The COVID-19 pandemic has significantly impacted us all, including institutional consultants. In response to social distancing and work-from-home orders, institutional consultants have had to change the ways in which they interact with asset managers and add value for their clients. While some of these changes in business practice may revert to pre-COVID-19 routines at some point, the pandemic has permanently shifted the perspectives of institutional consultants in many ways and will shape long-lasting trends in the institutional market for years to come. Asset managers need to pay attention.

More Reliance on Consultants

In a series of in-depth interviews conducted by Cogent Syndicated in November 2020, consultants revealed that the pandemic is increasing reliance on their knowledge and expertise. Many believe that outsourcing investment management functions—from traditional advice to outsourced CIO services—is an ongoing trend that COVID-19 has greatly accelerated. According to consultants, some institutional investors have fewer dedicated staff internally, necessitating more outsourcing. In addition, the unknown factor of the economic crisis caused an increasing number of investors to seek expert opinions.

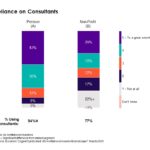

In our most recent annual survey of institutional investors conducted in Q4 2020, we found that more than nine in ten (94%) pensions use external consultants to some degree, significantly higher than the 77% of non-profits that do so. It follows that substantially more pension than non-profit investors rely heavily on outside consultants, investment specialists or advisors to evaluate and/or select investments or external asset managers.

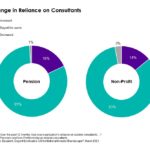

Somewhat surprisingly, more than eight in ten institutional investors (81% of pensions and 83% of non-profits) report their reliance on consultants has remained unchanged over the past year. That said, more investors are saying their need for consultants has increased versus decreased.

Changes in Client Interactions

Consultants are quick to point out that their interactions with clients have changed due to the pandemic, both in terms of time and methods. Through the first half of 2020, consultants were having more meetings with clients but on different topics and for shorter durations. Given how positively clients have reacted to virtual meetings that kept them up-to-date, consultants will adjust their practices to sustain more market/economic updates moving forward. Consultants predict there will be a permanent shift to a mix of fewer in-person meetings and more virtual interactions with clients.

Changes in Search Activity

Consultants admit to giving asset managers some leeway in the midst of the pandemic, acknowledging that all investment firms are operating in an extremely volatile and challenging environment. In fact, during the first half of 2020, some consultants were hard-pressed to know what changes to even recommend. When markets are “super” atypical, many consultants would rather stick with their asset managers for another quarter than risk making a wrong move. Yet many anticipate pent-up demand spurring substantial search activity in the months and years ahead.

Implications for Asset Managers

Institutional asset managers often debate internally whether to spend more of their time and effort on end-client decision-makers or their corresponding consultants/advisors. Our research concludes that, particularly in the DB pension market, time is better spent cultivating relationships with consultants as their influence and decision-making power strengthens.

Given the increase in frequency of client interactions, consultants will need help keeping their pipeline of talking points full and fresh. Asset managers should strive to provide strong market commentary and economic outlook thought leadership on a more frequent and ongoing basis so that consultants and advisors always have something new to share with clients.

Going forward, asset managers have a real opportunity—as clients are getting back into the search mentality—to provide consultants a great story about how their investment strategies “plug the holes … fill up the lineup” and otherwise correct for portfolio deficiencies highlighted during the recent market volatility. Asset managers should expect substantial activity in the coming year and be prepared to fulfill the pent-up demand that the temporary paralysis has generated. Firms can help consultants and advisors who have backed off new searches to show their clients the value they bring and prove their worth coming out of a period of inactivity.

For more information on the full US Institutional Investor Brandscape report, publishing this month, click below.