The electrification of home appliances and transportation is important in fighting climate change and increasingly being supported by policymakers. At the federal level, the Inflation Reduction Act has created or expanded tax credits for heat pump HVAC, heat pump water heating and electric vehicles (EVs), among other electrification technologies. At the state level, states such as California, Illinois and New York have used carrots and sticks to encourage electrification, with utilities taking a key role.

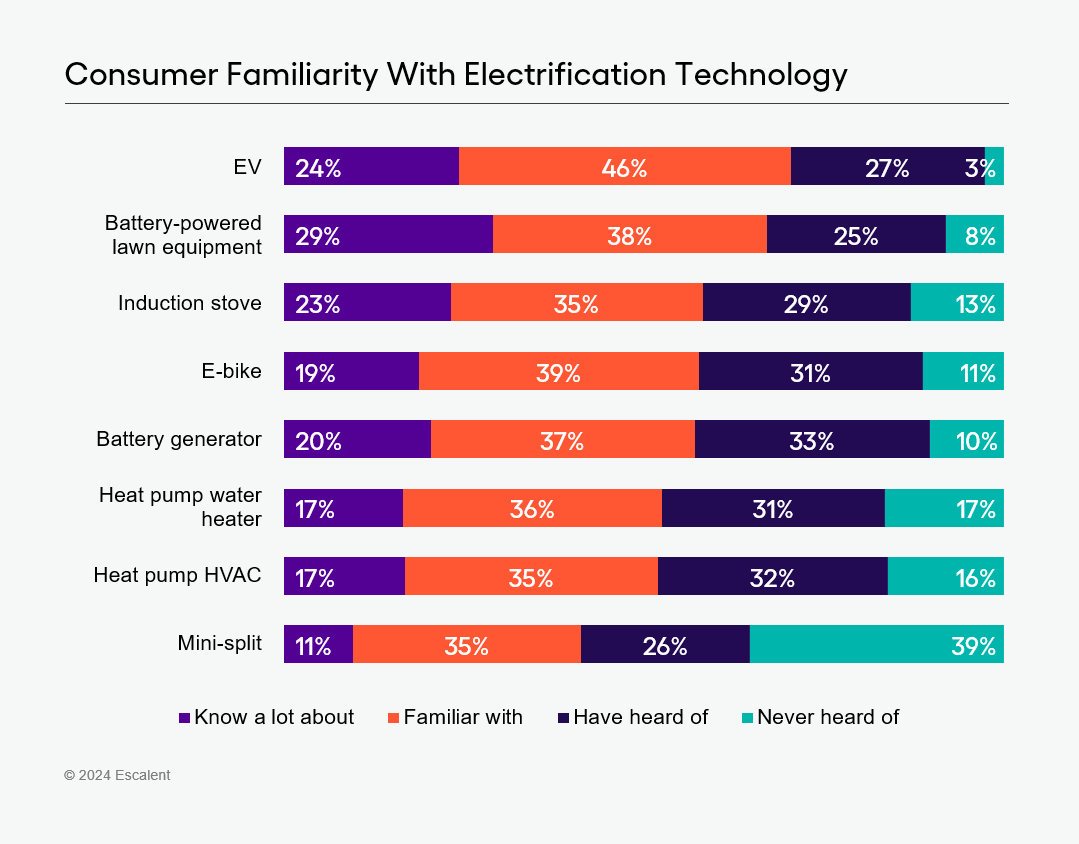

As supportive policy grows and electrification technologies become more mainstream, the public’s awareness of these innovations is also growing. We recently surveyed a representative nationwide sample of US adults ages 18 and older and found that 80% of consumers are familiar with the key technologies for home and transportation electrification. However, while technologies such as EVs and battery-powered lawn equipment are relatively well-known, heat pump technologies, especially mini-split heat pumps, remain less familiar to consumers.

In this blog, we’ll explore more of these findings, the current landscape of electrification technologies, the drivers and barriers to adoption, and the implications for the broader “electrify everything” movement.

Familiarity With Electrification Technologies

In terms of public awareness, our survey shows that people are generally familiar with a wide range of electrification technologies, from EVs to heat pump HVAC systems. The least known technology in the mix is the heat pump mini-split system, with 39% of consumers indicating they have never heard of it. Other heat pump technologies, such as central heat pump HVAC systems and water heaters, also have lower levels of familiarity compared with other devices such as battery-powered lawn equipment, induction stoves, and, of course, EVs.

