Data from Investor Brand Builder™ report from Escalent suggests investor adoption of AI could be outpacing advisor readiness

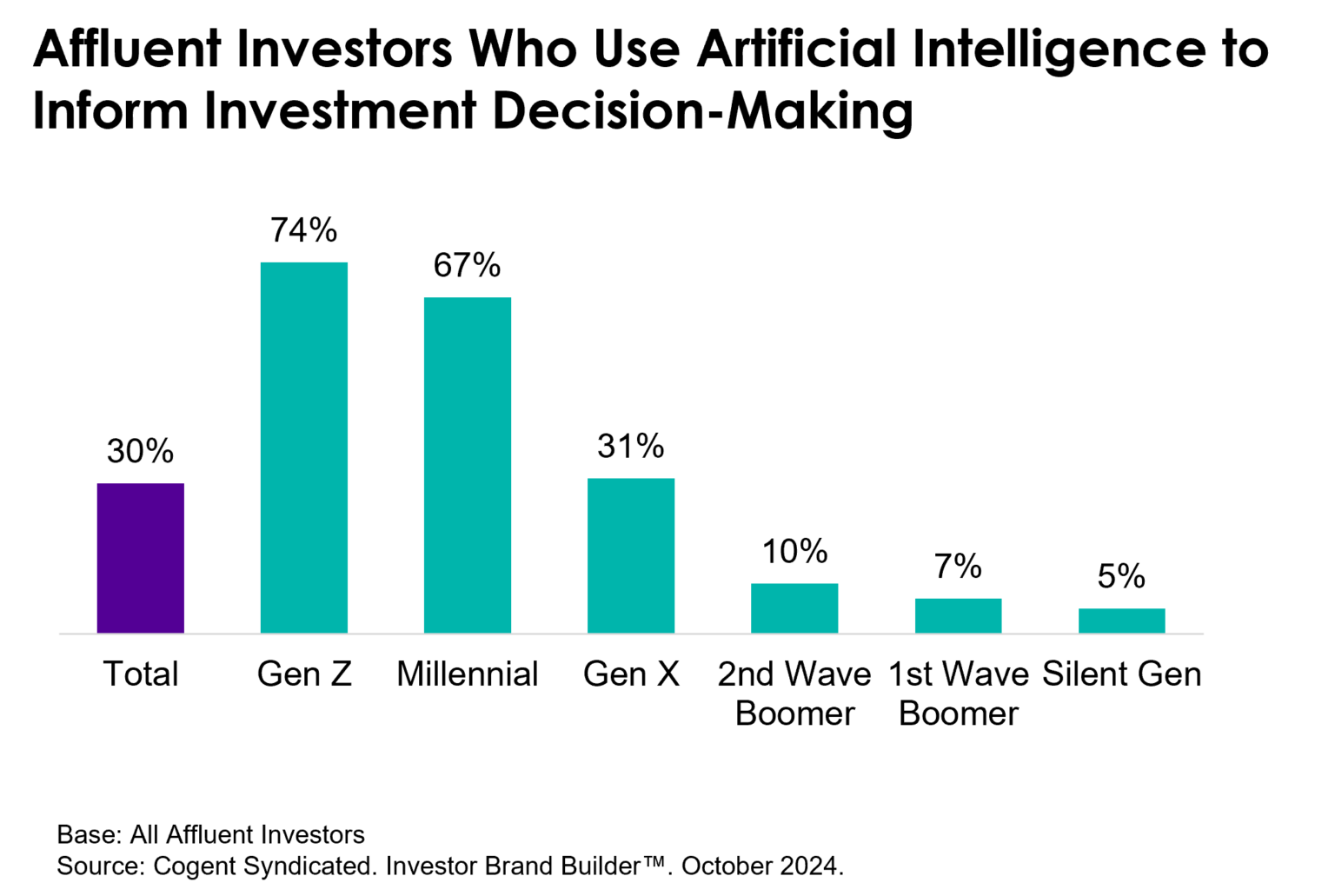

Trust in the financial investment community has reached an all-time high. However, this hasn’t stopped investors from embracing artificial intelligence (AI)-powered solutions to summarize market insights, identify new investment opportunities, and guide their allocations. Almost one-third (30%) of affluent investors are leveraging AI to inform their investment decision-making. Of those, nearly half (46%) say they use these tools on a daily basis.

These are the latest findings from Investor Brand Builder™, a Cogent Syndicated report from Escalent. This annual study is designed to support firms with critical decision-making around their competitive positioning in the wealth management space, offering a comprehensive overview of key trends and insights affecting the affluent investor market. It includes an in-depth analysis of investors with purchase intent and a competitive evaluation of brand health. The 2024 report also features new sections exploring investor use of AI, active trading, and advertising likeability for major players in the sector.

“The wealth management industry is at a critical juncture where trust, technology, and human expertise converge,” said Steve Ethridge, a senior director in Escalent’s Cogent Syndicated division. “The data indicates that affluent investors may be utilizing AI more extensively than advisors had previously realized — pointing to a need for wealth management firms to accelerate their use and understanding of these tools. At the same time, trust in the financial investment community is on the rise. It’s clear that the future of wealth management lies in the integration of technology with the insight that only a skilled financial advisor can offer.”

In 2024, two-thirds (66%) of advised investors reported strong trust in the financial investment community, up from 61% in 2023. In tandem with this increase, trust and service assumed greater prominence as drivers of consideration. Based on Escalent’s statistical analysis, trust rose in importance as a consideration driver for both distributor firms — where it ranked second — and exchange-traded fund (ETF) providers. “Best-in-class service” emerged as the top consideration driver for ETF providers and ranked fourth for distributor firms and mutual fund providers.

While the growing confidence in the financial investment community suggests that brands understand the interconnected relationship between service and trust, Escalent’s data shows that investors are increasingly taking a “trust but verify” approach. Only half of advised investors said they would accept financial advisor recommendations without independent validation, down from 56% in 2023.

In addition, while traditionally advised investors (those working with a financial advisor) expressed the highest level of trust in the financial investment community, they were also the most likely to use AI. More than two-thirds (34%) of participants in this group told Cogent they utilize AI to guide their investment decisions, versus 28% of “adviced” investors (those serviced by an online provider or firm investment representative) and 27% of self-directed investors.

The use of AI was particularly prevalent among the younger generation of affluent investors, with 74% of Gen Z and 67% of millennials leveraging the technology versus only 7% of first-wave boomers.

“The rapid adoption of AI-powered tools by younger investors shows that this technology is not just a passing trend — it’s becoming a fundamental part of the industry,” said Linda York, a senior vice president in Escalent’s Cogent Syndicated division. “Advisors will need to refine their approach to client engagement, deepening their knowledge of the capabilities and limitations of various AI solutions so they can offer enhanced counsel and guidance. That said, this remains an emerging field. The market is wide open for a wealth management firm to take the lead in this area — either by partnering with an existing provider or developing its own AI-enabled platform.”

To learn more about Investor Brand Builder™, click below.