This blog is the first in a three-part series being released as we head into 2021, covering telematics adoption, service retention, and data overload concerns. This installment covers telematics adoption rates and patterns—and implications for the industry going forward.

At a time when transformative new tools and technologies are profoundly disrupting the commercial and fleet vehicle industry, product manufacturers and service providers need to rise to the challenge of meeting equally-dynamic customer needs and expectations.

The 2020 Commercial Fleet Telematics and Data Analytics report, the latest in a series of forward-looking fleet technology publications from Escalent’s Fleet Advisory Hub, is designed to help make sure that happens. The report reveals critical new information about attitudes, adoption and use patterns regarding telematics and data analytics solutions, offering insights and timely analyses gleaned directly from commercial and fleet vehicle decision-makers. Given the projected explosive growth of the global commercial vehicle telematics market in the next decade, understanding the perspectives, patterns and priorities of decision-makers could significantly impact businesses and bottom lines.

Key Insights and Takeaways

The headlines from the newest findings begin with low adoption rates for telematics and data analytics solutions among commercial and fleet vehicle decision-makers. Currently, just 15% of fleets surveyed have adopted telematics solutions—primarily due to regulations (such as with trucking and transportation in response to Electronic Logging Devices mandates) or larger fleets looking to leverage economies of scale for increased return on their investments.

Digging deeper into the data reveals intriguing nuances and important opportunities behind the headlines:

Enormous Opportunity

While 15% represents a low market penetration, close to half (44%) of fleet decision-makers are actively shopping for telematics solutions—including 55% of those leading operations with 6–50 vehicles. Many decision-makers who have not yet adopted a solution are considering how to prepare their business for integration. The relatively low rate of adoption, in conjunction with a comparatively high rate of active shoppers and a general openness to the technology, reveals a market poised to explode.

Think Big by Going Small

Small fleets are an especially promising target. They have a familiarity with telematics and their understanding of the importance of the technology mirrors that of medium and large fleets, which currently lead the adoption curve. This also presents a promising opportunity for commercial and fleet vehicle dealers, as more small fleets prefer to acquire telematics solutions from vehicle manufacturers and dealers.

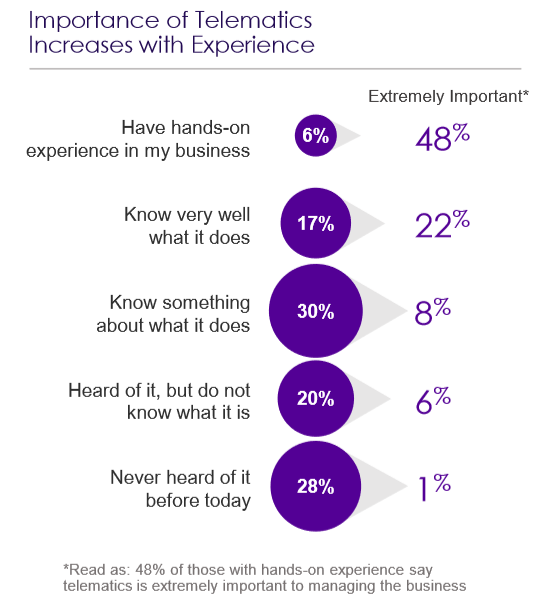

No Substitute for Hands-On Experience

Exhibiting value is key to driving adoption. Recognition of the importance of telematics’ role in managing the business nearly triples when knowledge of telematics solutions improves. Remarkably, 90% of fleet leaders with hands-on telematics experience rate the technology as “extremely important” or “somewhat important” to managing their business. That’s an excellent sign—and one that bodes well for the future of the market—assuming providers can bridge the experience gap and continue to find ways to demonstrate the value of their products, both before and during implementation.

Bridging the Gap

Providers must find bold and innovative ways to connect and communicate with prospective adopters—and must go beyond traditional marketing and transactional sales models. To capitalize on growth opportunities in this space, providers should leverage fleet vehicle manufacturers’ distribution networks to partner with fleets, and demonstrate their commitment to the success of their customers’ business. Vehicle manufacturers and dealers are most trusted by fleet decision-makers; dealers can be excellent educators when describing specific features and adept at establishing personal relationships that evolve into a trusted advisor role.

ROI-Driven Adoption

In the months and years ahead, providers looking to drive adoption need to continue to increase exposure and experience among fleet decision-makers—and to show decision-makers how telematics and data analytics solutions can improve their fleet’s efficiency, effectiveness and overall profitability. Tangible use cases and coaching for a data-driven management model—including the compelling case that adopters typically see increased ROI the longer they stick with telematics solutions—are effective in making that happen.

If you would like to know more about Fleet Advisory Hub or discuss how we can help you increase fleet adoption of telematics and data analytics solutions, please send us a note.

To read the second article in this series about telematics and data analytics service retention, click here.

About Fleet Advisory Hub™

The results reported come from our 2020 third quarter report on telematics and data analytics, comprising a subset of commercial and fleet vehicle decision-makers drawn from the Fleet Advisory Hub audience. Participants were recruited from an opt-in online panel of business decision-makers and interviewed online. Escalent will supply the exact wording of any survey question upon request.