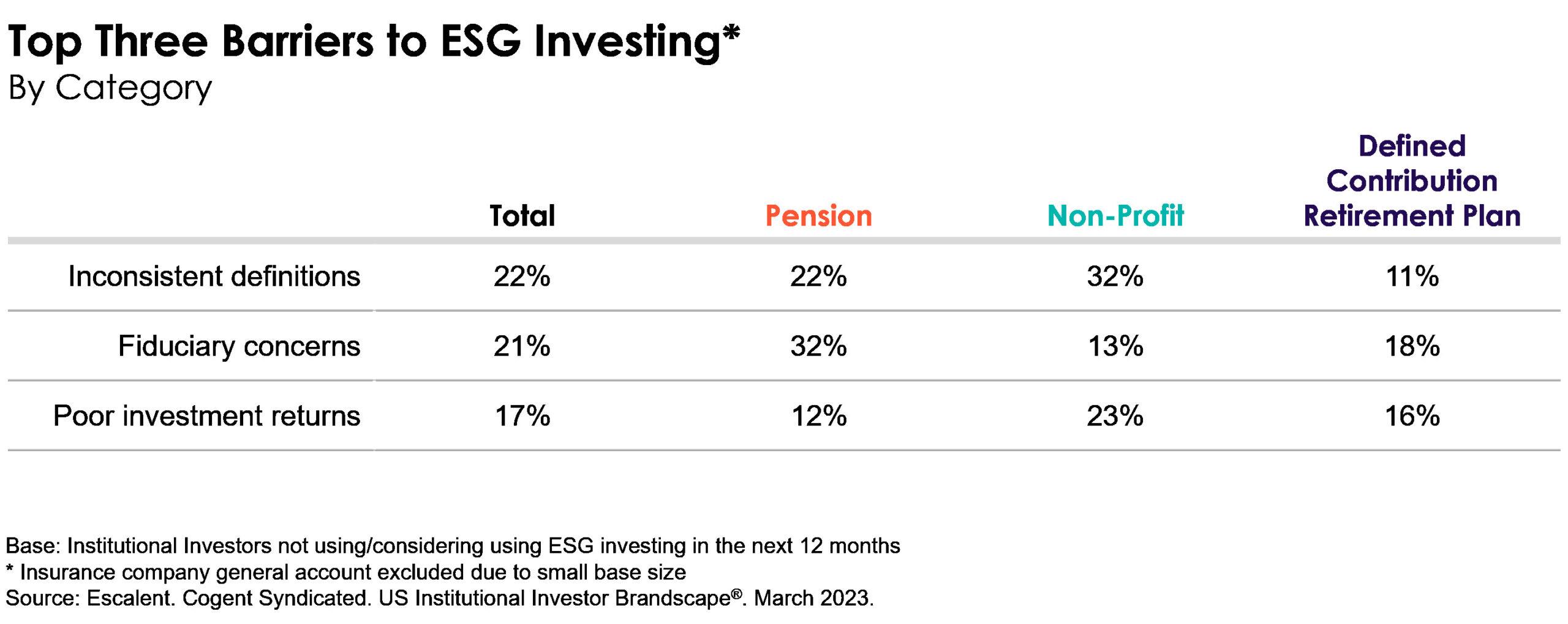

The anti-ESG movement and ensuing backlash are certainly curbing some appeal, yet many in the institutional community remain loyal proponents. Consultants and OCIOs recognize that the recent ESG pushback is more of a reflection of political divide in the US than a sign of substantive decline in adoption. As such, institutional consultants and OCIOs are fully equipped to discuss ESG options with their respective clients and have been actively vetting different asset managers.

That said, even consultants who have developed their own ESG ratings are still gaining their footing and would welcome more standardization and definition in the space to propel increased understanding and adoption. Meanwhile, a fair number of institutional consultants and investors remain on the sidelines and are awaiting more guidance from the Department of Labor (DOL) before incorporating any ESG investment options.

