Generation Zers have been at the center of lots of media attention lately and for good reason. Often called the youngest and most ethnically diverse generation in American history, they’ve grown up with modern technology, and according to some of the larger estimates, comprise 27% of the US population.

According to Pew Research Center, Gen Zers were born from 1997 to 2012, right between Millennials and the younger Generation Alpha (which is still accepting new members through 2025). Per Insider Intelligence, “the average Gen Z got their first smartphone just before their 12th birthday. They communicate primarily through social media and texts, and spend as much time on their phones as older generations do watching television,” with most favoring streaming services to traditional cable. As such, Gen Zers have been characterized as everything from tech-addicted and antisocial to social justice warriors.

And this year, Cogent Syndicated is excited to introduce Gen Zers—which for the purpose of our research we define as ages 26 and younger—in our 2023 DC Participant Planscape study. Gen Z represents more than one-tenth of current and former retirement plan participants ages 18 and older who are either actively contributing at least 1% to a current plan and/or have $5,000 or more in at least one former plan.

What are the biggest takeaways from our first dedicated retirement research on Gen Z? I’ll tell you. This up-and-coming segment brings forth fresh perspectives and novel opportunities for us to consider as the DC marketplace seeks to create a lasting impact.

Gen Zers Are Tinkerers

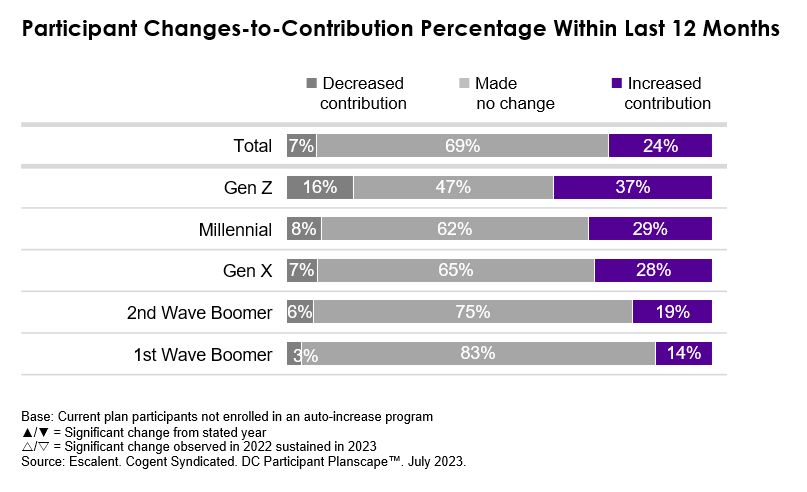

Fresh out of college and settling into new careers, Gen Z participants are beginning to learn the mechanics of retirement plans. Half of Gen Zers have been busy tinkering with their contribution levels as they adjust to other first-time financial responsibilities such as rent, car payments and budgeting for nights out with friends.

Over the past 12 months, 37% of Gen Zers have increased their employer-sponsored retirement plan (ESRP) deferral rates (compared with 29% of Millennials) while 16% have decreased their respective contribution levels (double the 8% figure Millennials cite).

Overall mean deferral rates are at 7.5% of salary, or $2,700 annually among Gen Zers, which is a higher percentage rate than the 6.0% cited by Millennials and Gen Xers, whose mean contributions are $3,900 and $4,000, respectively. Even so, extra guidance and education could benefit Gen Z participants to ensure they are maximizing their full savings potential, as many retirees often wish they started saving more earlier.

Gen Zers Are Risk-takers

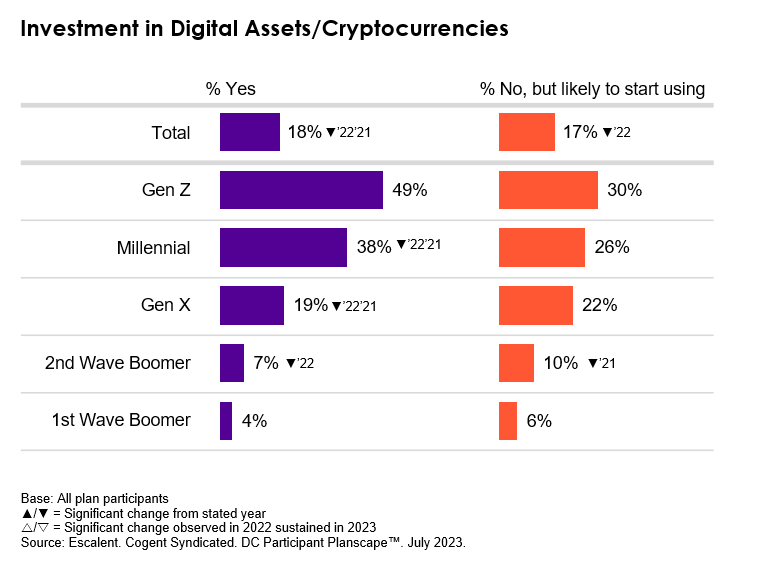

Nope, we aren’t talking about bungee jumping or taking a gap year to travel the world. Our latest research reveals even after the collapse of the cryptocurrency markets, nearly half of Gen Zers (49%) still have money invested in digital assets, a sharp contrast to Millennials (38%) and Gen Xers (19%). And while others are shying away from ESG investing amid contentious political discourse, enthusiasm for ESG investing within ESRPs is strongest among Gen Zers (37%).

