Fleet managers are harnessing the potential of telematics, data analytics and artificial intelligence (AI) to drive operational efficiency. New research from Escalent indicates that overall technology readiness among fleet businesses has risen by 39% since 2020, demonstrating a growing appetite for advanced tools and capabilities. However, fleet leaders are not embracing every technology with equal enthusiasm.

The annual Fleet Technology Index (FTI) report from Escalent’s Fleet Advisory Hub™ surveys more than 1,000 fleet decision-makers to assess their attitudes toward advancing and emerging fleet technologies and expectations of the technologies’ applications in fleet businesses.

The FTI report analytically measures expectations for the adoption of four core technologies: data analytics, telematics, battery electric vehicles (BEVs) and autonomous vehicles (AVs). It also covers four technologies that Escalent categorizes as emerging: AI, drones, mobility services and blockchain. Based on survey responses, Escalent assigns each technology an index score that gauges fleet decision-makers’ technology readiness and expectation for adoption.

Fleet Leaders Turn to Data for More Confident Decision-Making

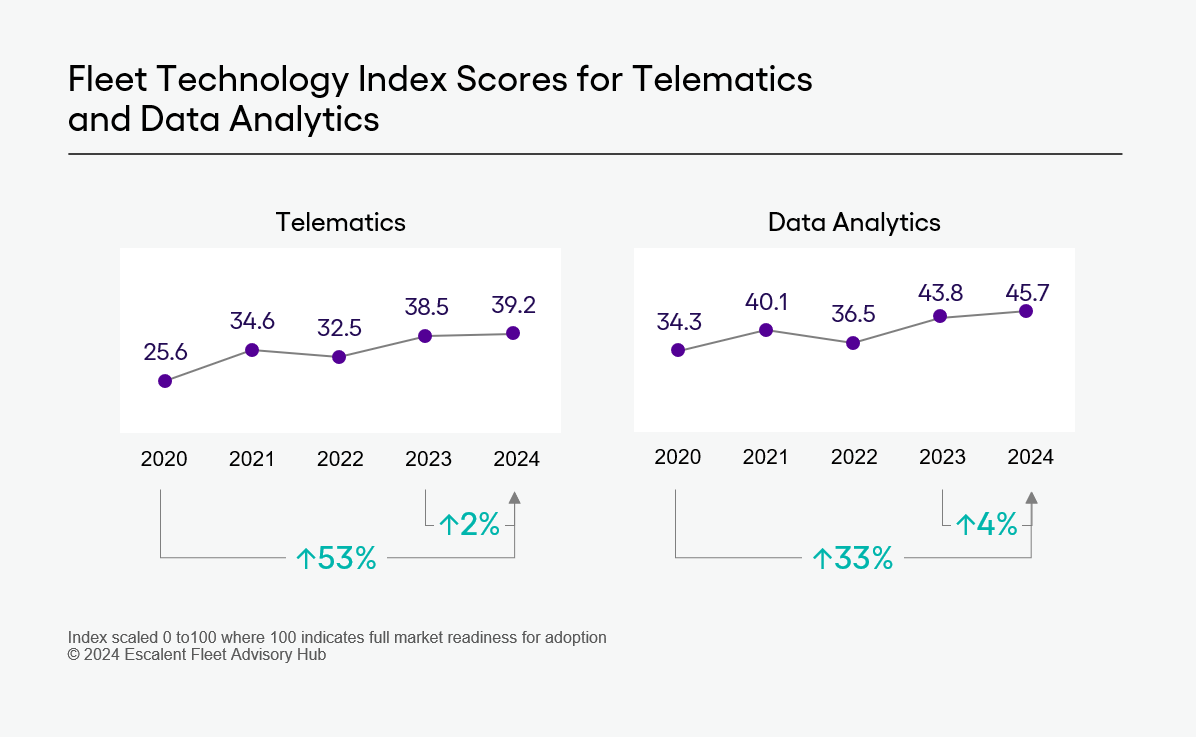

Among core technologies, data analytics and telematics are leading the way for fleet businesses. Since 2020, the index score for telematics has increased by 53%, although these gains are now leveling off. Between 2023 and 2024, the index score for telematics rose by just 2%, suggesting that use is reaching a late early adopter stage—and paving the way for an early majority to come next. Our findings on data analytics exhibit a similar pattern. Over the past four years, the technology’s index score has climbed by 33%, while 2023 to 2024 is up only 4%.

Increasingly, these two tools are intersecting with one that is making strides from our emerging technology category: AI. Over the last 12 months, adoption of AI has risen by 86%, contributing to a 41% year-over-year index score spike. Within a broader context, the data are even more remarkable. From 2020 to 2024, emerging technologies net an overall index score increase of 43%. During that same period, AI’s index score has risen by 75%.

Harnessing Generative AI in the Fleet Industry

AI is a broad term that covers a wide range of applications. Within the 2024 FTI report, we define AI as any technology that allows machines to learn from experience, adjust to new inputs, and perform human-like tasks. A subset of this technology that has been gaining traction in the fleet industry is generative AI (GAI).

GAI is trained on vast datasets to create new data or outputs based on user prompts. Since ChatGPT was released at the end of 2022, the technology has rarely been out of the news. To determine its impact on the fleet industry, this year we produced a complementary fleet report that examines how fleet managers and businesses are leveraging GAI’s capabilities.