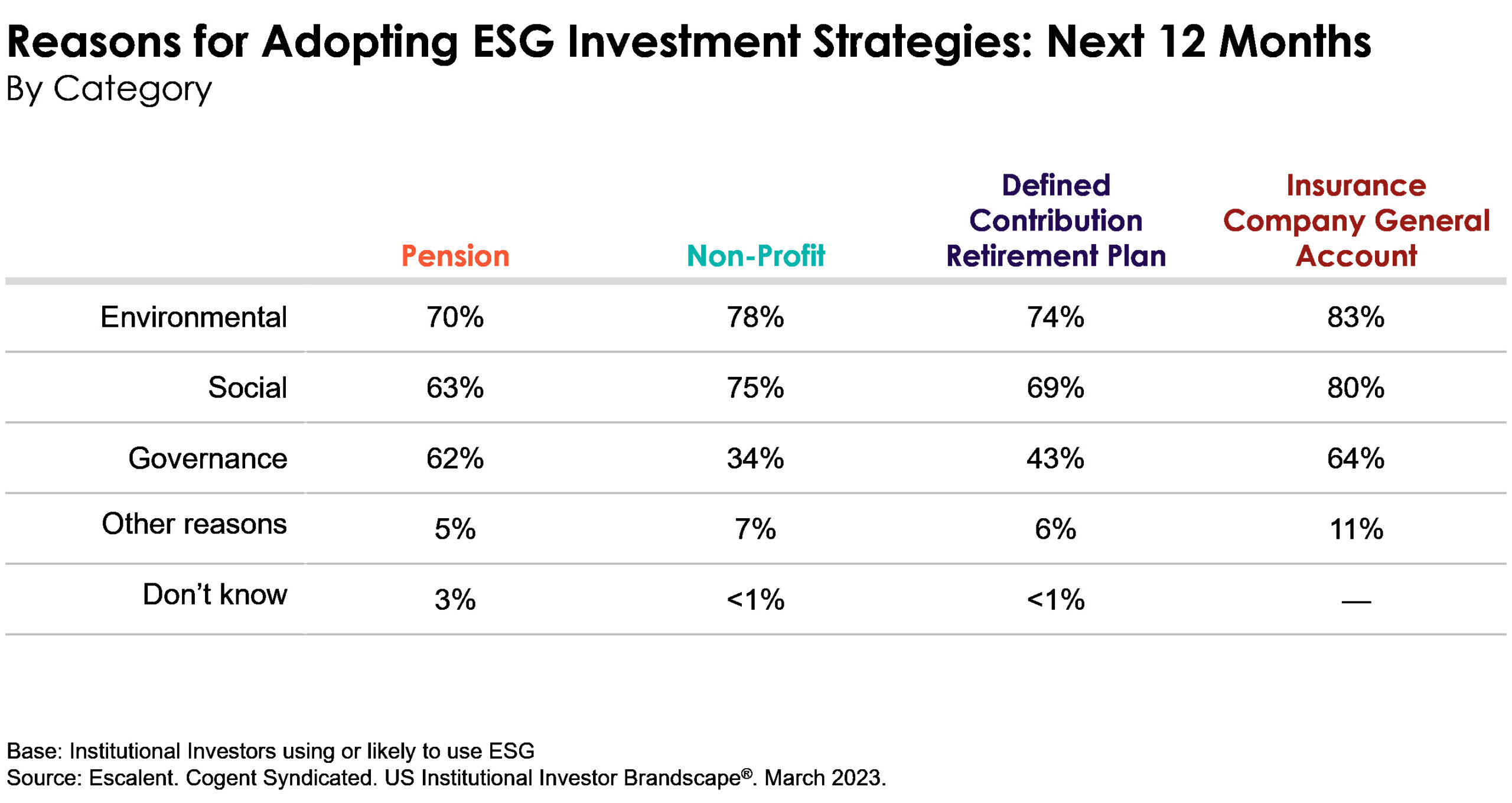

Despite these ongoing concerns, the institutional community appears to be converging on the opinion that ESG investing—particularly the environmental aspect—is here to stay. Many feel that stronger ESG movement outside the US will help keep the ESG movement from stalling completely. In addition, we found a striking ethical cultural alignment during our recent interviews. With the ebb and flow of ESG debate, we heard nearly universal agreement on anti-Russian sentiment and virtually no pushback on exclusionary investing along those lines. When it comes to fundamental human rights, there are ESG facets that all can align on.

Cogent Syndicated’s US Institutional Investor Brandscape® examines the behaviors and attitudes of senior investment professionals and identifies key trends in investment strategy and asset manager selection in this critical market. To learn more about the report, click below.