This is the second blog in a three-part series on building trust in the wealth management space. You can read our first blog here.

Cogent Syndicated recently presented our clients with the results of a three-pronged analysis on trust—one of the most in-depth statistical analyses on trust in the wealth management industry. Previously, I shared findings from the first prong: a longitudinal analysis in which we identified the biggest drivers of trust over time as well as the point in time in which perceptions begin to impact trust, and are, therefore, the strongest predictors of trust. In this blog, I’ll share the results of a regression analysis that reveals the aspects that drive trust in the moment.

Many of our clients are familiar with Cogent Syndicated’s drivers of consideration analysis, as we feature this incredibly valuable analysis in nearly every report we publish. Over the years, we’ve seen the prominence of the attribute “a company I trust” grow to become a key driver, if not THE key driver, of consideration across many of the markets we study.

Here, in the second of our three-pronged analysis of the science behind trust, we took it one step deeper. Rather than what drives consideration, with “consideration” the dependent variable, we examined what drives trust. We made “a company I trust” the dependent variable, or outcome, to uncover not just the importance of trust, but how to actually build it. In this analysis, the independent variables, or “predictors” of trust, were the results of Cogent’s descriptive brand imagery attributes. In this case, we asked financial advisors which brands, if any, they most associate with a list of different characteristics.

Now if you’re not a statistics major, just bear with me for a minute, as I believe a brief technical overview may be helpful here. To identify the drivers of trust, we performed a Shapley Value regression analysis to determine the relative importance of each predictor (brand imagery attribute) on the outcome variable (trust) by running all possible combinations. We transformed the resulting coefficients into a proportion of the overall effect, thus allowing us to see which predictors have the strongest relationship to the outcome variable. Thus, our analysis takes into account the multicollinearity within this set of variables and reveals how impactful the different attributes are in driving trust at a specific point in time.

With that understanding of what we did, let’s take a look at what we found.

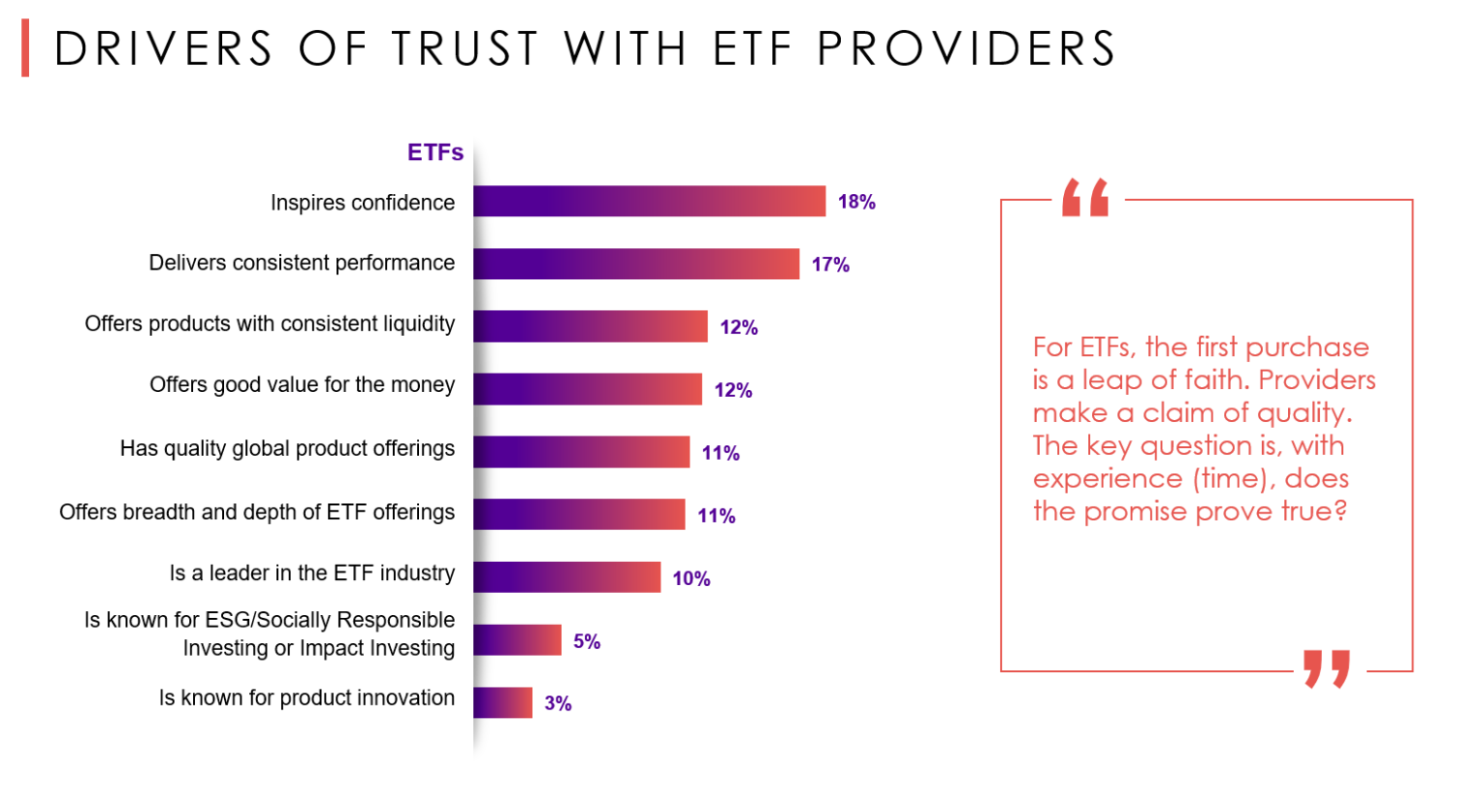

In the ETF market, which is comparatively young in the product life cycle, the emotional benefit of “inspires confidence” rose to the top as the most impactful driver of trust. In some ways, confidence and trust reinforce each other. From the psychological perspective, trust is a key aspect that can create confidence, and confidence is an emotion that is strongly linked with trust. Think of confidence as the internalization of trust—advisors feel more confident when they work with ETF providers they trust. So it makes sense that confidence is predicting the top driver of trust.

