Editor’s Note: This is the first in a series of short blogs on gender and racial disparity in financial services. When it comes to diversity and inclusion, all of financial services—Escalent included—has an imperative to make changes. We need to do better. Change is going to take sustained, hard work but we must not shy away from progressing with something that cannot be accomplished all at once.

Disruption has increased social and financial engagement, perhaps higher than any of us will ever again see in our lifetimes. Let’s find ways to use that to our advantage to make a difference. Let’s aim big, moving beyond just diversity to equality and fairness. Median American household net worth of all whites is nearly 10 times that of Blacks.^ Data can tell us how we’re progressing and, also more precisely, what needs to change. Then we can move past the surface and to a foundation of financial security.

Measure Your Progress

“You can’t manage what you don’t measure.” – Peter Drucker

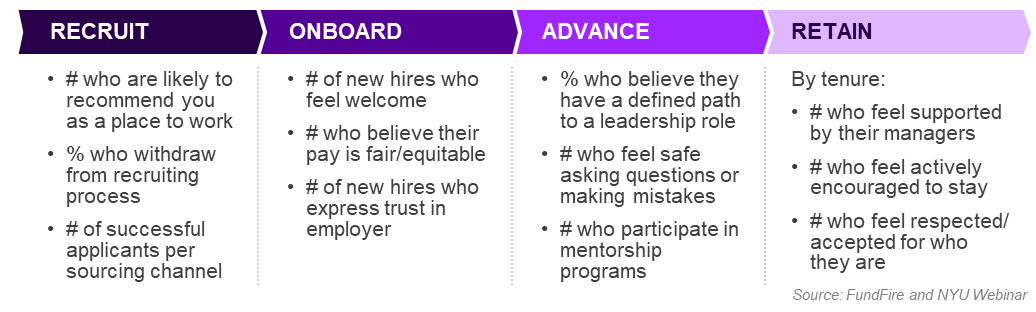

As researchers we know that if you want to discern whether the actions you take make a real difference, you have to identify the right key performance indicators (KPIs) and track them over time. Without measuring, it becomes supremely difficult to identify aspects that succeed or fall short, and/or to sustain focus and accountability for the long haul. Much of the financial services industry’s dialog around gender and racial equality KPIs currently emphasizes metrics such as:

By looking at important metrics like these, firms can get a benchmark—one that factors in the quality of the workplace experience and not just the quantity of the people. This benchmark allows measurement of progress as firms implement new policies, install new programs and evolve the company culture moving forward. It’s impossible to know where to go without first knowing where you are. Although, we also must not let perfection be the enemy of progress, as increasing equality in the financial services industry is so long overdue.

Mentor and Be Mentored

Mentors and support networks exist to help address gender and racial disparities in financial services. Personally, I am a proud member of the Women in Pensions Network (WiPN), a forum where women in the retirement plan industry can create meaningful and lasting connections. I find both comfort and power in identifying shared and relatable experiences with the women I meet through WiPN. This type of connection can enable you to be your best self and to do your part to make the working environment the best it can be for others.

“The obstacles women (including women of color) face that keep them from advancing to top-level positions often have their roots in a lack of mentorship and sponsorship both within their organizations and the industry. Isolation is a huge issue for women in male-dominated fields such as the retirement plan business.” – Women in Pensions Network

If you would like to learn more about how we’re measuring racial and gender equality in financial services, send us a note.

^ Board of Governors of the Federal Reserve System, 2016 Survey of Consumer Finances