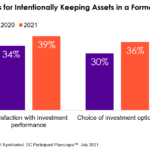

Staying on top of what sparks IRA rollovers has never been more vital for financial service providers, as the battle for rollover IRA dollars is no longer a game against inertia. With so much movement in the job market, providers may expect that rollover dollars are coming their way, as new employment has historically been the leading trigger for IRA rollovers. However, new data from our DC Participant Planscape report reveal more plan participants are intentionally keeping assets in-plan based on satisfaction with the investment performance.

To unlock these former-plan assets, providers need to tap into the needs of participants. At least one-fifth of participants who have made at least one rollover cite a desire to consolidate brokerage accounts/providers and to gain access to investment options with better investment performance as top triggers.

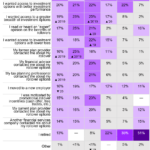

New employment—which has historically served as the number one trigger—has fallen dramatically as a reason for rolling over funds in the wake of the pandemic, falling to 16% this year from 22% in 2020. With job changes becoming less influential, a growing number of participants are citing breadth of investment options (19% in 2021 vs. 15% in 2019 and 2020) and outreach from former plan providers and tax professionals (both 16% in 2021 vs. 11% in 2019 and 2020) as reasons for rolling assets out of a former employer plan and into an IRA.

With more than eight in ten participants (86%) likely to roll over former ESRP assets this year (up from 76% in 2019 and 77% in 2020), it’s important for providers to know who are their best targets for marketing and sales efforts. Gen Xers are leading the rollover charge, with nine in ten (91%) likely to roll over funds in the next 12 months. 1st Wave Boomers are the most lucrative target, with potential assets averaging over half a million dollars ($554K). A growing number of rollover candidates work with traditional advisors (64% today vs. 57% in 2019 and 55% in 2020). In turn, just 6% of rollover candidates are self-directed, half of the 12% figure reported last year.

To learn more about rollover IRA triggers and the firms best positioned to capture rollover assets, check out our DC Participant Planscape report. We can ask the questions your firm can’t and the report offers firms a unique understanding of what drives participant contribution and investment behavior.