EVs are among the most recognized technologies, perhaps due to the increasing number of models on the market and heightened media attention. Meanwhile, electrification in home heating and cooling, particularly heat pump systems, is lagging in public awareness, which may hinder wider adoption. For the electrification movement to succeed, more marketing about the efficiency, performance and benefits of heat pump technology is essential.

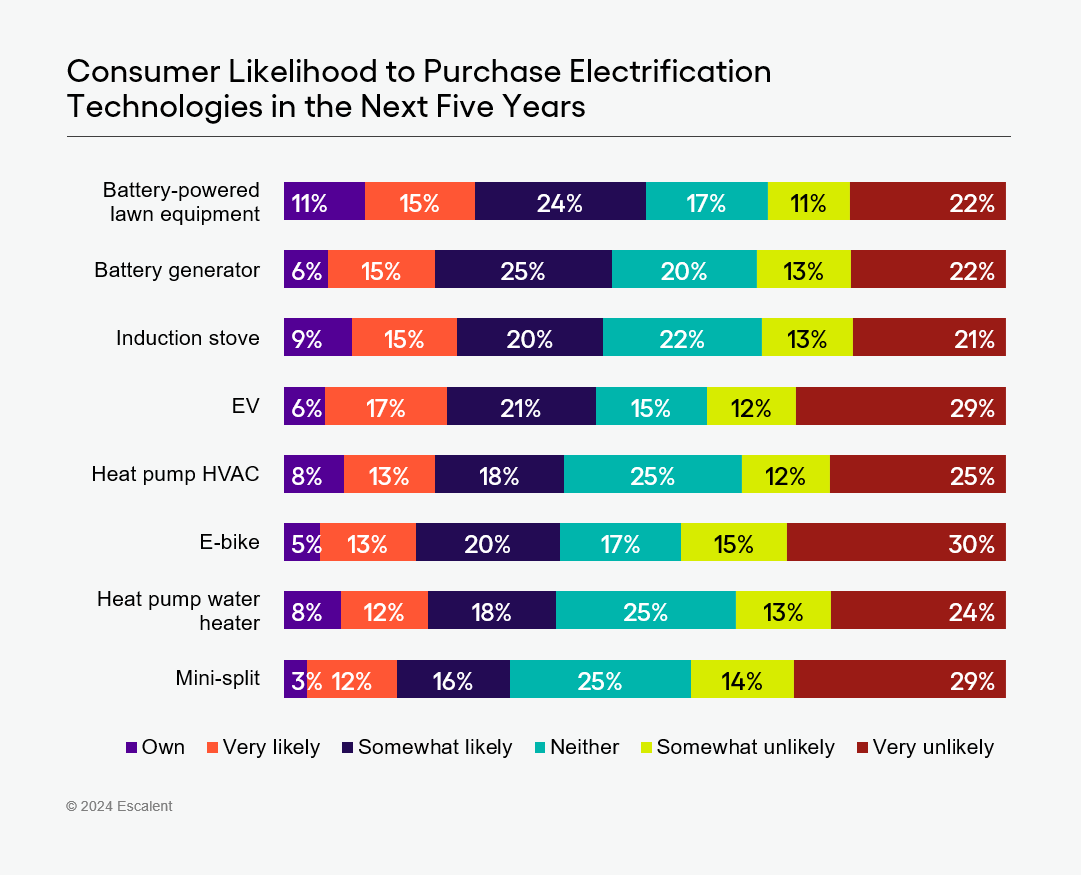

The Likelihood of Adoption: What’s Driving Demand for Electrification Technologies?

Consumers show varying levels of interest in purchasing different electrification technologies over the next five years. Notably, battery-powered lawn equipment and generators top the list, with a significant portion of consumers showing a high likelihood of adoption: 39% of consumers are somewhat or very likely to purchase battery-powered lawn equipment in the next five years and 40% for battery generators. These technologies are popular not only for their performance but also for their positive impact on local air quality. However, their contribution to overall electricity demand is minimal, as they do not use high amounts of energy.

