Amid ongoing industry consolidation, retirement plan recordkeepers are charged with offering competitive fees and a compelling suite of service capabilities to boost plan enrollment, maximize contribution levels and prepare diverse groups of participants for retirement. All of this is on top of combatting cybersecurity threats, being vigilant against potential lawsuits and ensuring that their clients’ plans adhere to the latest regulatory compliance.

Yes, Cogent sees firms vying to be superhero service providers and we applaud their efforts to deliver all of the above with aplomb. In fact, our new DC Participant Planscape™ report confirms that to meet the expectations of plan sponsors and their plan participants, firms must now deliver excellence in a multitude of areas.

Through a regression analysis on 25 individual experience ratings, we determined which metrics are most vital for providers to boost satisfaction among participants. While in previous years we saw clear front-runners in terms of which metrics drive satisfaction the most, this year’s results produce little difference between the top drivers in the aggregate. This suggests that providers must be proficient in a multitude of areas including account statements, website and online capabilities, investment planning tools, investment performance, data security/cyber-risk management practices, and number of investment options.

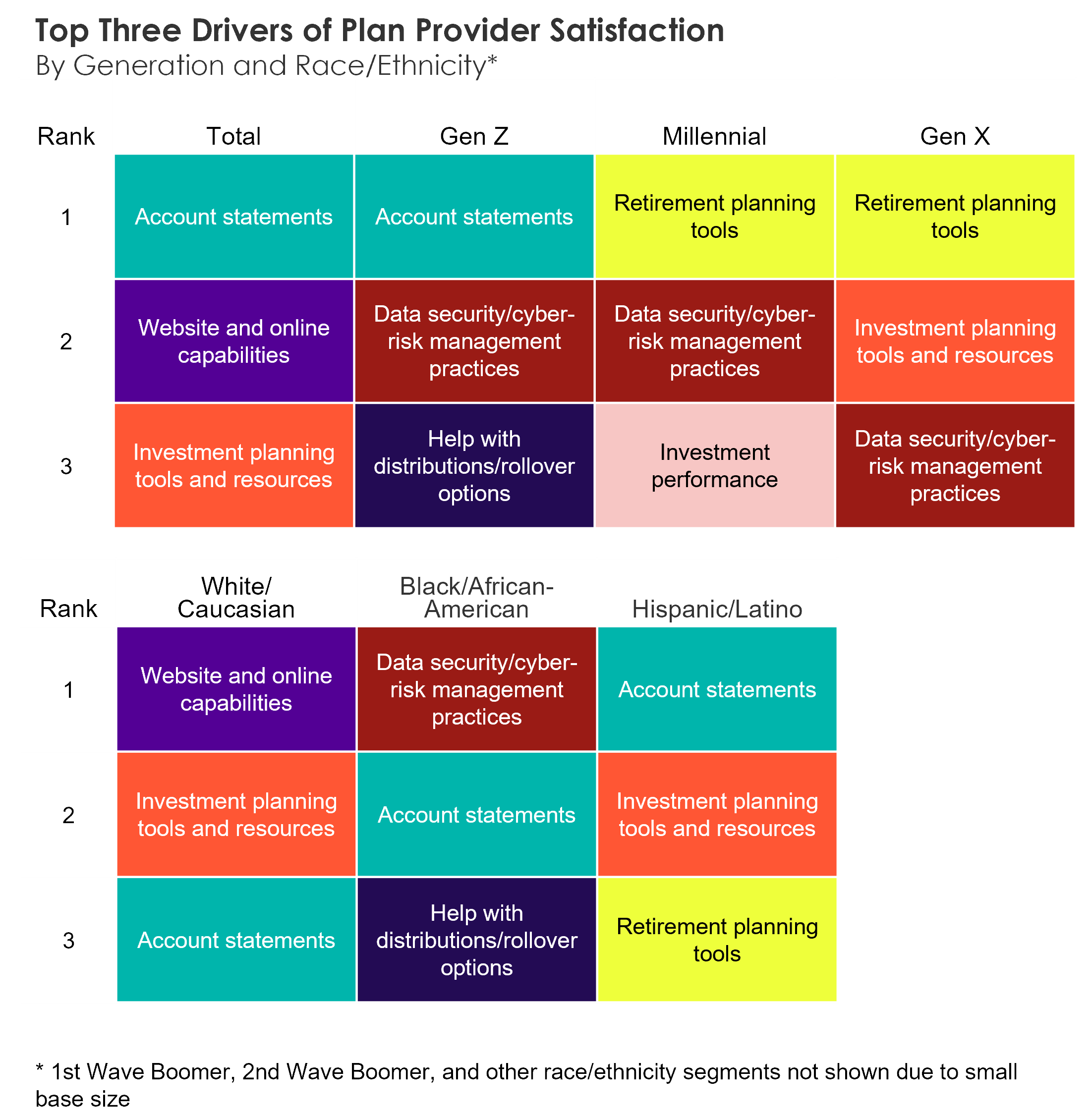

However, when we dug below the aggregate and compared the key satisfaction drivers between generational and race/ethnicity cohorts, we found that providers have options in terms of which areas their client service teams should emphasize:

- Data security/cyber-risk management practices are a top satisfaction driver among Gen Z, Millennial, Gen X and Black/African-American participants.

- Retirement planning tools are vital to Millennial, Gen X and Hispanic/Latino participants.

- Account statements are critical among Gen Zers and across all race/ethnicity cohorts.

- Help with distributions/rollovers is key to boosting satisfaction ratings among Gen Z and Black/African-American participants.

- Investment performance is important to Millennials.

- Investment planning tools are must-haves among Gen X, White/Caucasian and Hispanic/Latino participants.

Opportunity for segmentation also exists across some of the least influential satisfaction drivers. Podcasts, for example, rank 25th in overall importance but have comparatively larger weight among Gen Z participants. Similarly, smartphone/table capabilities and the enrollment process hold less significance in the aggregate but are deemed more valuable among Gen Z and Hispanic/Latino participants.

While firms can still set high-performance expectations, this analysis serves as a useful blueprint for participant segmentation to ensure that DC plans address the needs of all constituents and offer guidance for specific goal-setting efforts so that recordkeepers don’t blindly set their sights on being retirement superheroes.

Our full DC Participant Planscape report offers firms a unique understanding of what drives participant contribution and investment behavior. The report benchmarks the top plan providers on key satisfaction drivers and brand engagement metrics, monitors the brand perceptions of leading investment account providers and identifies the firms best positioned to capture rollover assets.

For more information on the full report, click below.