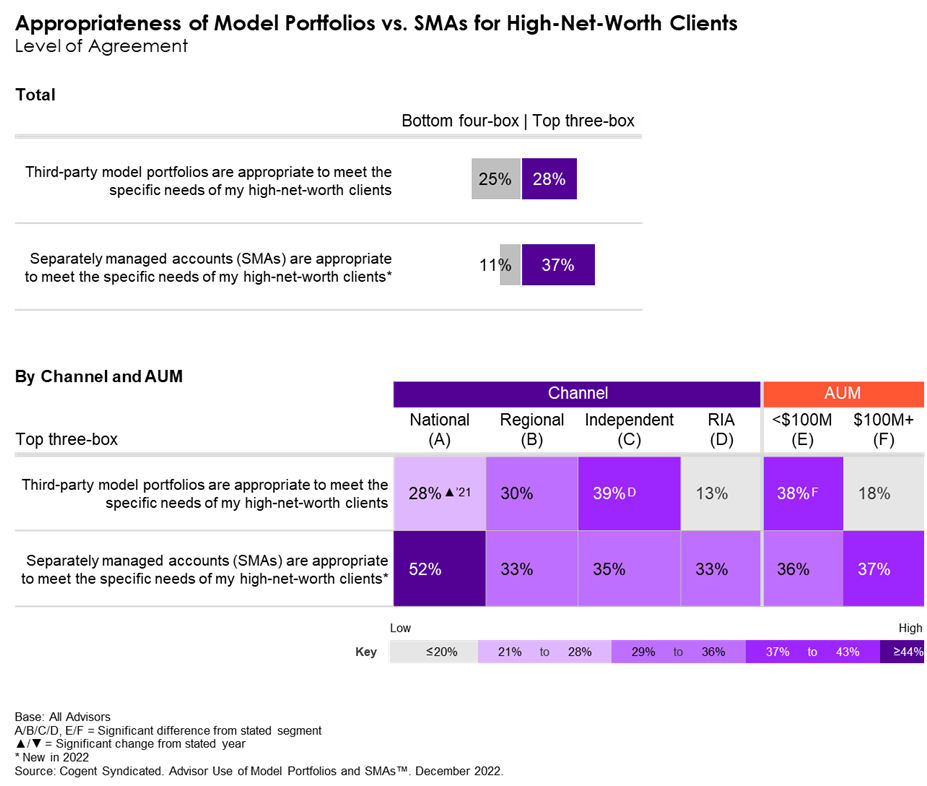

Third-party model portfolio use is on the rise in the financial advisor community, but there is a perception among some advisors that model portfolios are not appropriate to meet the more sophisticated needs of high-net-worth clients. Instead, advisors managing larger books of business are increasingly turning to separately managed accounts (SMAs). These advisors express fewer concerns about the appropriateness of SMAs for their high-net-worth clients compared with model portfolios, fueling growth in the SMA category.

Cogent Syndicated’s second annual Advisor Use of Model Portfolios and SMAs report, published last month, examines the competitive landscape for third-party model providers and asset managers. This year’s report finds that advisors are increasing their use of SMAs to meet the needs of high-net-worth clients. In fact, significantly more advisors are likely to agree that SMAs are appropriate to meet the needs of their high-net-worth clients compared with model portfolios. A preference for SMAs when serving more-affluent clients is most pronounced among National advisors, RIAs and $100M+ producers.

Adoption of SMAs is growing in the National wirehouse channel and among advisors managing at least $100 million in assets. SMA allocations are forecast to grow from 18.2% today to 24.6% two years from now. While National wirehouse advisors commit the highest proportion of their assets to SMAs presently, Independent advisors and advisors managing larger books are expected to drive growing reliance on SMAs.

While these data support where the surge in popularity of SMAs is originating, it’s also important to keep in mind that the growing popularity of direct indexing for tax optimization and ESG customization offers the potential to further accelerate SMA growth. Advisor Use of Model Portfolios and SMAs includes much more on the current and anticipated growth of SMAs as well as the brand performance of 17 players in the space.

To learn more about the full report and how your firm can leverage our data to build your business, click below.