Editior’s Note: Cogent Syndicated’s annual US Institutional Investor Brandscape has just published – read on for a sneak peek at the introduction to the report.

Contending with a volatile equity market, the US presidential election bringing in a Republican-led administration, decreases in interest rates and growing geopolitical tensions, institutional investors are viewing their portfolios with justifiable trepidation. Many quantitative measures suggest prudence with an increase in risk management, cost reductions and diversification strategies. Yet, with all the economic models and data-driven forecasts, the personal interactions between asset managers and investors are becoming more influential in prospecting and relationship management endeavors.

Fostering a strong sense of trust emerges as the most important factor in driving consideration of new asset managers, overtaking investment performance and fees. Moreover, our analysis found that the most effective way to build consideration is via stronger perceptions of dependability (noteworthy organizational stability, experienced investment teams, trust, breadth/depth of investment research, and strong and consistent investment performance) and collaboration (providing customized investment solutions; exceptional relationship management, service and support; and best-in-class risk management practices), both of which encompass many more person-to-person factors than quantitative measures.

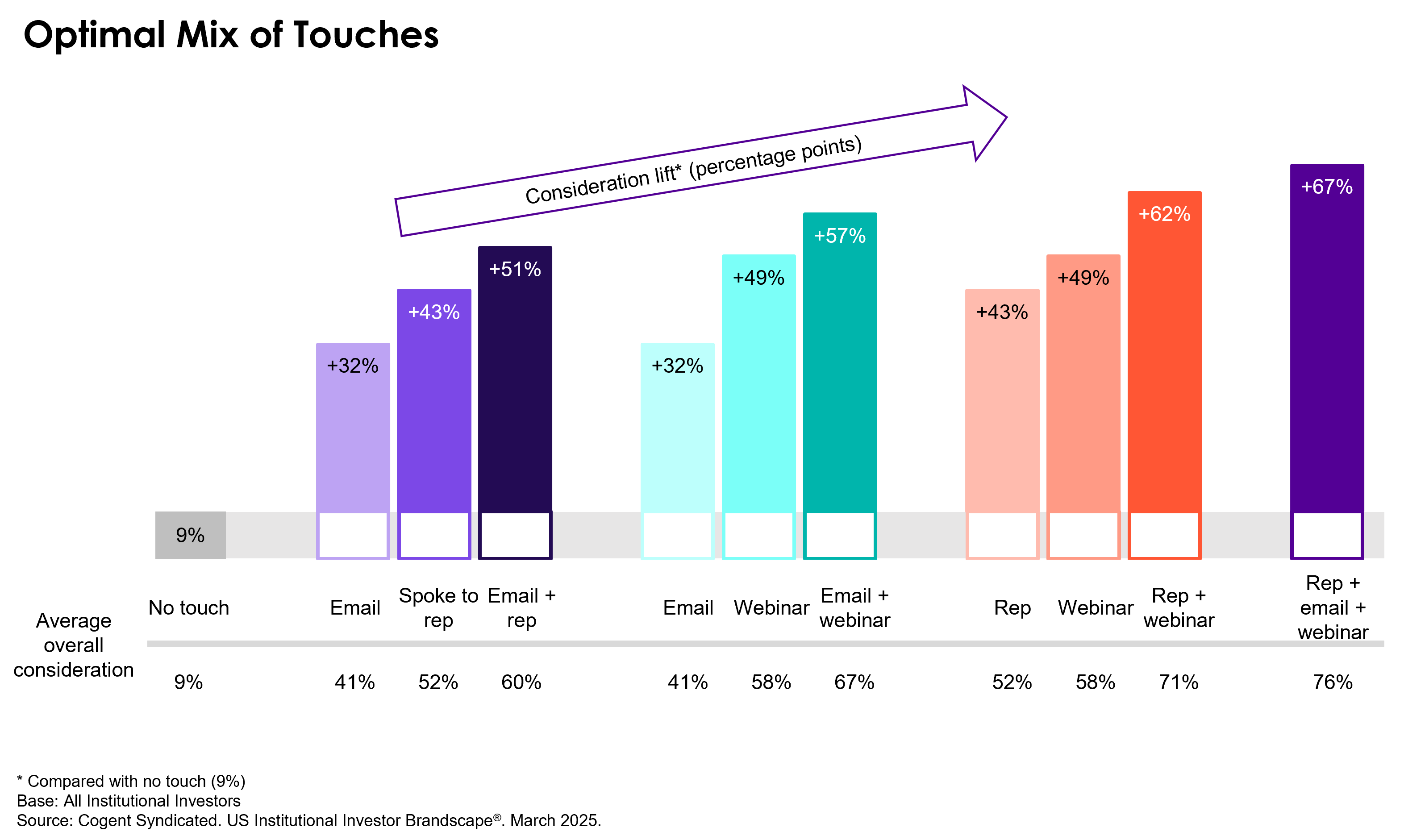

Outreach to institutional investors also requires a human component. Evidence of the effectiveness of personal touch combined with digital outreach, the results of our derived analysis reveal the combination of conversations with asset manager representatives, email and webinars are the optimal mix, with the greatest potential to increase consideration levels. The firms that can demonstrate the ability to act as a reliable partner with each unique institutional client are the ones best positioned for future growth.

To aid institutional asset managers in differentiating their capabilities and demonstrating their strengths, we present our annual review of the US institutional market. We examine key investment trends and anticipated behaviors of investors overseeing defined benefit pensions, non-profits, defined contribution retirement plans and insurance company general accounts and provide a comprehensive competitive analysis of more than 50 leading institutional asset managers. Our goal, as always, is to help firms understand the marketplace, define their place in it and identify their best opportunities to compete.

To learn more about the full report, click below.