Connected vehicle technology is rapidly becoming ubiquitous, both here in the United States and across the globe. This year, according to Statista, it is expected that more than 64 million cars worldwide will be shipped with some form of connected tech.

For those proclaiming the arrival of a bold future – one in which cars will pilot their way down the road with little to no input from a human driver – connected services are seen as a major building block of this transformation, and manufacturers clearly are eager to put upgraded tech into the hands of consumers. Ultimately, many OEMs would love it if consumers viewed them as much as mobility providers as manufacturers of transportation products.

As OEMs gain greater ownership stakes in innovative mobility entities, connected services are also seen as a new, recurring revenue stream of the future for the automotive industry. Manufacturers are counting on these services as future drivers of engagement and consumer loyalty, helping to offset declining revenue in other areas.

However, in a proprietary survey* we recently conducted, it appears that consumers are still struggling to develop a connected relationship with their daily rides. We found that 84 percent of 1,000 drivers surveyed aren’t using mobile apps that OEMs have developed to control aspects of the ownership and driving experience.

It’s a startling statistic, given that mobile application use is a very common consumer practice across most service sectors, from buying tickets online and monitoring news feeds to business practices such as remote industrial control and fleet management. So why the reluctance to adopt connected car applications? And how do OEMs close this gap? Let’s take a closer look.

Marketing OEM Apps and Connected Services

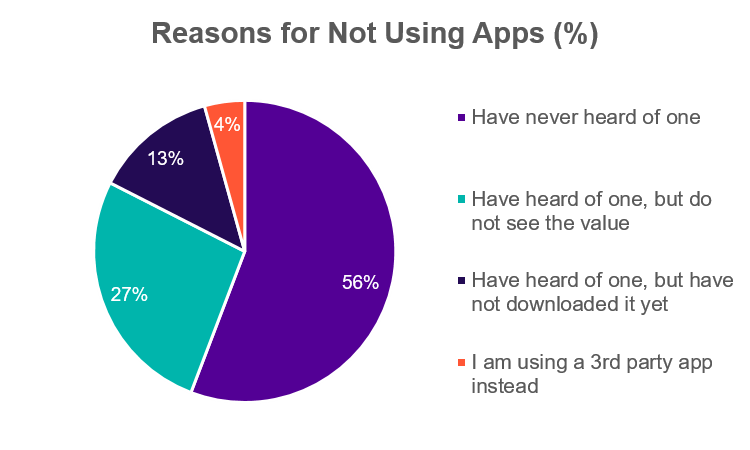

We learned from our sample group that a majority – 56 percent – weren’t even aware of the existence of an OEM app. This stifling lack of awareness would seem to be an easy hurdle to cure – far easier, it would seem, than convincing the next largest group – 27 percent – who were aware of the existence of the OEM app but weren’t impressed enough to use it.

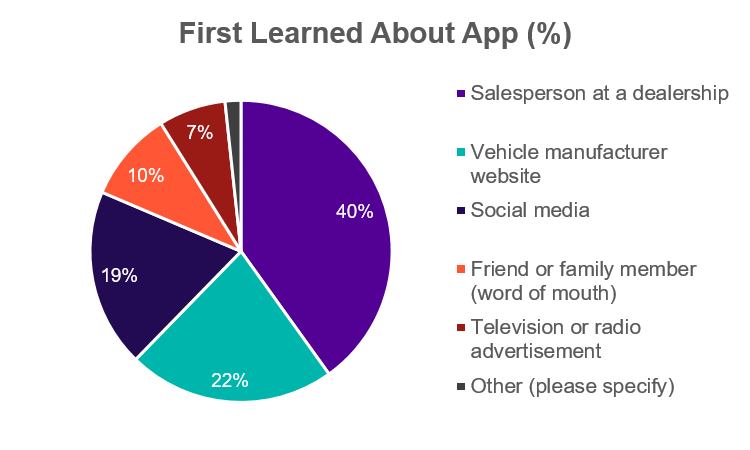

As we delved deeper, we learned that marketing of OEM apps was limited – mostly left to salespeople who may not have the technical background to spotlight key features; or to a link on a website with little fanfare.

Clearly, more proactive marketing of the apps will help, but it also will be valuable to position these apps as a critical ingredient in “personalizing” the driver experience. Salespeople at the dealership have an opportunity now to use these apps to build trusted relationships with buyers by focusing on features of connected services particular to that individual. If the sales mantra in the past was to get “butts in the seats,” the future will be about getting “thumbs on the buttons.” Focusing on the connected services that heighten the level of interaction between the consumer and the vehicle, and getting consumers to experience the digital relationship with the vehicle can, over time, become a new way to create brand and dealer loyalty.

