It’s no secret that fintech is bringing in big dollars with solutions that give consumers hundreds of ways to manage and move their money digitally. But the digital ecosystem is growing even more complex. Fintech, the darling of IT and marketing teams (not to mention M&A) in recent years, has seen user growth slow and adoption rates stagnate as it seeks to move beyond early adopters and into the mass market. A recent study from Escalent’s financial services team has found convincing evidence that fintech is hitting some friction points, causing once-snowballing growth to even out.

Let’s look at mobile payments.

Mobile payment services take the place of cash, checks and debit and credit cards. Fortunately, mobile payments can leverage the network effect to drive growth. But even with that benefit, growth has stalled. Players in this space are competing with banks that have been around for hundreds of years, so these solutions must demonstrate they can truly be trusted.

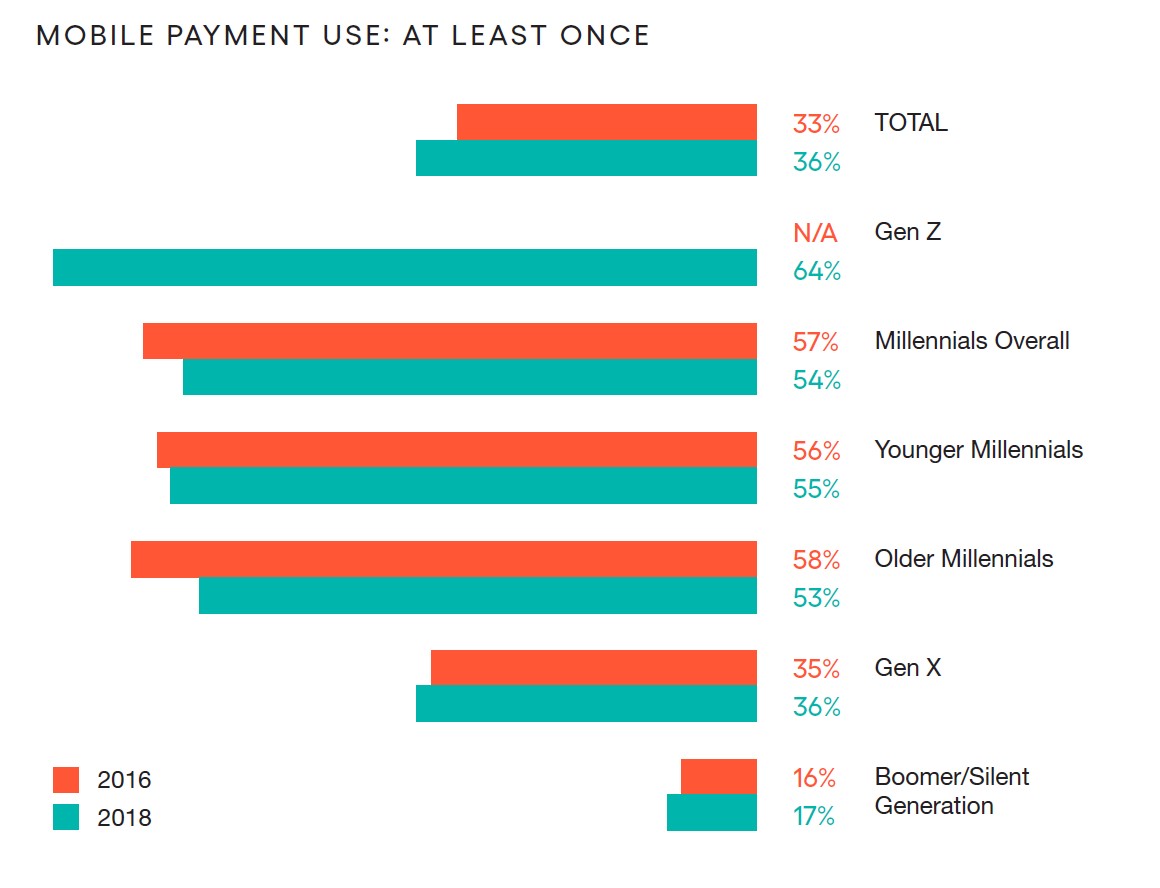

Until recently, adoption of mobile payments has been consistent, but that steady growth has begun to idle. A 2017 report found that about 77% of US adults have a smartphone, and of those users, only 13% have tried Apple Pay, 7% Google Pay and 5% Samsung Pay. In fact, the highest use of mobile pay seems to be among retailer-specific services such as Walmart (24%) and Starbucks. Our data show that in 2018, about 36% of smartphone owners used mobile pay once in the previous year; in 2016, the proportion was 33%. And surprisingly, use among Millennials actually decreased. More startling, those who haven’t tried mobile payments are now less likely to try such a service, a big change from 2016 when they were more likely to give it a try.

Source: Escalent. System Idling: Growth slows across the digital ecosystem. June 2019.

There are similar problems in growth and adoption with peer-to-peer payments, robo-advisors and micro investing platforms. But traditional financial firms are still expanding into fintech, new companies are popping up with innovative solutions, and behemoth tech players such as Facebook are entering the fintech space. The problems facing the digital ecosystem aren’t uniform—consumer needs, expectations and comfort vary by type of solution and generation.

Click below to download the full System Idling white paper and dive into these differences. Learn how firms can build their own digital ecosystems to find efficiencies in new product offerings and cast a wider net to meet the needs of consumers across generations and tech-savviness.