EVs, on the other hand, are likely to have the most significant impact on electricity demand growth. With 38% of consumers saying they’re at least somewhat likely to purchase an EV within the next five years, these vehicles could substantially drive up electricity consumption. As EV adoption continues to rise, the electricity grid will need to adapt to support this increased demand and utilities will need to ensure that the infrastructure is in place to handle the load.

Induction stoves closely follow EVs in terms of adoption likelihood, with 35% of consumers indicating they are at least somewhat likely to switch to this technology. Though induction stoves offer faster cooking times and higher energy efficiency, they are unlikely to contribute significantly to higher electricity demand due to their limited use compared with larger appliances such as HVAC systems.

Despite the potential for HVAC and water heating systems to increase electricity demand, these technologies rank lower on the list of likely adoption. Heat pump HVAC and water heaters are complex installations and as many as 85% of replacements happen during emergencies, making it less likely for homeowners to choose electric alternatives without proper consumer education and marketing before they find themselves in a “must-replace” situation.

The Barriers to Electrification Technology Adoption: Cost and Performance Concerns

While performance and lower operating costs are key motivators for many consumers who are considering electrification technologies, significant barriers still exist. Chief among them is the perception that electric technologies are more expensive than their alternatives. Nearly half of consumers (48%) have expressed concern that the higher up-front costs of electrification technologies would deter them from making a purchase.

This concern is particularly notable among potential buyers of induction stoves, heat pumps and EVs. The initial cost of these products is often higher than that of their fossil fuel-based counterparts, making it harder for consumers to justify the switch without clear financial incentives, such as tax credits or rebates.

Performance concerns also play a role in dampening demand. While many consumers are drawn to electric technologies for their improved performance, others worry that making the switch could result in poorer performance than traditional systems. In fact, performance is the top concern among consumers who are at least somewhat likely to purchase induction stoves and heat pump technologies (for both space and water heating). This means that utilities and other players trying to spur consumer adoption of electric technologies need to tell compelling stories of how these technologies are better than the alternatives. For instance, the ability of induction stoves to boil water in a fraction of the time compared with gas or conventional electric stoves is a compelling argument for those seeking high-performance kitchen appliances.

Motivators for Likely Adopters of Electrification Technologies

For consumers who are at least somewhat likely to adopt electrification technologies, performance and access to tax credits are the most common drivers. For several technologies, including induction stoves and EVs, the promise of lower operating costs are also motivators.

These motivations are almost the inverse of the barriers discussed above, which again makes the case for touting the performance benefit of electric technologies and ensuring that consumers are aware of tax credits and other incentives (e.g., utility rebates) that can help defray the up-front purchase cost of electric technologies.

Who Is Likely to Buy Electrification Technologies?

Those most likely to adopt electrification technologies identify with an “early adopter” mindset. These consumers are generally the first to embrace new products, and owning the latest design or technology is important to them. They are somewhat environmentally conscious, but this is not their primary motivation. Instead, they are driven by the desire to be at the forefront of innovation and to experience the benefits of new, high-performance technologies.

This suggests that we are still in the early stages of the “electrify everything” movement. Early adopters will continue to drive the market for electrification technologies for the foreseeable future, with wider adoption only occurring as more mainstream consumers become convinced of the value and performance of these products.

The First Inning of Electrification: How Utilities Can Help in the Transition

The electrification movement is still in its early stages and early adopters will continue to be pivotal in driving market demand. However, for wider adoption to take place, it will be essential to address concerns about cost and performance. By promoting tax credits and telling compelling stories about the benefits of electrification, the industry would help more consumers make the switch to electric technologies.

In our Energy practice, we have worked with numerous utilities and energy providers to develop programs and strategies that promote electrification. If you need support in this area, contact our energy industry experts by filling out the form below.

Want to learn more? Let’s connect.

About the Study

Escalent interviewed a national sample of 1,318 consumers ages 18 and older from August 2 to August 26, 2024. Respondents were recruited from various opt-in online panels of US adults and interviewed online. Demographic quotas of age, gender, ethnicity and income were in place to represent the US adult population. As the sample for this research comes from an opt-in, online panel, any reported margins of error or significance tests are estimated and rely on the same statistical assumptions as data collected from a random probability sample. Escalent will supply the exact wording of any survey question upon request.