New Retirement Planscape® report from Escalent reveals rising optimism about technology even as plan sponsors grapple with cybersecurity risk

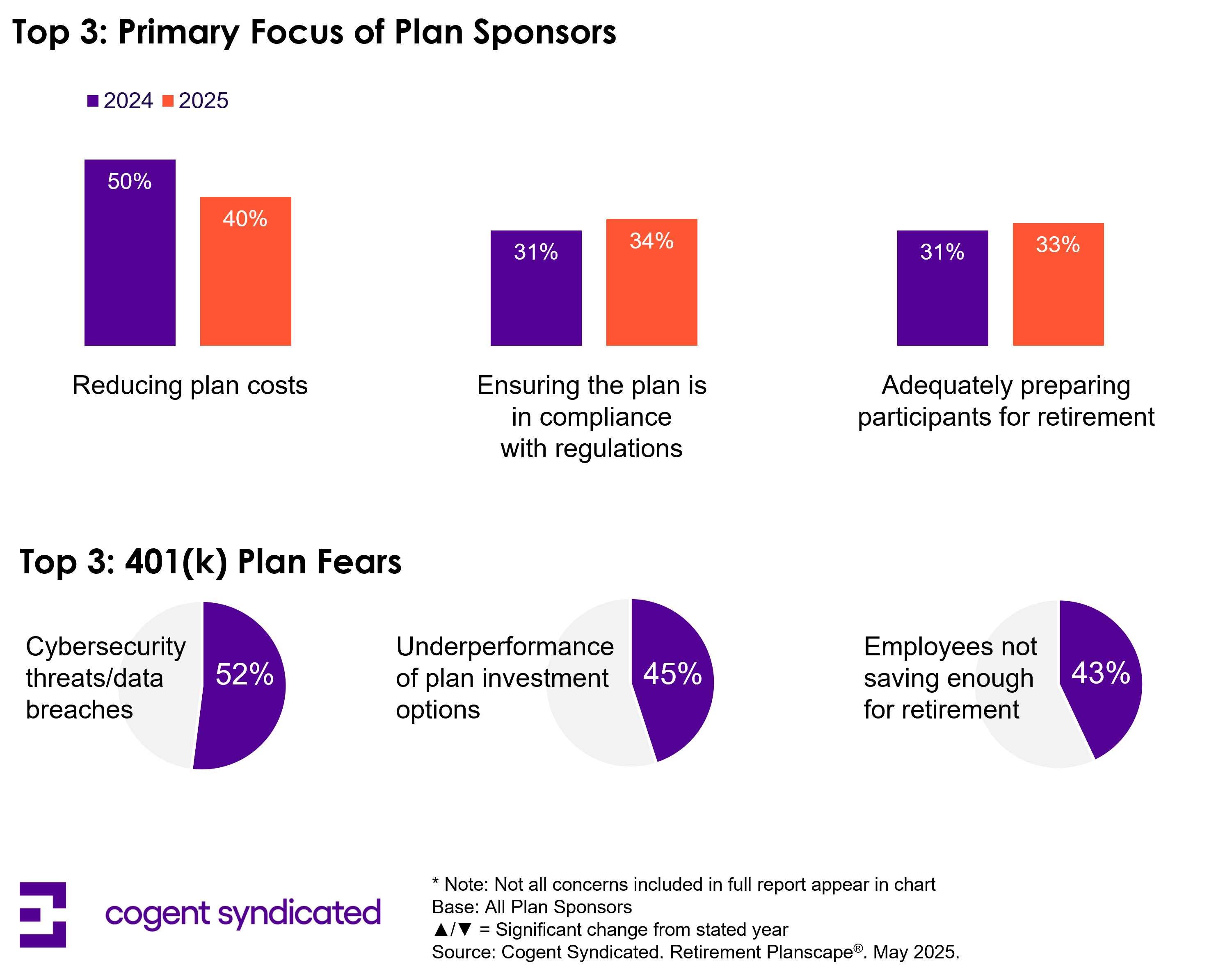

Defined contribution (DC) plan sponsors are placing less emphasis on reducing plan costs, signaling an important shift in their strategic mindset. While cost management remains a top priority, just 40% of plan sponsors cited this factor as a key focus for the coming year, a notable decline from 50% in 2024. As cost-cutting pressures begin to ease, attention is shifting toward emerging challenges and opportunities, such as cybersecurity and artificial intelligence (AI).

