Imagine driving to work in your battery electric vehicle (BEV)—also known as EVs. You enter a public parking lot, pull into the space of your choice, and press a button on your smartphone app to request a charge. While you’re away, a mobile charging robot rolls to your car, opens the charging socket flap, connects a battery wagon to provide a charge, and then disconnects and removes the wagon, all before you return.

A prototype developed by Volkswagen, the self-driving charging robot is just one possible solution to overcoming what consumers say is their biggest barrier to BEV adoption: charging infrastructure.

Our latest proprietary research on the future of BEVs shows that 74% of US consumers believe that charging infrastructure needs improvement. European consumers also see room for improvement, as only 28% believe it’s easy to charge at home, while even fewer (16%) believe it’s easy to charge at work. And as more electric vehicles take to the streets, the need for infrastructure—and its associated costs—will grow. According to the National Council on Clean Transportation (NCCT), the US will need to invest more than $2.2 billion in BEV charging infrastructure across 100 of its most populated metropolitan areas by 2025 to cover the expected increase in electric vehicle adoption.

At the same time, BEV adoption rests on the ability to access electricity and charging stations whenever and wherever drivers need them. And while consumers expect governments, automakers and even fuel providers to help build the charging infrastructure, there is no grand plan or working policies in place.

So, the world is left wondering: Who will pay for and build the BEV charging infrastructure necessary to keep the wheels of electric vehicles rolling?

People have long engaged in the debate over infrastructure as an enabler of innovation, steering the conversation toward government funding and subsidies or tax incentives. One of the most prominent examples of government-funded infrastructure that paved the way for innovation is the internet. Backed by US Department of Defense funding and tax subsidies, the government contracted with private companies to help build the backbone of today’s internet economy. What if the federal government threw billions into infrastructure like it did for the internet? Would it jump-start the private sector into investing more into building out BEV infrastructure, thus driving up BEV sales? Right now, there are lots of industries that are playing a role, but is any one of them more effective than the other?

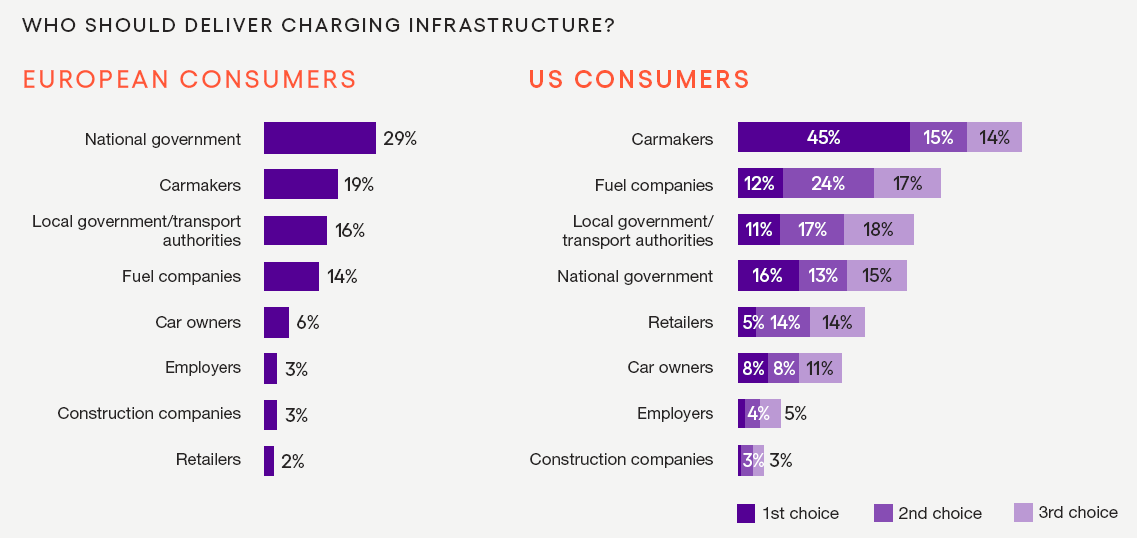

According to our research, US consumers believe carmakers are primarily responsible for building BEV infrastructure at home, while fuel companies, local and national government should build public infrastructure. European consumers, on the other hand, say national government should provide funding for public infrastructure, followed by carmakers and local governments.

Government

Currently, the federal government hasn’t indicated it will invest in building BEV charging infrastructure directly, but it does provide tax benefits to private companies building the infrastructure, such as charging network providers. However, these benefits don’t appear to be driving purchase or infrastructure build-out.

