Battery electric vehicles (BEVs)—commonly known as electric vehicles (EVs) in the US—are the future. Consumers know they are coming. However, high prices and limited choices continue to feed the counter-BEV movement. Coupled with a non-ideal charging infrastructure and significant doubt about the journey range of current BEV choices, many consumers are adopting a wait-and-see attitude.

However, the recent news that Tesla—the world’s leader in BEV manufacturing—will ship 500,000 models across the globe in 2020 confirms that there is a company getting BEVs “right” for a growing number of BEV buyers worldwide.

Escalent’s Automotive & Mobility team recently conducted a global study to explore how manufacturers can make BEVs exciting—thereby spurring greater rates of adoption—and which companies consumers trust to make the best BEVs. Here’s what we found.

What Will Motivate European Consumers to Buy BEVs?

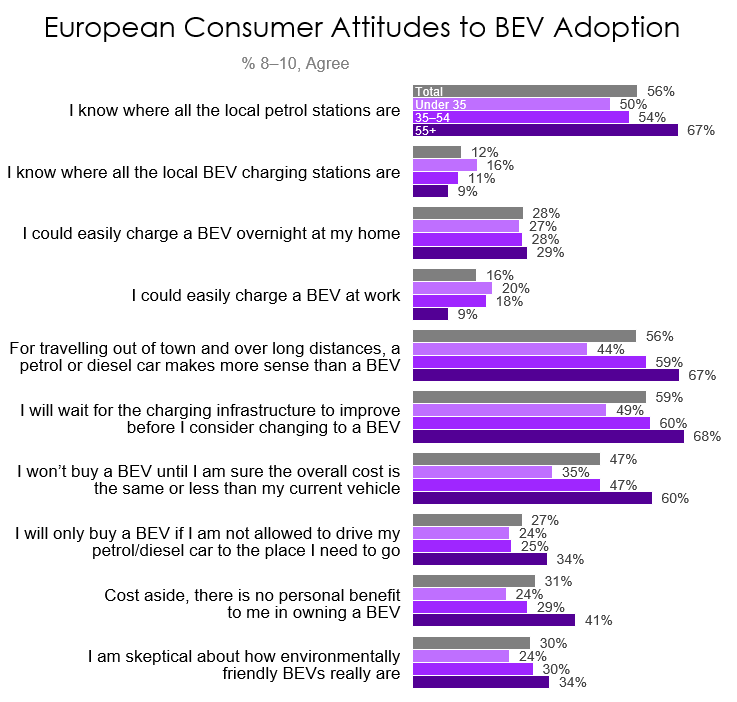

Our study shows that European consumers are more willing to buy a BEV today (13% of vehicle purchasers) versus US consumers (4%). However, European vehicle buyers appear to be grudging participants in the transaction, viewing BEVs as inevitable rather than inviting due to an expectation that governments will artificially induce the BEV-buying market with use restrictions, taxation and financial incentives.

Findings also reveal that, predictably, car buyers age 55 and older are the group least likely to make the jump today, preferring to wait until BEVs meet their standards rather than sacrificing comforts to which these car buyers feel they have become accustomed. These buyers will also likely adopt BEVs when they feel pricing is more equivalent with that of internal combustion engine (ICE) vehicles—and when they are sure they can use the vehicle without facing additional inconveniences.

On the other hand, buyers younger than 35 are less inclined to recognize what those age 55-plus see as issues. The younger group more readily acknowledges the existence of altruistic benefits, such as environmental protections, and seems to be more willingness to make what they feel is a socially conscious choice—even if it means they must adapt traditional behavior to a BEV lifestyle.

What Types of BEV Companies Will European Consumers Trust?

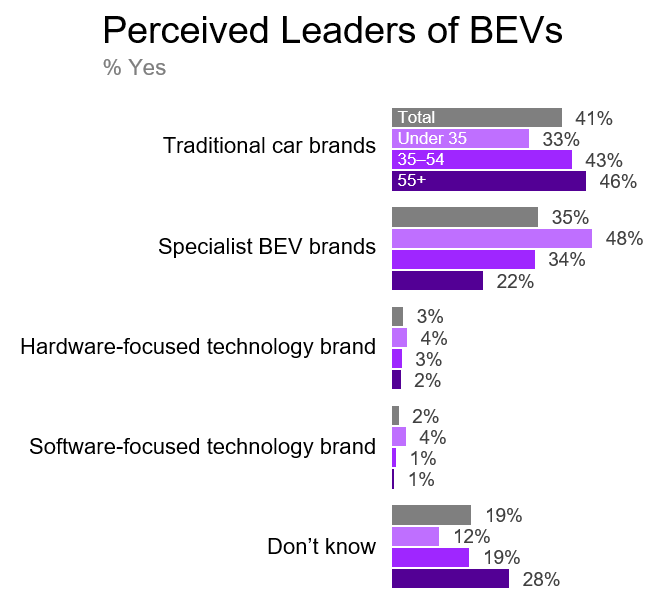

There is a healthy contingent of European consumers who simply don’t believe that incumbent ICE vehicle manufacturers are the obvious choice to bring the BEV promise to reality. According to our survey, these consumers feel that BEV leadership is a virtual draw between legacy carmakers and newer EV specialist brands. This should serve as a warning to traditional vehicle manufacturers: their reputation alone won’t be enough to encourage consumers’ transition to electric vehicles.

What are the factors causing this uncertainty?

Some consumers’ doubts about the reliability of legacy car brands contribute to the sense of risk they feel about BEVs. This means that consumers don’t necessarily consider traditional car brands to be the natural go-to specialists of new-wave cars.

Traditional car brands have never been able to completely rely on the unconditional trust of their customers. This is even a factor for older drivers who have had a longer relationship with traditional brands and, thus, dealt with more broken promises than their younger counterparts.

Those younger than 35 feel confident that newer, specialist BEV brands have the flexibility to produce true, forward-thinking designs and technology.

What Does This Mean for BEV Makers?

So, who will ultimately win the hearts, minds—and wallets—of the BEV-buying public? How will the winners do so? And what is the responsibility of private industry, public interest groups and governments to facilitate a bright BEV future?

In The Future of BEV: How to Capture the Hearts and Minds of Consumers, we address these questions—and draw more insights—using the innovation adoption litmus test, an approach used in tech to evaluate new products. This test looks at five key factors to help companies identify areas of strength, opportunity and likelihood of adoption, which we apply to BEVs.

To read The Future of BEV: How to Capture the Hearts and Minds of Consumers, click the button below.

Methodology: We reference data from an Escalent study involving a sample of 1,012 consumers from Germany, Spain and the UK aged 18 and older interviewed from June 25 to July 9, 2019. Respondents were recruited from the Full Circle opt-in online panel of European adults and interviewed online. The data were weighted by age, gender and census to match the demographics of the German, Spain and UK populations. Due to their opt-in nature, these online panels (like most others) do not yield a random probability sample of the target population. As such, it is not possible to compute a margin of error or to statistically quantify the accuracy of projections. Escalent will supply the exact wording of any survey question upon request.