As institutional investors venture into their third year post-pandemic, their world in many ways is forever changed. Much of the professional work culture has been impacted by an extended period of working from home, spurring the “Great Resignation” and prompting many to reassess how, where and upon what to spend their time and focus.

As a whole, institutional investors express cautious optimism about the stability of the global economy. Defined benefit pensions certainly reaped the benefits of the strong economic conditions in the US in 2021, as the funding status of both corporate and public DB pensions has improved dramatically over the past year. In addition, we find that 55% of investors managing insurance company general accounts are very or extremely confident. However, non-profit institutions are much more cautious, with just 23% feeling very or extremely confident about the state of the global economy.

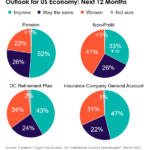

When asked about their prospects for the US economy, institutional investors report mixed opinions. More than half (52%) of public DB pensions and nearly half (47%) of insurance company general accounts believe conditions will improve. And while more than four in ten (43%) DC retirement plans forecast improvement in the US economy, 41% of non-profits fear conditions will worsen—a significant increase from 21% a year ago. Moreover, only one-third (33%) of non-profits report optimism, a significant decline from 60% in 2020.

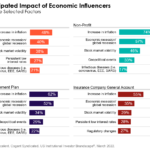

Compounding these challenges is the need to be constantly mindful of the impacts that geopolitical events have on the global economy. While the immediate concerns over infectious diseases have diminished, institutional investors are facing new pressures on their investment portfolios including continued volatility, inflation and rising interest rates.

Continued shifts in the economic environment have forced institutional investors to consider changes to their investment portfolios to address interest rate uncertainties and the inflationary environment while still maintaining adequate returns. In response, many are expanding into “nontraditional” asset classes such as private equity, private debt, emerging markets, cryptocurrencies and other alternatives, requiring new skills, knowledge and access.

The need for informed, sound, fact-based decision-making with a wide purview has never been stronger. Asset managers, investment consultants and institutional investors all require an increased level of expertise along with the ability to synthesize vast amounts of data to choose the best path forward. No one can expect to navigate this complex investing environment alone. This new reality will only increase the need for organizations to engage the right partners at the right time going forward.

For more information on the full report, click below.