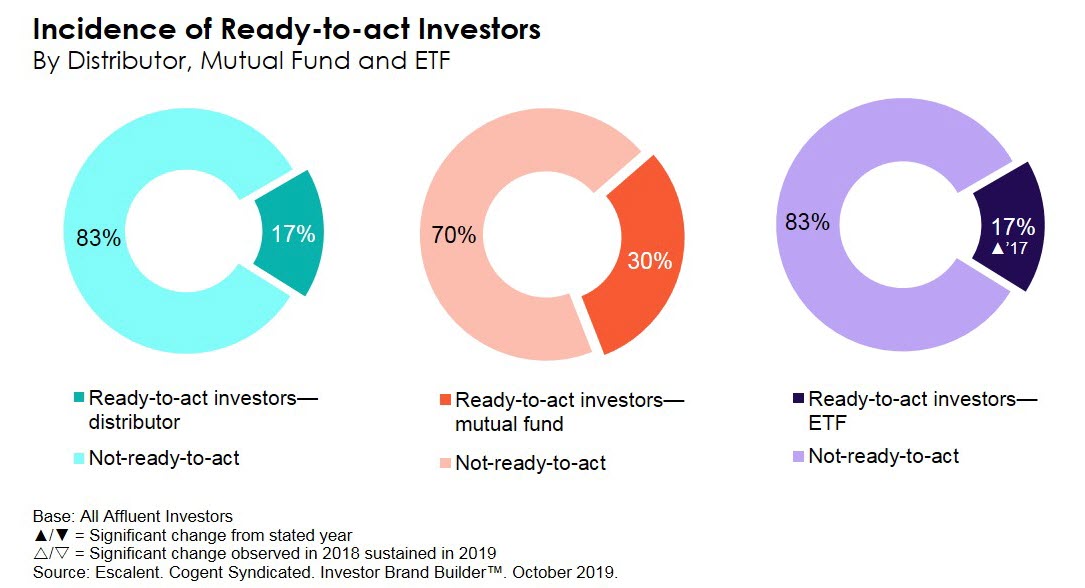

Fewer than one-third of affluent investors are in the market for a mutual fund, and even fewer are looking to open an investment account or buy an ETF in the next three months. While the challenge of finding investors who are ready to act isn’t quite that of finding a needle in a haystack, it is still a tall order. Asset managers must not only ensure that their retention and acquisition efforts reach the minority of investors in the affluent market who are ready to make a move, but that these initiatives cut through the marketing clutter to deliver the intended messaging.

While many ready-to-act (RTA) investors feel that the volume of marketing content they currently receive is manageable, they still trash and discard a great deal of content almost immediately. In fact, investors take just seconds to assess how valuable the piece is and what to do with it. Given this backdrop, we embarked upon an in-depth qualitative study with affluent investors in each ready-to-act segment to help distributors and product providers deliver timely and relevant content that speaks to the specific needs and interests of each group.

Ready-to-act Investors: Distributor Accounts

RTA investors in the market to open an investment account look for these qualities in marketing content:

- Relationship-Oriented: This segment strives to connect with providers, somewhat more than the other segments. It values partnership, a “listening ear” and a consultative approach when it comes to marketing materials. Thus, a clear call to action in order to interact and communicate with a provider, as well as multiple ways to interact (e.g., phone, email, online chat), is valuable.

- Results-Driven: Though results matter for all ready-to-act investors, this segment more readily wants to understand what impact content will have on its overall portfolio strategy. As such, testimonials, case studies and referrals are all impactful and seen as value-add.

- Differentiation: This segment values when providers make a case as to why they are different, why they are unique, and what advantages they have over competitors. Given that relationships and a consultative partnership are important to this segment, a clear case as to why a provider, product or service is different is extremely valuable.

Ready-to-act Investors: Mutual Funds

Investors intending to buy a mutual fund are particularly sensitive to “sales-ey” marketing pieces and more focused on credibility and differentiation in marketing outreach.

- Sales-Sensitive: This segment seems particularly sensitive to marketing materials that enlist a hard sell. Nonthreatening pieces more focused on soft selling are particularly appealing and have a better chance of cutting through the clutter.

- Credibility-Focused: This segment craves transparency when it comes to the source of a particular marketing piece. Source information and specifics about the provider (e.g., brand story) or author can help establish credibility and trust in the content and offer a better chance of cutting through the clutter.

- Differentiation: Similar to the Distributor segment, this segment also values differentiation in marketing content. Establishing uniqueness and a clear value prop over other providers, products or services will have significant impact on this segment and is much more likely to incite action.

Read-to-act Investors: ETFs

Investors planning to buy an ETF appear somewhat more cost-conscious and more influenced by transparency and hard data within the marketing pieces they receive.

- Cost-Conscious: Costs, fees, commissions and expenses seem to more important to this segment. Where applicable, marketing materials targeted to this segment should keep costs and financial implications at the forefront and easily accessible.

- Transparency-Focused: Given this segment’s attentiveness to cost, it is keen on transparency with marketing content. Whether it be about costs and fees or about the terms and small print within a marketing piece, investors within this segment want full-disclosure and full visibility to ensure their questions are answered and skepticism resolved.

- Data-Driven: This segment gravitates to the hard facts and figures within a marketing piece. Cross-comparisons, charts and graphs are appealing and help tell the story succinctly and directly. Similarly, provider comparisons, and how providers stack up against each other, are also compelling.

Affluent investors deal with a daily barrage of both traditional and new modes of communication. Our qualitative research underscores how critical it is for financial services firms to customize content and target their outreach. With an ever-expanding toolbox including digital and sophisticated targeting techniques, breaking through the clutter has become a more feasible yet challenging endeavor. Our research provides specific direction with respect to best practices in marketing content delivered through a variety of formats for maximizing the reach and impact of investor-targeted marketing efforts.

Send us a note to learn more!