Most industry experts are quick to recognize that the benefits of DC plan participant digital engagement can be limitless:

- Higher rates of client satisfaction

- Expanded cross-sell opportunities

- Greater overall financial wellness

- Reduced call-center volume

- Fewer email inquiries

But how can providers propel participants to log in to provider websites more frequently? Successfully engaging participants on online recordkeeping platforms has been and continues to be a quandary marketing teams have wrestled with since the platforms’ inception. Recognizing the importance of engaging participants for both recordkeepers and the participants themselves, this year we asked respondents of our DC Participant Planscape™ study to specify what inspired them to log in (or not) and what could make provider websites more enticing.

Over the past year, more than eight in ten participants (81%) have reported logging in to their plan provider websites. But the majority of these visits are solely transactional, prompted by a desire to check account balances (56%) and review investment options (33%). While older cohorts are taking the initiative to log in for informational purposes, Millennials are compelled by a multitude of factors spanning mobile app notifications, social media links and texts.

In contrast, participants who have steered clear of their plan provider websites deem their account statements to be sufficient (38%) or find it quicker to speak with a person (21%). Others turn to their financial advisor for questions or own up to forgetting their log-in passwords. On a cautionary note, however, more than one-tenth of Millennials have found the online information uninteresting or irrelevant or had trouble finding answers to their questions—areas plan providers can more readily address.

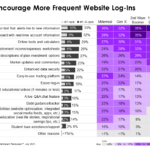

Regardless of recent log-in activity, we asked all DC participants to rank the top five features that would encourage them to log in to their plan provider’s website more frequently. Email/text alerts linking to new information and online dashboards with real-time account information top the list across all generations. Online tools and calculators, retirement income/expense worksheets and simplified descriptions of plan investments round out the top five ways providers could generate more website visits.

Millennials and Gen Xers are amenable to a variety of influencers, including easy-to-use trading platforms, short educational videos, better mobile capabilities and personalized education such as real-life stories and inspirational savings tips.

But ultimately, the goal isn’t just getting participants to log in; it’s keeping participants’ attention and inspiring them to come back for more education and updated information. Developing the tools that will engage participants with provider websites is a win-win, as it boosts cross-sell opportunities and decreases call and email service volumes for providers while also helping participants better prepare for retirement and secure their financial futures.

For more on what plan providers can be doing to meet participant needs and better service them, check out our DC Participant Planscape report. We can ask the questions your firm can’t and the report offers firms a unique understanding of what drives participant contribution and investment behavior.