States and municipalities have already begun engaging in infrastructure ventures. According to the Center for American Progress, 17 states provide financial incentives that lower the costs for installers of BEV chargers. Washington state, for example, offers tax exemption for the installation of chargers, while New York state has committed to provide $250 million for charging infrastructure through the year 2025.

One aspect to consider with government funding is whether the service being considered is a public good. When it comes to climate change and environmental concerns, the answer to that question depends on whom you’re talking to. Gallup research shows that 70% of Americans age 18–24 are worried about global warming, while only 62% of those age 35–54 and 56% age 55 and older believe the same. Based on the apparent divide between generations, younger generations might believe that electric charging infrastructure is a public good and should be funded by governments, while older generations might think it’s a luxury good and prefer that governments fund something else like healthcare or road infrastructure.

Utilities

Utilities in many states have already pledged to increase electric charging stations in their territories, as well as offer rebates to consumers for installing new chargers.

- Pacific Gas and Electric Company announced it would install 7,500 EV chargers at workplaces and apartment buildings across Northern California, in addition to the 21,000 stations already used in the state.

- Georgia Power has installed public charging stations across the state and offers rebates to customers who install home charging stations.

- Kansas City Power and Light has installed more than 1,100 public EV charging stations in its service territory, with plans to continue expanding.

However, it remains to be seen whether regulators will converge on a national consensus about putting infrastructure investments into utility rate bases or will expect infrastructure investments to stand on their own as unregulated programs. Utilities should also consider that the increased demand for rapid charging may create burdens on the electrical grid and will require a greater understanding of BEV drivers’ patterns and habits than ever before.

Auto Manufacturers

Automakers around the world are working to meet the infrastructure challenge—even collaborating with each other to make a bigger impact. Volkswagen’s Electrify America, funded by the automaker’s 2016 diesel emissions settlement, has committed to investing $2 billion over 10 years in BEV infrastructure, access and education programs across the US. The company reported that it has built 400 stations in fewer than two years.

Tesla has invested in charging stations across the world to support its BEVs, as well as partnered with charging station providers to install Tesla chargers in their facilities. The company reports that it has more than 1,800 charging stations worldwide.

In the UK, six car manufacturers have teamed up to create IONITY, a high-power charging network that currently has more than 400 charging stations along major highways in Europe. A joint venture between BMW Group, Daimler, Ford, Volkswagen, Audi and Porsche, IONITY has partnered with businesses like Shell and Circle K to house its charging stations.

Fueling Stations

As a growing number of BEV and hybrid vehicles take to the road, there will be less need for traditional gas stations. Fueling stations will need to pivot their business model to accommodate this change unless they want to cede territory to another entrant, such as new companies, local utilities or even governments, that will provide charging services.

Companies such as Royal Dutch Shell and BP have already begun building charging infrastructure. Shell has been implementing its Shell Recharge BEV charging service in sites across Europe since 2017. In November 2019, the company installed its first EV charging station in the United States in Boston Logan International Airport, made possible through an acquisition of Greenlots, a Los Angeles-based provider of BEV charging software and solutions.

BP is investing in both electric vehicle charging companies and battery technology firms in the UK and China to expand BEV charging infrastructure. Its charging company, BP Chargemaster, has already installed 7,000 charging points across the UK and is now working to create a nationwide network of ultrafast chargers to increase BEV adoption and help ease consumer concerns around long charging times. BP launched its first 150kW ultrafast BEV charger on one of its BP Retail sites near Heathrow Airport, and plans to roll out 400 more in the UK by 2021.

The Future of BEV Infrastructure Is Anyone’s Game

The future of BEVs and charging infrastructure is up in the air. Not only that, but because current infrastructure is being built piecemeal and incrementally, there is no center of gravity for the build-out.

As with the internet, figuring out where the funding for BEV charging infrastructure comes from and how it’s built out will take time. Further, the “good” derived from investing in this sort of infrastructure is somewhat unknown. Will it lead to some sort of disruption on the highway roadside fueling economy? Will it require a massive reconfiguration of utility services that then sparks another unforeseen disruptive technology?

If you’d like to know more about how your business can thrive in this emerging landscape, we can help. Read our new white paper, The Future of BEV: How to Capture the Hearts and Minds of Consumers, to learn what it will take for auto manufacturers and tech companies to make a BEV with functional and emotional benefits that will have mass appeal.