Escalent’s Trends in Alternative Investments™ report reveals light users backing off of the asset class as heavy users double down

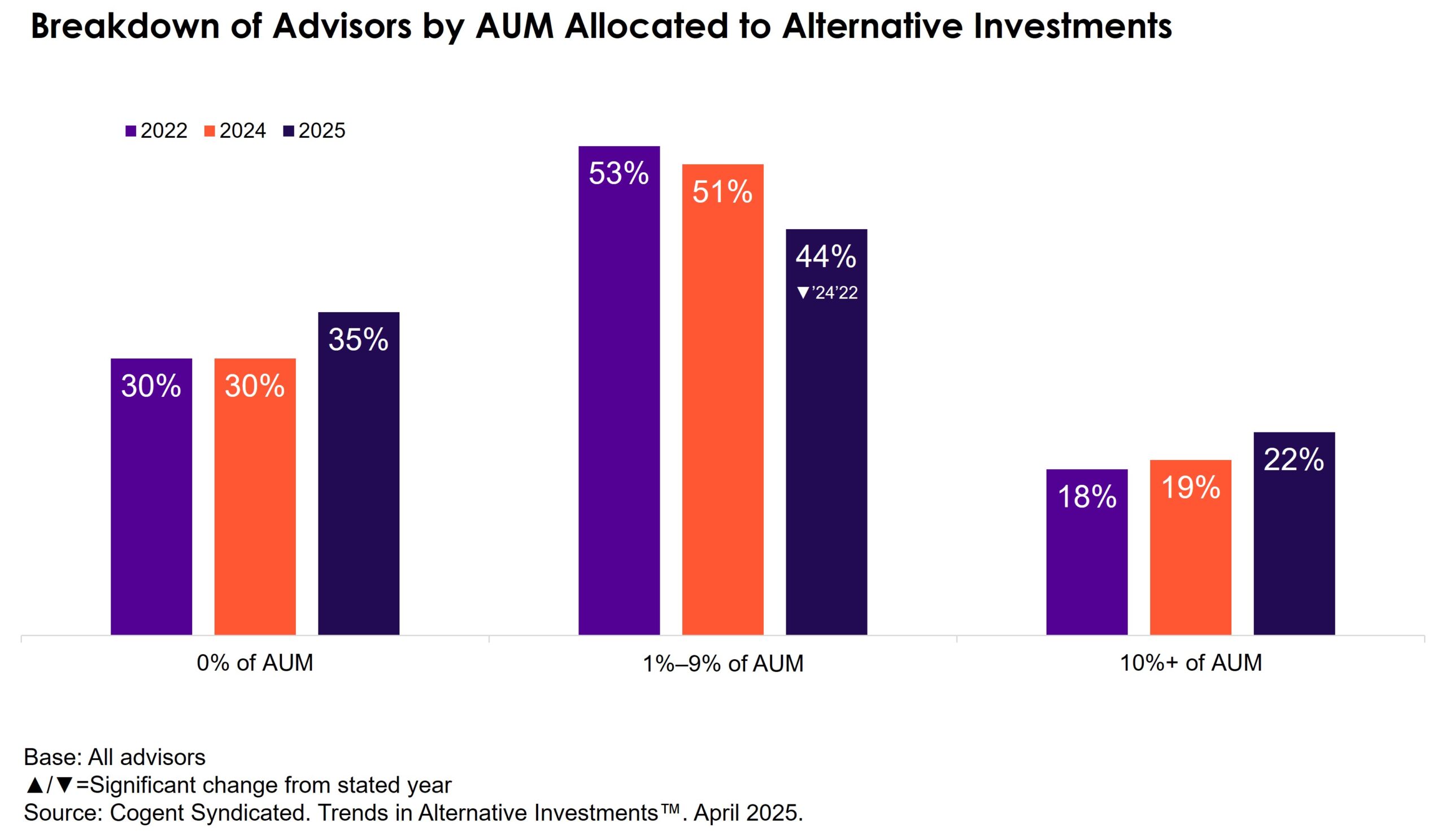

Amid economic volatility and uncertainty, advisors are making noticeable adjustments to their portfolio strategies—particularly in their use of alternative investments (alts). While allocations to alternative investments continue to climb, the percentage of advisors categorized as light users, those with 1%–9% of assets under management (AUM) in alternatives, has notably shrunken as heavy users (those with 10% or more of AUM in alts) deepen their commitments.

This is according to the latest Cogent Syndicated Trends in Alternative Investments™ report from Escalent. The annual report measures the rate of adoption and share of assets dedicated to alternative investments among advisors and affluent investors as well as which asset classes within the category are currently favored and how they are being accessed. This year’s report also leveraged The Advisor Exchange™, Escalent’s online insight community of financial advisors, to gather qualitative insights for a deeper dive into advisors’ opinions on private markets and their anticipated growth.

“Advisors with less experience in alternative products are increasingly abandoning the category, having incurred negative outcomes, particularly in private markets. This is evidenced by a 7% decline in ‘light users,’ with a corresponding 5% rise in ‘non-users,’” said Kristin Hall, report author and senior product manager Escalent’s Cogent Syndicated division. “Conversely, more experienced advisors are continuing to increase their allocations to alternatives, with the proportion of those with more than 10% of AUM allocated to alternatives growing from 19% to 22% year over year.”

Likely in response to market volatility, inflation and the pursuit of diversification, 44% of advisors view alternative assets primarily as a hedge for risk mitigation—up significantly over the past 12 months. Looking ahead, more than half anticipate increasing their hedge allocations further over the next two years. In contrast, the percentage of advisors using alternatives for “core” portfolio stability is down significantly, indicating a shift in perceived utility for the category.

Despite liquidity remaining a critical consideration for adoption, advisors are increasing their use of real estate, private equity and private credit as a hedge or risk mitigation tool. Real estate and REITs continue to be the most popular alternative asset class with 68% of advisors indicating they use or plan to use the sub-asset. Private equity (48%), structured products (40%) and private credit (35%) also emerged as areas of growing interest, especially favored by heavy users. Alternatively, a surge in digital assets and cryptocurrencies was driven by light allocators.

“As the ‘retailization’ of alternative investments accelerates and the narrative of widespread alternative adoption becomes more prevalent, it’s crucial to recognize that not all advisors and investors are embracing them. There’s a clear divide between those who are strong proponents of the asset class and those avoiding alternatives altogether,” said Linda York, a senior vice president at Cogent Syndicated. “Recognizing that alternatives aren’t a fit for everyone, asset managers and advisors must focus on understanding and engaging their advocates rather than pursuing a broad-based approach.”

About Trends in Alternative Investments™

Cogent Syndicated conducted an online survey from February 10 to February 24, 2025 of a representative sample of 648 financial advisors. In order to qualify for this study, survey participants were required to have a book of business of at least $5 million and offer financial advice or planning services to individual investors on a fee or transaction basis. In determining the sampling frame for this study, Cogent relied upon the most recent Discovery registered representative and RIA databases. To ensure the population for this research was representative of the universe of financial advisors, the databases were analyzed to determine the current distribution of advisors by AUM, channel, age, gender and region. Quotas were then established to produce a final set of respondents that is truly reflective of the advisor population. Minimal weighting was applied to adjust for any deviations from the actual marketplace distribution. The data have a margin of error of ±3.85% at the 95% confidence level. Cogent Syndicated will supply the exact wording of any survey questions upon request.

For more information about the full report, click below.