There is no shortage of differing opinions on environmental, social and governance (ESG) investing these days, and the future path for the wealth management industry appears to be getting murkier. Yet there is perhaps no greater example of “disconnect” than that between financial advisors and their affluent investor clients.

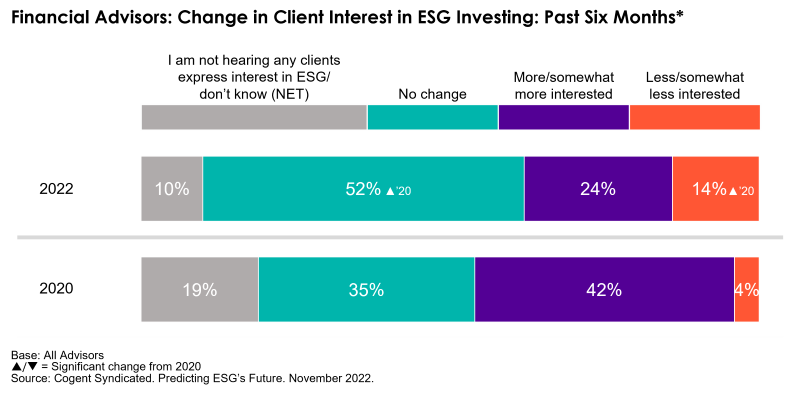

In a recent survey of financial advisors conducted by Cogent Syndicated in August, more than half (52%) of advisors said there has been no change in their clients’ interest of ESG investing over the past six months, and another 14% said their clients’ interest has declined. Both of these proportions are significantly larger than they were two years ago, when ESG investing was just beginning to hit the mainstream.

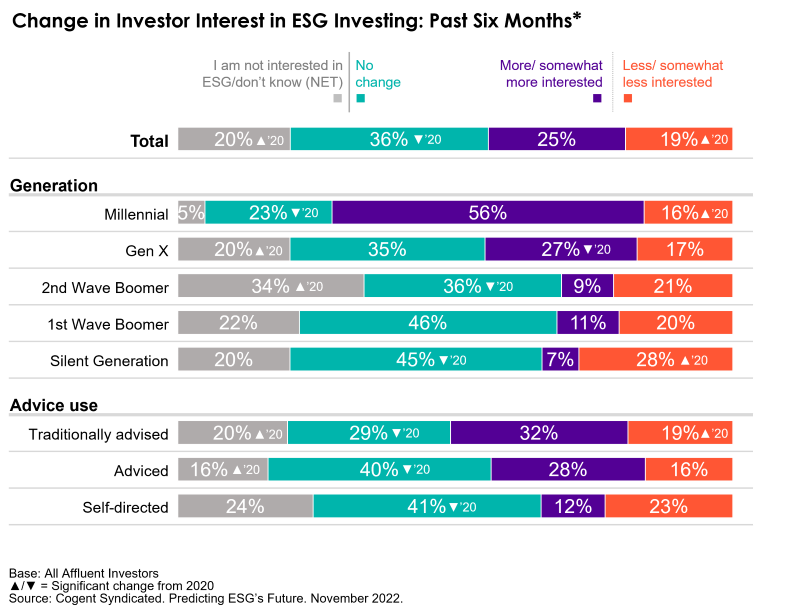

Yet affluent investors are telling us a different story. In fact, one-fourth (25%) of all affluent investors indicate their interest in ESG investing has increased over the past six months, and more than half (56%) of Millennial investors feel this way. Moreover, interest in ESG investing is significantly higher among advised investors than those taking a self-directed approach.

Younger affluent investors, particularly Millennials, feel strongest about the importance of customization in ESG strategies. More specifically, six in ten Millennial investors consider it “extremely” (20%) or “very important” (40%) for an investment manager to personalize or customize an ESG investing strategy to their specific interests—highlighting the appeal of direct indexing among this group, a topic our colleagues at Javelin recently examined.

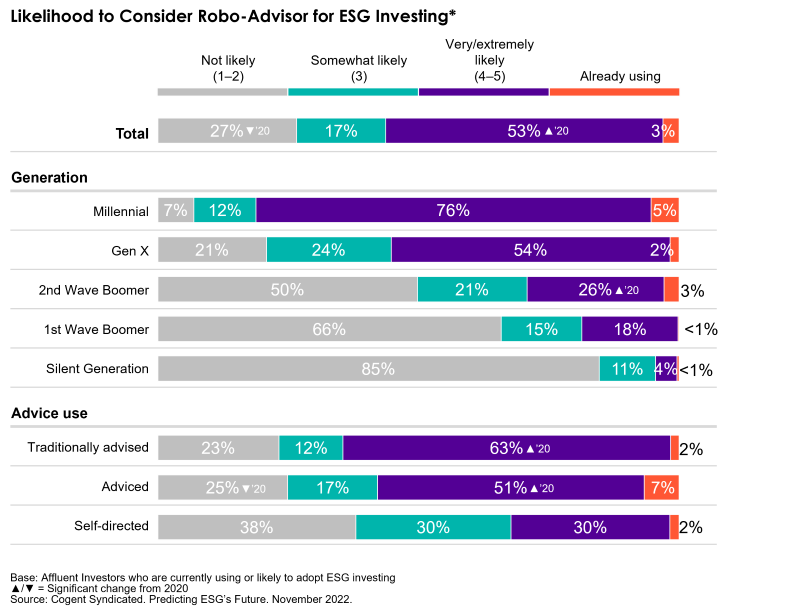

Younger and advised ESG users and intenders report stronger interest in using a robo-advisor for ESG investing than their self-directed peers. This suggests that traditional advice providers may not be doing enough to meet the demands of younger investors in this area.

Financial advisors and advisory firms would be wise to take heed of these warning signs. Millennials represent a growing proportion of the affluent investor population, and their investment approach is quite different than those of their elders. If these investors continue to encounter resistance to their ESG ideals from traditional financial advisors, a large percentage of this client base is likely to turn to other means of achieving their goals.

With the growing attention and varied perceptions towards ESG investing, Cogent Syndicated’s Predicting ESG’s Future report keeps a pulse on all industry dynamics and influencers. To learn more about the report click below.