What’s better than a loyal customer? Not much. It’s well recognized that maintaining an existing customer relationship is far less expensive than courting a new one. And in the wealth management industry specifically, as the length of a customer relationship grows, so do the customer’s assets with the firm. With continued economic growth and affluent investors feeling more confident in their investing acumen, it is imperative for advice providers to justify their role and build loyalty to retain client assets.

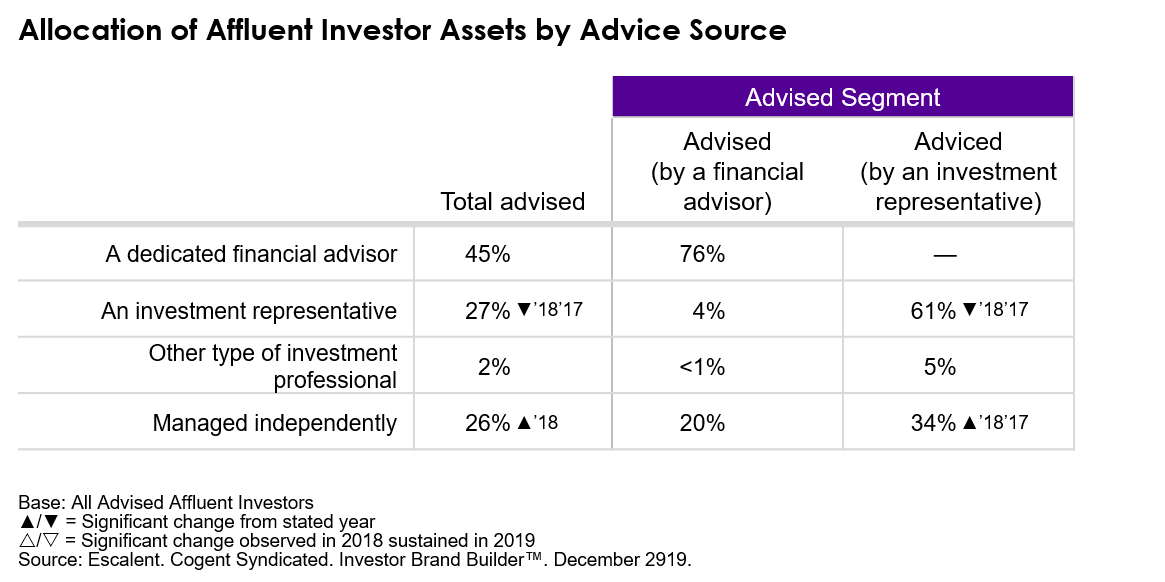

That said, it seems that fewer and fewer investment firms are able to successfully pull this off. Customer loyalty to investment firms remains relatively low on average, signaling some level of doubt regarding the added value advice providers bring to the table. In fact, over the past year, “adviced” affluent investors (those working with an investment rep other than a traditional financial advisor) are managing more of their assets solo, reducing their share of assets managed by an investment representative to 61% in 2019, down significantly from 67% in 2018 and 2017.

To strengthen client loyalty, investment firms must emphasize the areas that are most important to affluent investors: financial stability, access to a range of investment products and services, high-quality investment advice, reasonable fees and expenses, and a wide range of retirement planning services.

Advice providers would also benefit and build loyalty by focusing on the harder to measure emotional needs of affluent investors. Based on our research on investor sentiment, to enhance loyalty levels among those using advice, advisory firms should reinforce the relative peace of mind they bring to the emotional aspect of investing. Conversely, in servicing self-directed investors, it is important to understand and accept their volatile mind-set in uncertain times, giving these investors the information they need to make informed decisions.

For more on affluent investor loyalty and to see which firms are successfully building those bonds, contact me or click below to learn more about the Investor Brand Builder™ report.