Gen Zers Are Optimistic and Underprepared

Gen Zers, alongside Millennials, report more optimistic outlooks about the US economy and stability of the global markets. However, this generation is least equipped to tackle the unexpected, hence the boomerang phenomenon some empty nesters inevitably face. At the aggregate level, one in ten participants (10%)—most visibly Gen Zers (14%)—doesn’t have any money set aside for emergency expenses, underscoring the need for emergency savings account (ESA) solutions in the market.

Even more concerning? Estimated retirement savings goals are lowest among this cohort. The overall mean goal is $946K across all types of accounts (ESRPs, IRAs, taxable brokerage accounts, bank accounts and other vehicles), ranging from a low of $498K among Gen Zers to a high of $1.2M among 2nd Wave Boomers and $957K among Millennials. In fact, average ESRP goals are just $285K among Gen Zers, nearly half the $522K figure 2nd Wave Boomers cite and considerably trailing the $453K figure Millennials cite. These dramatic differences in retirement savings estimates showcase how much Gen Zers could benefit from provider education, particularly on how much is required to live comfortably in retirement.

Gen Zers Are Open to a Wider Range of Advice

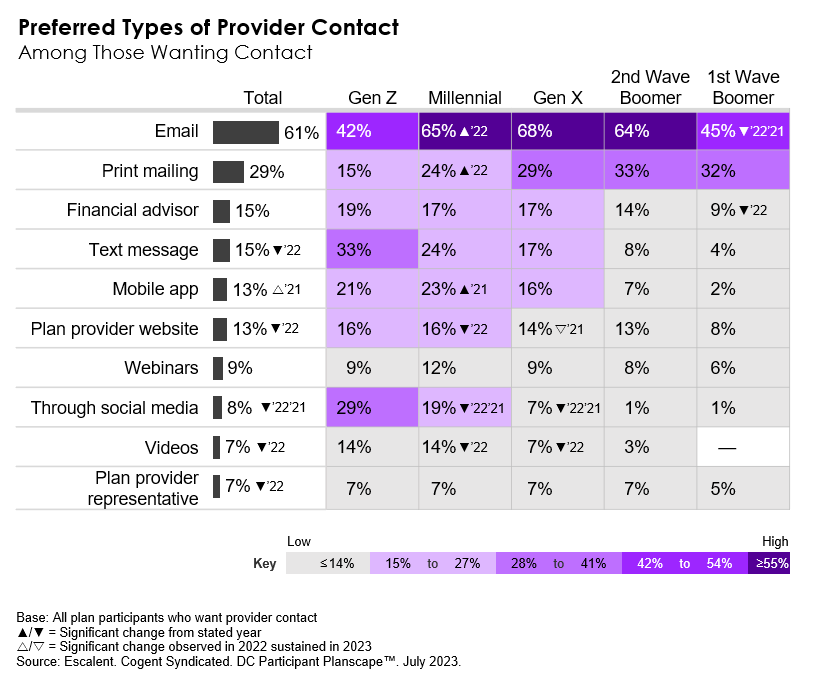

While overall robo-advisor use is starting to taper, Gen Zers report the greatest adoption, at 90%. This cohort is also more at ease with different styles of accessing retirement planning advice and support. Nearly three in ten Gen Zers prefer working with plan advisors via text (29% vs. 21% of Millennials), and assuming employer availability, nearly four in ten Gen Zers (39%) are interested in fee-based retirement planning advice from a financial advisor.

Gen Zers Are Also Comfortable With a Broader Array of Communication

While most participants are logging into provider websites merely to check account balances, more than one-fifth of Gen Zers are prompted via email and mobile app notifications. Cross-sell opportunities are also promising within this new cohort, as many Gen Zers are open to product marketing via texts (33% vs. 24% of Millennials) and social media (29% vs. 19% of Millennials).

First impressions aside, what I find most exciting about Gen Zers is that they offer providers a fresh start in educating and engaging the next generation of retirement savers. For those willing to dive into the analysis, this cohort has the potential of inspiring new product innovation around financial wellness, retirement readiness and in-retirement income solutions. Of course, Gen Zers could also benefit from the wisdom of older peers along the way to set them on a more secure path.

With Gen Zers sharing ideal retirement visions of “a faraway tropical island,” “owning property out West in the mountains” and “having time and money to do everything that I couldn’t do when I was younger and working,” there is often a stark reality on the other side. As one 2nd Wave Boomer retiree recently suggested, “help educate individuals about how much money they will really need—it’s much more than you think.”

For more information on the full report, click below.