Following confidence, the key drivers of trust are consistency, quality and value. The consistent performance and liquidity aspects are evidence of advisors crying out for consistency from a broad perspective. They don’t just want investment performance, they want consistent performance in the overall business relationship. In our third prong of this analysis, we will dive deeper into the connection between these attributes and it will become readily apparent how these elements reinforce each other.

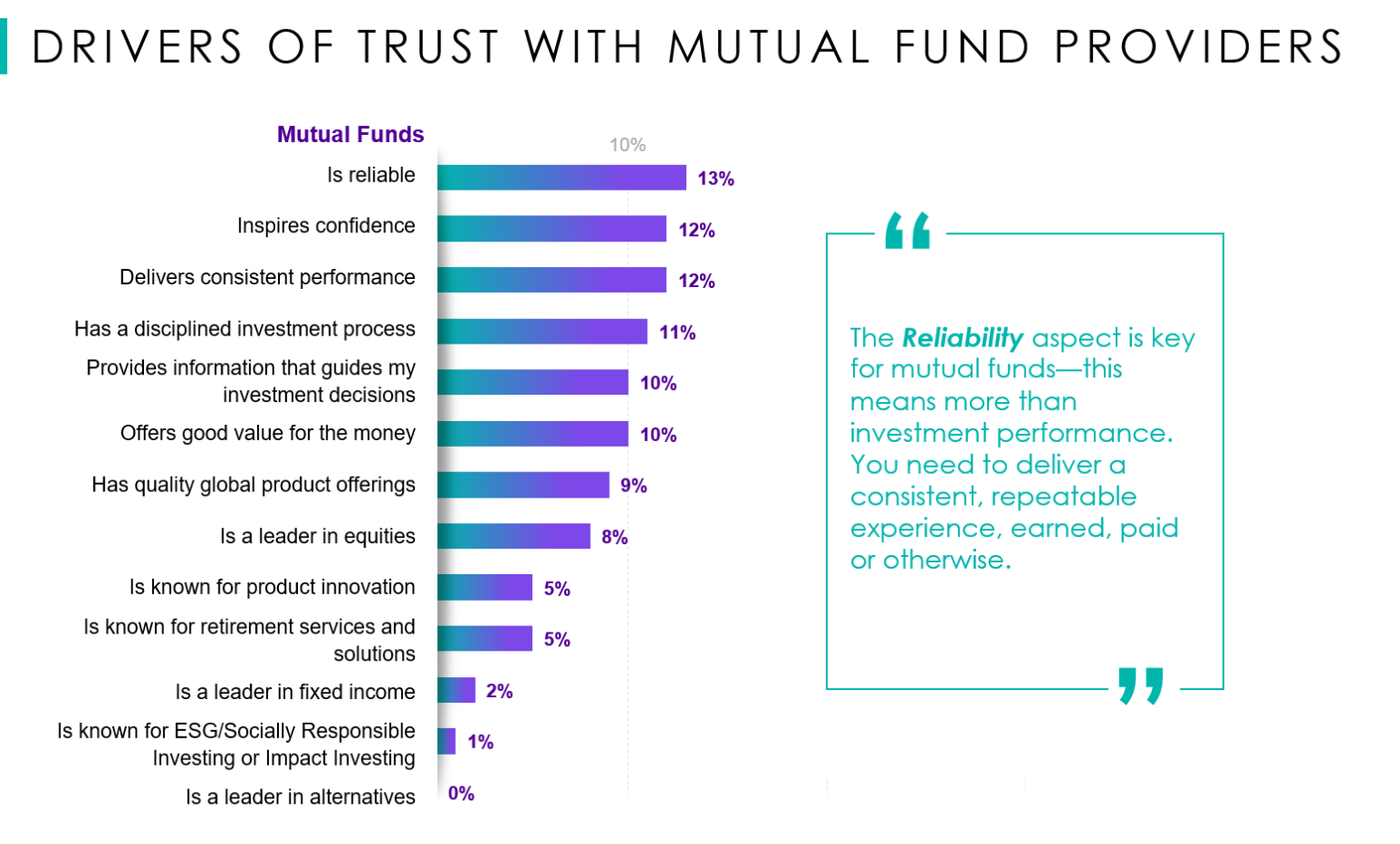

Next we turn to the mutual fund market, which is much more mature in terms of its product life cycle. Yet similar to ETFs, the emotional benefit of “inspires confidence” emerges as a key driver of trust. Other variables rising to the top are reliability, consistency of performance, investment process discipline and value.

The uniformity of the messages that we’re seeing with this analysis is remarkable. Advisors want product providers to be reliable, deliver consistent performance, and operate with discipline to produce predictable outcomes over time. Predictability is inherent in the definition of trust in the wealth management industry. And the value component impacts trust with mutual fund and ETF providers alike.

Want to know more? Watch a replay of our latest webinar or send us a note to learn how we can help you find the right levers to pull to build, strengthen and harness trust in your brand.