Creating a More Engaging Experience

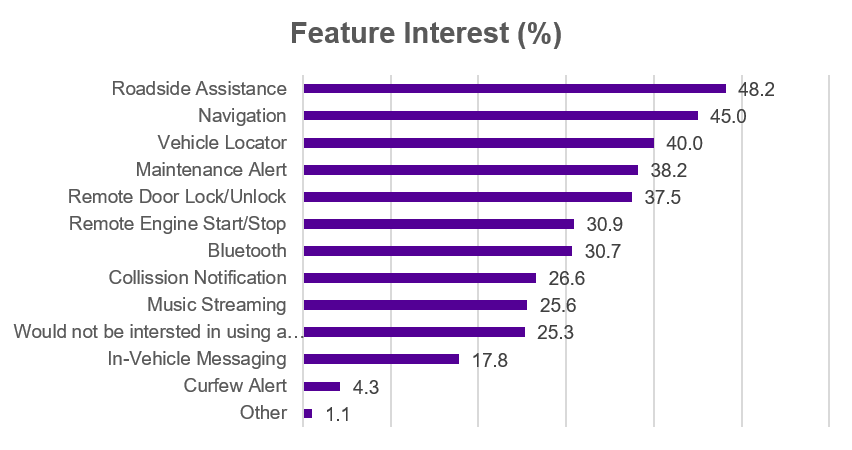

The most popular features of connected services all endeavor to heighten the direct level of interaction between the driver and the vehicle. That said, it’s the table stakes of the driving experience – things like roadside assistance and navigation – that are seen as most valuable in an OEM app. Though in-vehicle messaging and music streaming are innovative, they rank near the bottom of the survey because they’re not as essential to bringing the driver closer to the automobile as things like maintenance alerts, remote lock/unlock or remote engine start. So it’s not surprising that features that offer the convenience of interacting with the car from a remote location or help to improve the experience with the car, rank near the top.

When asked to be futurists, survey respondents said they hoped that future enhancements to OEM apps would include things like notifications, remote climate control, personalized cabin preparation or remote access to onboard cameras.

App School 101

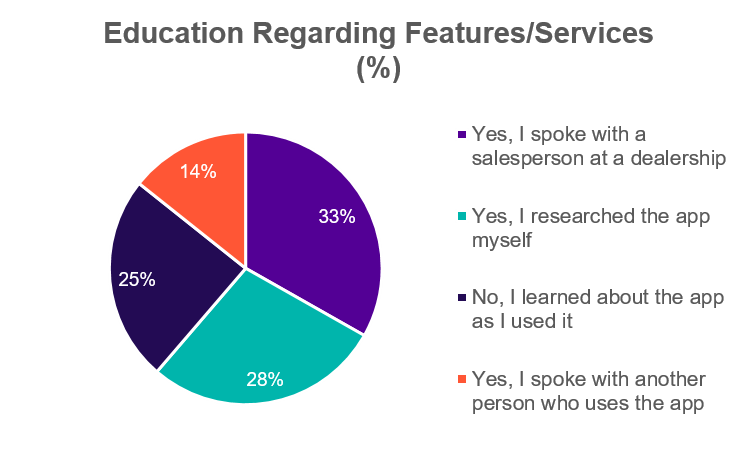

Those same salespeople who first introduced the app to the consumer were also called upon to train consumers on their use. Though we cannot draw a conclusion about the effectiveness of salesperson-led training, it’s noteworthy that nearly the same amount of those surveyed opted to educate themselves about the app outside of the dealership. This underscores the importance of making training materials easily available online, so consumers can bone up at their leisure.

Reinventing the Customer Relationship

By using the app training experience as another touchpoint toward personalization of the vehicle to the owner’s individual tastes, dealers can build a better relationship between the buyer and the dealership itself. Hence, the new offerings of connected services provide the dealerships with a unique window of opportunity to reinvent the relationship with their customers by focusing on the engagement with the vehicle rather than focusing on just the vehicle itself.

If dealerships can move away from the transaction mindset and, instead, help create a personal relationship between the customer and the vehicle, then dealerships themselves have the opportunity to create a personalized retail experience. They can then better retain their customers outside of warranty lifespan and the relatively long period of time in-between the next car purchase.

Delivering Satisfaction

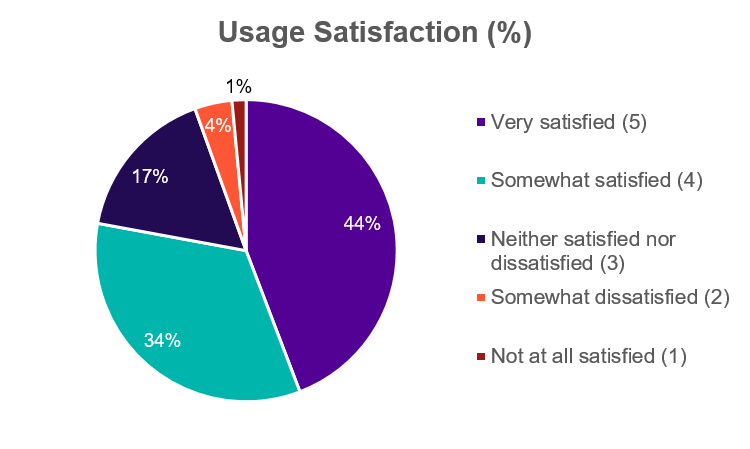

OEM apps tend to receive the best ratings from drivers who have integrated the apps into their routine. A strong majority of drivers surveyed responded that they are very satisfied with the usage of OEM apps, while a very small minority reported not being satisfied at all with the app usage. As OEM app usage is adopted at a greater level, and the insight provided by current users is ascertained and acted on for future feature development, OEM apps can heighten the level of satisfaction and, as a result, increase the loyalty to the brand.

So, how will the market ultimately embrace OEM apps? As our survey indicates, having a deep and detailed understanding of the digital experience – and the role OEM apps can play in helping to personalize this experience – represents the best pathway to success. Although the adoption of connected services may become more prevalent over time, OEMs and dealers will experience faster and more profitable growth if they understand how to bring the consumer into a level of personalization with the apps. This, in turn, will bring consumers closer to the automobile, and create a more satisfied mobility experience inside and outside of the car.

If we can help you to better understand consumer habits around connected vehicle technology, please send us a note.

*The data collected by the Escalent Automotive Consumer Pulse Study are weighted to ensure relevant demographic characteristics of the sample matched those of the U.S. general population. All respondents are weighted to U.S. Census Bureau demographic profiles for the U.S. population 18+ on gender, age, income and ethnicity.