Asset managers know the power advisors hold over offering, or not offering, their products to clients. It’s why many asset managers have substantial marketing budgets to get their brands in front of advisors’ eyes and into their consideration sets.

Following a higher volume of communication activity at the outset of the pandemic, advisors subsequently felt a pullback on marketing from asset managers. When asked how many monthly touches they received from financial services providers, advisors remembered hearing from asset managers less. But this year’s Advisor Brandscape report finds that these touches are rebounding amid increasing apprehension about the current environment among advisors and their clients.

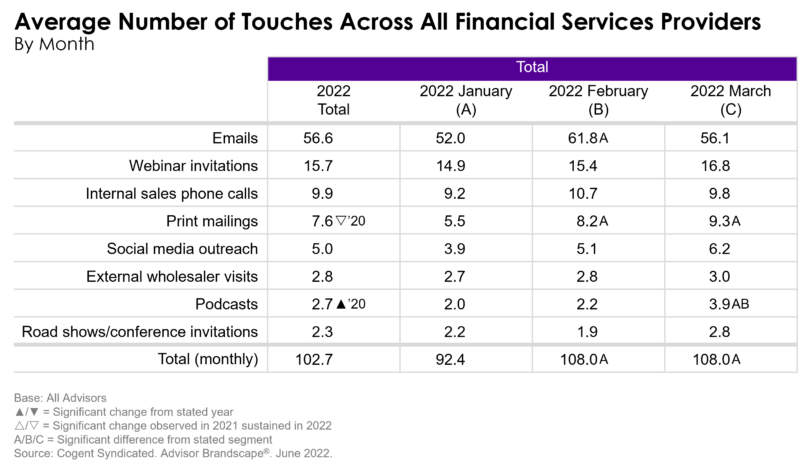

This year, advisors report an average of 102.7 monthly touches in Q1 across all types of financial services providers. Our unique ability to dig into changes month-over-month with Cogent Beat Advisor lets us unpack this annual uptick. January didn’t start with a boost to advisor communication, but there was clearly a resurgence in provider outreach in February and March amid growing uncertainty following Russia’s invasion of Ukraine. These communication levels are closing in on the highs achieved during the onset of the COVID-19 pandemic in March 2020.

Notably, more than half of advisor outreach is conducted via email, with advisors recalling an average of 56.6 emails a month. And podcast engagement has increased significantly from 2020. But while the volume of print mail increased from January to March along with more advisors returning to the office, advisors continue to receive fewer print materials than reported in 2020. Looking at social media outreach, we see that it continues to tick up, with advisors reporting 5.0 touches on average this year, growing from just 2.6 touches in 2017.

But any good marketer knows that it’s not just the quantity of the communication, but the effectiveness that drives ROI. This year, we used a MaxDiff approach to identify the most effective means of communicating with advisors. In the MaxDiff exercise, we showed respondents three touchpoints at a time and asked them to identify the most effective and least effective communication method. Although email is the most frequent method, advisors identified external wholesaler meetings as the most effective way for providers to engage with them. Nearly two-thirds of advisors (63%) favor this type of interaction. Emails are the second most preferred method for provider communication among advisors overall. Digitally driven RIAs are far more likely to tout emails, webinars and provider websites as effective communication methods compared with their broker/dealer counterparts.

In order to optimize advisor engagement, asset managers need to work to maximize the number and effectiveness of combined interactions. Wholesaler interactions remain a critical component as more advisors resume in-person meetings. In addition, integrated marketing campaigns that combine emails and paid media to drive traffic to websites for additional resources are key to increasing consideration. Pertinent materials that address advisors’ concerns and provide historic perspective that they can share with clients attract the most attention as advisors strive to reassure clients of the benefits of investing over the long term amid the current unsettled economic environment.

Cogent Syndicated’s Advisor Brandscape report offers a holistic view of the advisor landscape allowing asset managers to drive advisor engagement and elevate brand consideration. Click below to learn more about the report.