Advisors and affluent investors are met with yet another new set of challenges when navigating their clients’ or personal investment portfolios. In March of this year, inflation reached 8.5%, interest rates rose, and the geopolitical environment was left unsettled by the ongoing conflict between Russia and Ukraine. These compounding concerns have significantly impacted perceptions of the current investing environment, resulting in a lack of confidence in the resiliency of the US economy and future economic outlook.

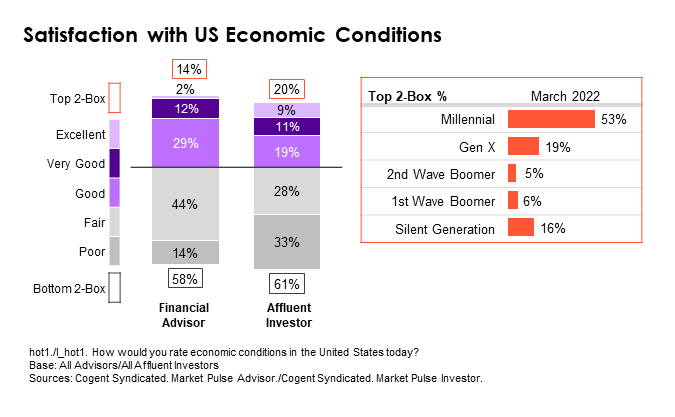

As of March 2022, advisors and affluent investors express little optimism with the then-current economic conditions in the United States. The majority of advisors (58%) and affluent investors (61%) consider the current state of the US economy as below optimal, with just 14% of advisors and 20% of affluent investors rating current conditions as “very good” or “excellent.” Among affluent investors, Millennials are the most optimistic when it comes to the US economy, with more than half reporting a positive outlook. In contrast, their older peers, 1st and 2nd Wave Boomers, report a far more critical perspective.

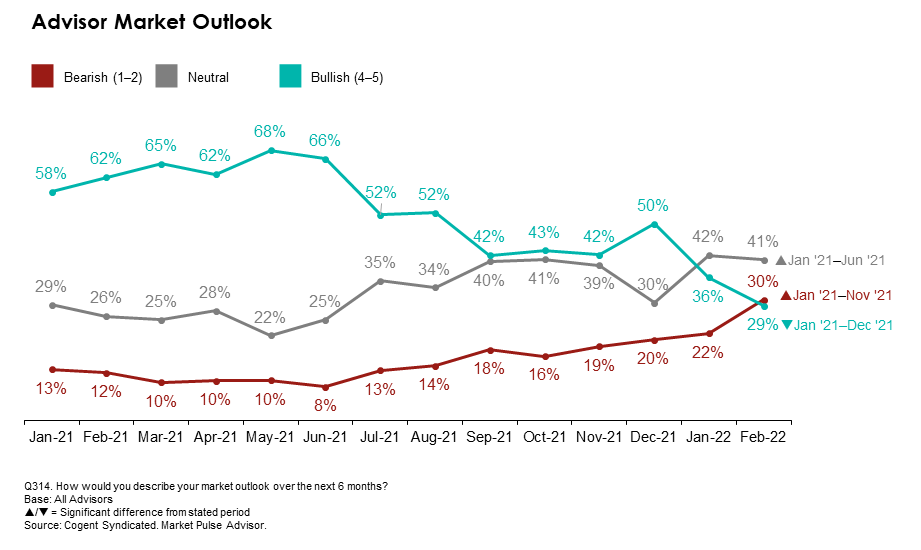

Faced with uncertainty amid heightened concerns surrounding the economic environment, just three in ten (29%) advisors describe their market outlook as bullish over the next six months, a significant decline from the 50% who were bullish at the end of last year and the two-thirds (65%) in March 2021. Inversely, the proportion of advisors with a bearish outlook has reached a new high, with three in ten (30%) describing their six-month market outlook as bearish compared with just 10% in March 2021. With the momentum behind the enduring bull market waning, advisors and affluent investors are tilting away from a growth to a value investing approach.

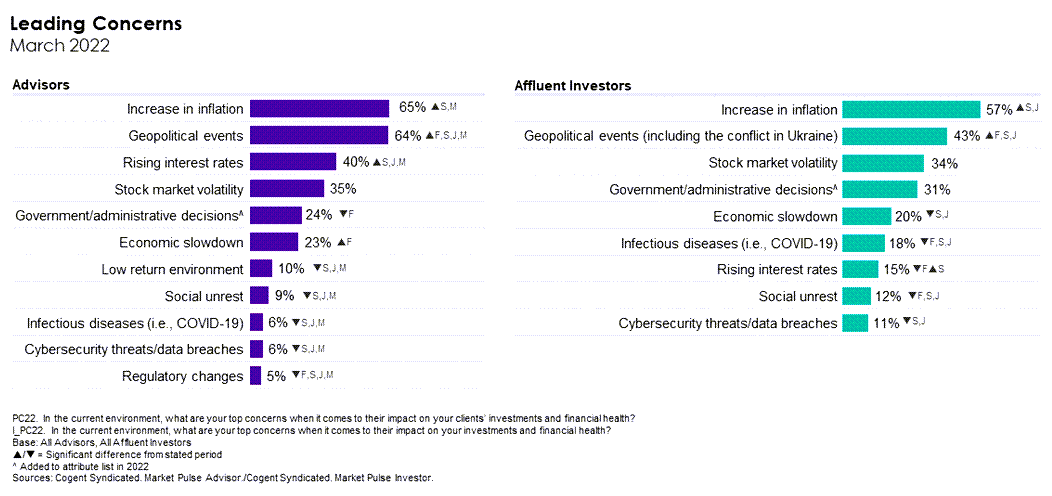

As concern about the COVID-19 pandemic wanes, advisors and affluent investors face a new set of challenges when navigating investment portfolios. Inflation continues to stand out as the leading concern, as advisors and affluent investors feel the impacts of rising costs on their everyday lives. Concerns surrounding geopolitical events (including the conflict in Ukraine) have nearly doubled between February and March, with financial advisors citing geopolitical events as a leading concern, increasing from 34% in February to 64% in March. However, concerns surrounding the conflict in Ukraine have softened somewhat since the initial invasion, with 39% citing it as a top-of-mind concern as of April. Similarly, concerns over geopolitical events have also doubled since February among affluent investors, from 21% in February to 43% in March, with that concern softening as of April (30%). These shifts underline the impact big market swings and the media can have on advisors and affluent investors.

These compounded concerns and continued uncertainty have significantly influenced perceptions of the current economy and its expected recovery timeline. Asset managers can help by providing market commentary that addresses current fears while providing the firm’s perspective on investment opportunities that offer strong potential. Advisors and affluent investors also seek educational materials that provide a historic perspective based on past events to offer reassurance on the benefits of investing over the long term.

We’re tracking advisor and affluent investor sentiment monthly. Let’s connect if you want to learn more!