These are among the latest findings from the 2025 Retirement Planscape®, a Cogent Syndicated report from Escalent. This annual study tracks key trends in the plan sponsor market and benchmarks leading DC plan providers and investment managers on brand equity and experience metrics to provide a better understanding of the plan sponsor mindset.

“Technology is advancing quickly, forcing plan sponsors to adapt in real-time. Cybersecurity is the most daunting fear among this demographic, especially as AI introduces new challenges around data protection,” said Sonia Davis, lead report author and senior product director in Escalent’s Cogent Syndicated division. “Many plan sponsors are vying to wrap their arms around these risks, establishing formal protocols and strengthening safeguards. The potential for litigation tied to breaches, fiduciary lapses, or compliance issues only adds to the pressure.”

Concerns around cybersecurity are well-founded. Seven percent of all plan sponsors — and 10% of Large-Mega plans — reported experiencing a 401(k)-related data breach within the past year. Cybersecurity threats/data breaches remain the top fear among plan sponsors (52%), ahead of plan investment options underperforming (45%), and employees not saving enough for retirement (43%). Among those impacted by recent data breaches, most respondents began by contacting their plan provider before taking corrective action, informing law enforcement, and notifying insurers and plan participants.

Despite these concerns, respondents expressed optimism about the ways technology is transforming the retirement industry. AI is a growing area of focus, with Large-Mega plans serving as significantly stronger proponents compared with their smaller plan counterparts. In fact, two-thirds (66%) of plan sponsors managing $100 million or more in assets believe AI-powered virtual assistants would be able to answer common questions about 401(k)s, expect AI-driven platforms and tools to deliver more dynamic and tailored simulations, and offer a more interactive, personalized planning experience for participants.

This enthusiasm for AI was also further echoed in respondents’ qualitative feedback. When plan sponsors were asked to describe one product or service they would like to see from their current plan provider or DC investment manager, several responses pointed to AI-enabled solutions. One Large-Mega plan sponsor expressed interest in “AI-powered investment real-time trackers and advice,” while another Small-Mid plan sponsor wished their provider offered “fully integrated AI financial advisors.”

“With cost pressures becoming less of a burden, plan sponsors can think more strategically,” said Davis. “The rising enthusiasm around AI presents an opportunity for providers to invest in tools that improve the 401(k) experience with increased support, education and a higher degree of personalization. The challenge will be in helping sponsors navigate this evolution intentionally, in a way that balances innovation with effective risk management.”

About Retirement Planscape®

Cogent Syndicated, a division of Escalent, conducted an online survey of a representative cross section of 1,350 401(k) plan sponsors from February 20 to March 17, 2025. Survey participants were required to have shared or sole responsibility for plan design, administration or selection and evaluation of plan providers, or for evaluating and/or selecting investment managers/investment options for 401(k) plans. In determining the sampling frame for this study, Cogent relied upon recent Form 5500 filings as maintained by ALM’s Judy Diamond Associates. To ensure the population for this research is representative of the universe of 401(k) plan sponsors, quotas were set during the data collection phase around key firmographic variables including total plan assets, number of plan participants, industry and geography. Minimal weighting was applied to adjust for purposeful deviations from the actual marketplace distribution. The data have a margin of error of ±2.67% at the 95% confidence level. Escalent will supply the exact wording of any survey question upon request.

For more information about the full report, click below.