Advisors and their clients are worried. Inflation is approaching historic highs not seen since the 1980s, interest rates are on the rise, and the geopolitical environment is left unsettled by the ongoing conflict between Russia and Ukraine and deep political divisions within the US. As a result, advisors’ economic outlook is worsening as the momentum behind the enduring bull market wanes.

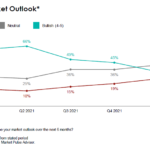

Faced with all of these concerns, just one-third (33%) of advisors now describe their market outlook as bullish over the next six months, a significant decline from the 45% who were bullish at the end of last year. Inversely, the proportion of advisors with a bearish outlook has doubled over the past year, with one in four (25%) now describing their six-month market outlook as bearish.

During these uncertain times, asset managers have an opportunity to offer reassurance. This year’s Advisor Brandscape report finds that trust continues to stand out as the most important consideration driver for asset managers and mutual fund and ETF providers. In addition to delivering consistent performance, demonstrating consistency and reliability in repeatable experiences for advisors over time directly impacts trust. This insight is critical as firms balance behaving in expected ways with the allure of innovation and the opportunity to stand out as a leader in a growing area.

For instance, Fidelity recently announced it will begin to offer cryptocurrency options within its 401(k) plans, which has the potential to erode brand perceptions for the firm. Actions that pose potential risk to the unified corporate brand could lead some asset managers to develop and promote innovative product capabilities though M&A activity leveraging a separate affiliate brand.

Asset managers have an opportunity to reinforce the strength and stability of their corporate brands through optimizing advisor engagement. Wholesaler interactions remain a critical component as more advisors resume in-person meetings. In addition, integrated marketing campaigns that combine emails and paid media to drive traffic to websites for additional resources are key to increasing consideration. Pertinent materials that address advisors’ concerns and provide historic perspective that they can share with clients offer the greatest support as advisors strive to reassure clients of the benefits of investing over the long term.

Click below for more information on the full Advisor Brandscape report.