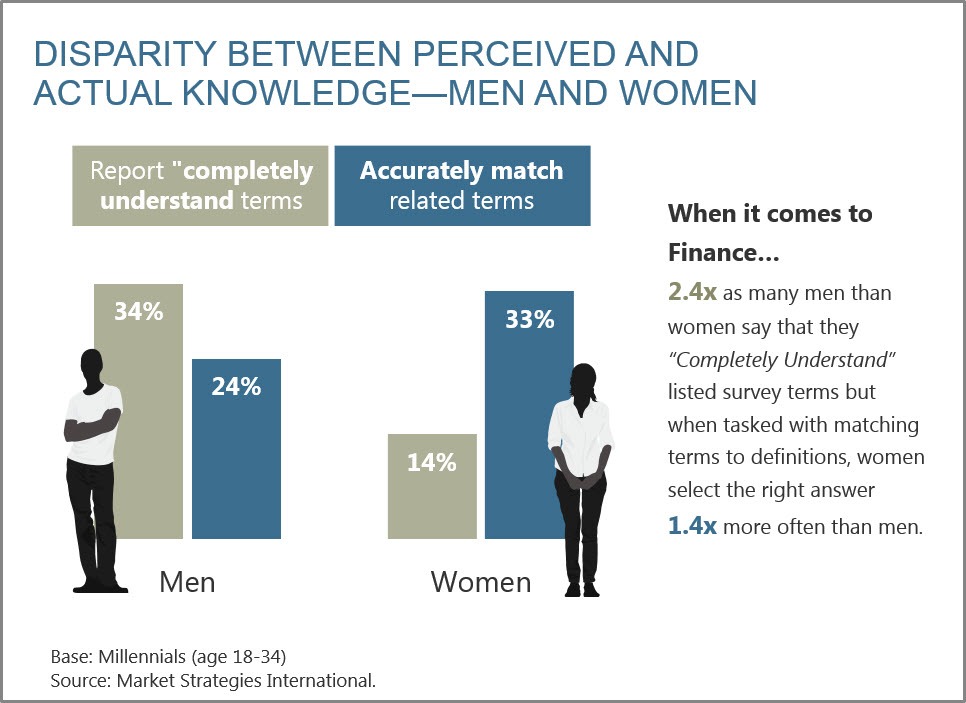

New research reveals that millennial women, despite their own uncertainty, outperform millennial men in their knowledge of financial and insurance terms. When asked to match financial and insurance related terms with definitions, millennial women selected the correct answer more frequently than millennial men did (33% vs. 24%, respectively). These and other findings are from a new financial services market research study conducted by Market Strategies International.

To gauge self-reported knowledge in financial services, Market Strategies asked survey respondents how well they felt they understood financial and insurance-related terms. Only 17% of millennial women reported that they “completely understand” financial and insurance terms while 2.4 times as many millennial men (34%) claimed complete understanding.

“Men typically have higher confidence in their knowledge in general. It’s unsurprising that double the percentage of millennial men than women reported they ‘completely understand,’” said Christopher Barnes, managing director of the financial services division at Market Strategies. “What is interesting, however, is that when asked to demonstrate that knowledge, millennial women perform better.”

“Historically, women have scored lower than men in terms of financial knowledge,” Barnes continued, “but as millennials are delaying marriage and making major financial decisions solo, like buying houses and managing student loan debt, it’s clear millennial women are getting proactive about their financial knowledge.”

The study also revealed interesting gender differences in the sources millennials use to learn and understand investments. Thirty-eight percent of millennial women look to friends, family and colleagues while that same percentage of millennial men are flocking to YouTube.

“Financial services firms looking to build trust and earn wallet share of burgeoning millennial portfolios need to capitalize on these knowledge sources to make it into the consideration set,” added Barnes.

About the Study

Market Strategies interviewed a national sample of 1,007 consumers age 18 and older. Respondents were recruited from the e-Rewards opt-in online panel of US adults and were interviewed online. In order to qualify, each survey respondent had to confirm they have either primary or shared responsibility for making household financial and purchase decisions. The data were weighted by age and gender to match the demographics of the US population. Due to its opt-in nature, this online panel (like most others) does not yield a random probability sample of the target population. As such, it is not possible to compute a margin of error or to statistically quantify the accuracy of projections. Market Strategies will supply the exact wording of any survey question upon request.