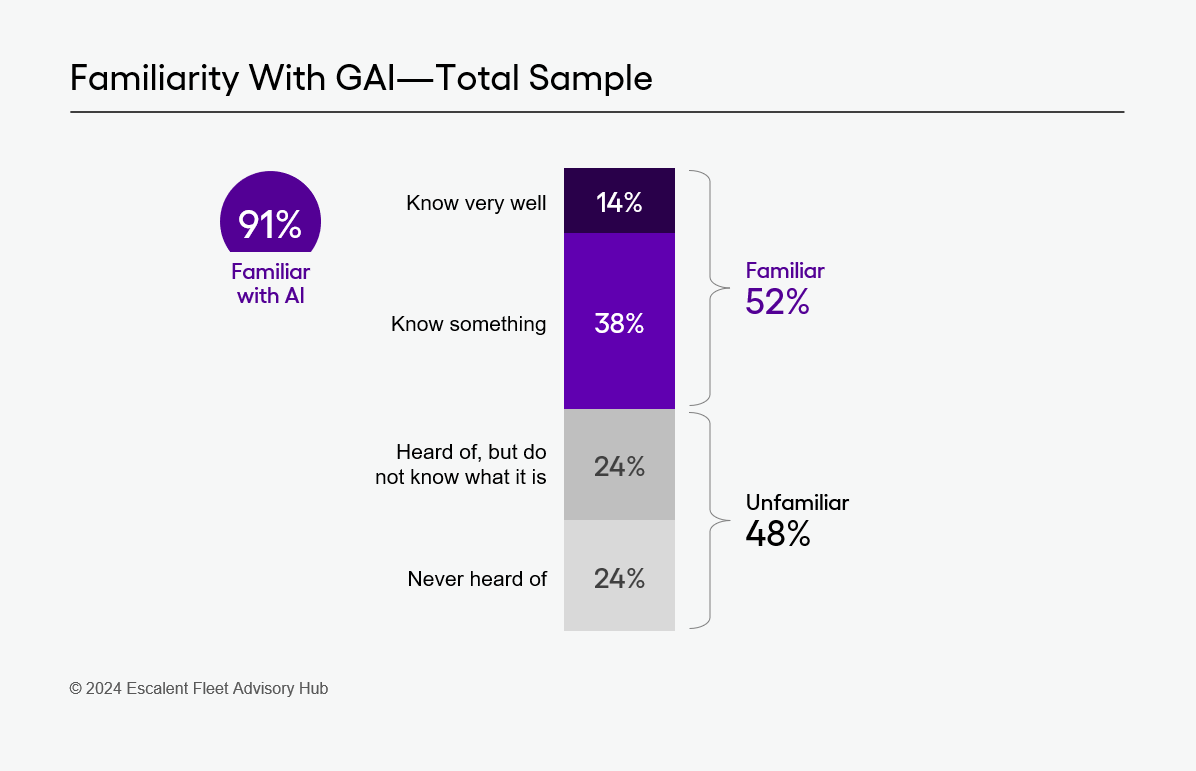

While nearly all (91%) fleet decision-makers are generally familiar with AI, a slight majority (52%) are familiar with GAI. Piqued by the promise of improved productivity and efficiency, almost one-third of fleet decision-makers are gathering information or conducting a cost analysis around GAI. Of the 15% of fleet decision-makers using GAI today, half are in early pilot testing. Further, fleet businesses are using GAI to enhance their marketing and content development efforts.

Early Enthusiasm Versus Long-Term Viability for Fleet Technologies

For now, fleets are testing the water with GAI. What is unclear is whether enthusiasm toward the technology will stand the test of time. The past four years have provided several examples of fleet technologies that exhibited early potential only to lose momentum.

For instance, between 2020 and 2021, the BEV index score rose by 34%. But in 2024, it has dropped by 8%, making BEVs the only included technology to register a year-over-year decline. Shifting attitudes around BEVs, fueled partly by recent media coverage, are behind this drop. Fleet leaders and decision-makers have cited stories of BEVs losing functionality and range in cold weather, among other concerns.

Beyond bringing products to market, automakers and fleet service providers need to ensure that the experience of owning and driving BEVs meets fleet managers’ expectations. This is especially true for smaller fleets that stand to be less impacted by regulations such as the Advanced Clean Fleet Act.

Fleets also appear to be softening on AVs. While the technology’s index score has increased by 27% since 2020, most of those gains were recorded in 2021. As fleet decision-makers look beyond the hype to assess the practicality and safety of AV applications, it is apparent that the technology has a long way to go. Many see AVs as a liability rather than an opportunity, with 44% saying the technology still needs to be proven.

Maintaining the Pace of Adoption of Fleet Technologies

After the chaos of the pandemic and supply chain disruptions, fleets are once again finding their feet. Staff are returning to the office and hitting the road. With sales meeting or exceeding pre-pandemic levels, 52% of fleet leaders and decision-makers report that business has returned to normal. This relative stability is prompting fleet businesses to invest in new tools and capabilities. That said, fleets can only adapt as quickly as the technology they rely on. Where technology and infrastructure development has slowed, as with BEVs and AVs, so too has adoption.

For product manufacturers and service providers, the pressure is on to make the case for the technologies they offer fleet businesses—and ensure the transition is as smooth and advantageous as possible. In the context of GAI, for instance, providing transparent security protocols and opportunities to experience these tools before investing in them will be critical.

It is clear that a connected, technology-enabled fleet business is the future. However, it remains to be seen which providers and technologies will dominate this landscape. Many fleet leaders and managers are still in the initial stages of a steep learning curve when it comes to leveraging and using advanced technologies. That makes it the ideal time for product manufacturers and service providers to step in and help fleets navigate the complexities of integrating new tools that will allow them to pull ahead in an increasingly competitive environment.

If you would like to learn more about our fleet industry research or speak with our commercial vehicle and fleet experts about how we can help you best respond to the needs of fleet leaders and businesses, please use the form below to connect with us.

Want to learn more? Let’s connect.