What to do when your Net Promoter ScoreSM is impacted by outside forces

The Issue: There is a strong relationship between stock market movement and Net Promotor Scores

The Net Promotor Score, or NPSSM, is a widely used measurement of customer loyalty and helps to assess a company’s stability and growth potential. It is calculated from a single question: How likely are you to recommend this company to friends, family or colleagues (or clients)? NPS was created from an in-depth research analysis by Frederick F. Reichheld.* Reichheld was quoted as saying, “In most of the industries that I studied, the percentage of customers who were enthusiastic enough to refer a friend or colleague—perhaps the strongest sign of customer loyalty—correlated directly with differences in growth rates among competitors.” This can be the case with car rentals or car purchases or other consumer goods industries. However, what if you work in an industry where NPS is heavily influenced by outside factors—like the stock market for instance?

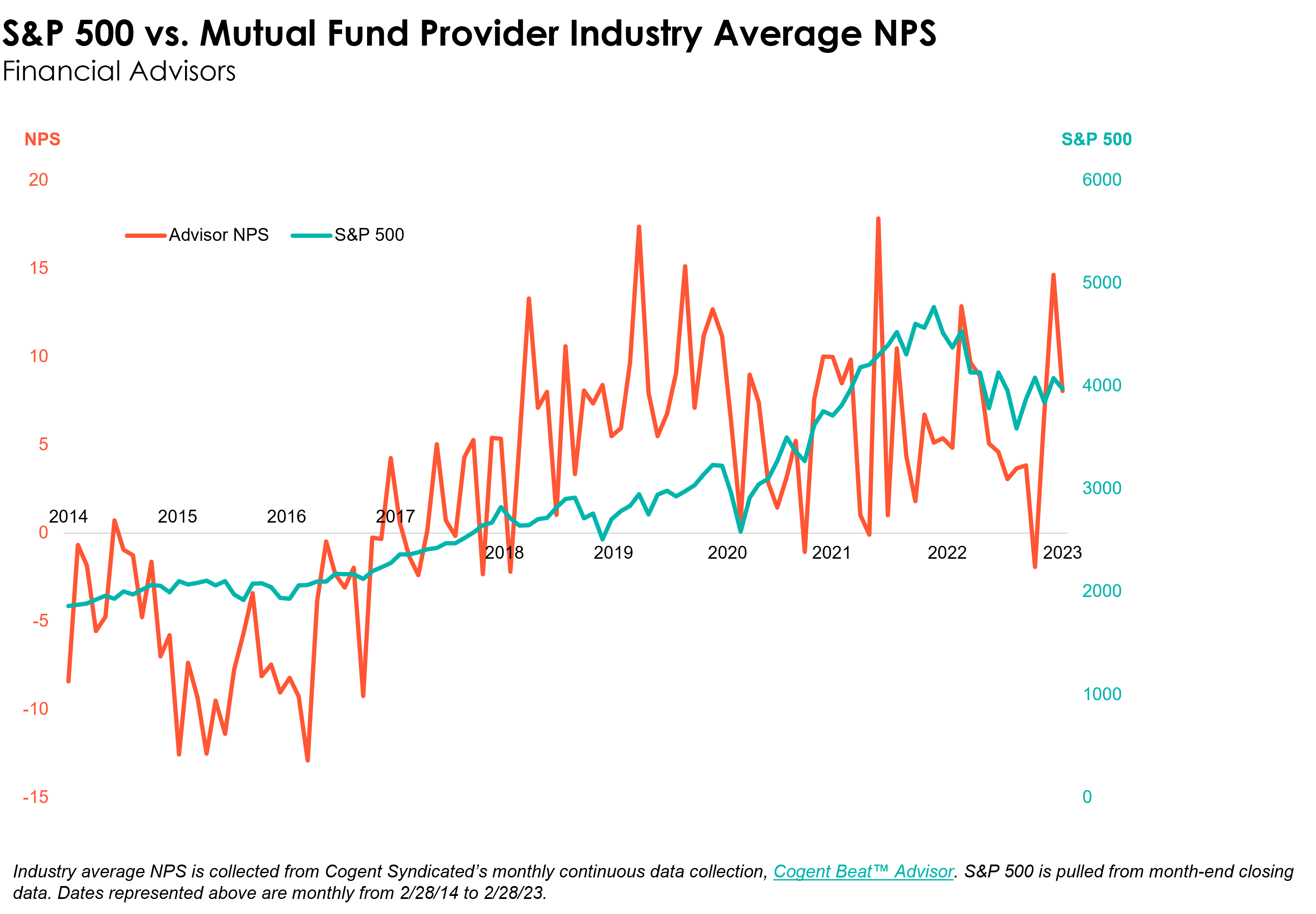

When plotted together, we can see that although NPS is variable, a relationship does exist between it and the S&P 500. Advisors’ net promoter scores show a moderate to strong correlation to the S&P 500, revealing that a moderate amount of advisors’ likelihood to recommend a mutual fund provider is influenced by stock market movements.

Cogent also tracks the NPS of affluent investors (those with at least $100,000 in household investable assets). NPS among affluent investors tends to be more volatile than among advisors and is even more heavily influenced by movement in the S&P 500, with strong to very strong correlations. In fact, our analysis shows that more than half of these scores are influenced by the S&P 500.

In an ideal world, a company could directly influence its NPS performance through its own customer service, product innovation and marketing and sales efforts without any outside interference. But for wealth management firms, among which a significant portion of NPS is influenced by outside factors, what do you do?

Recalibrating Loyalty Measures

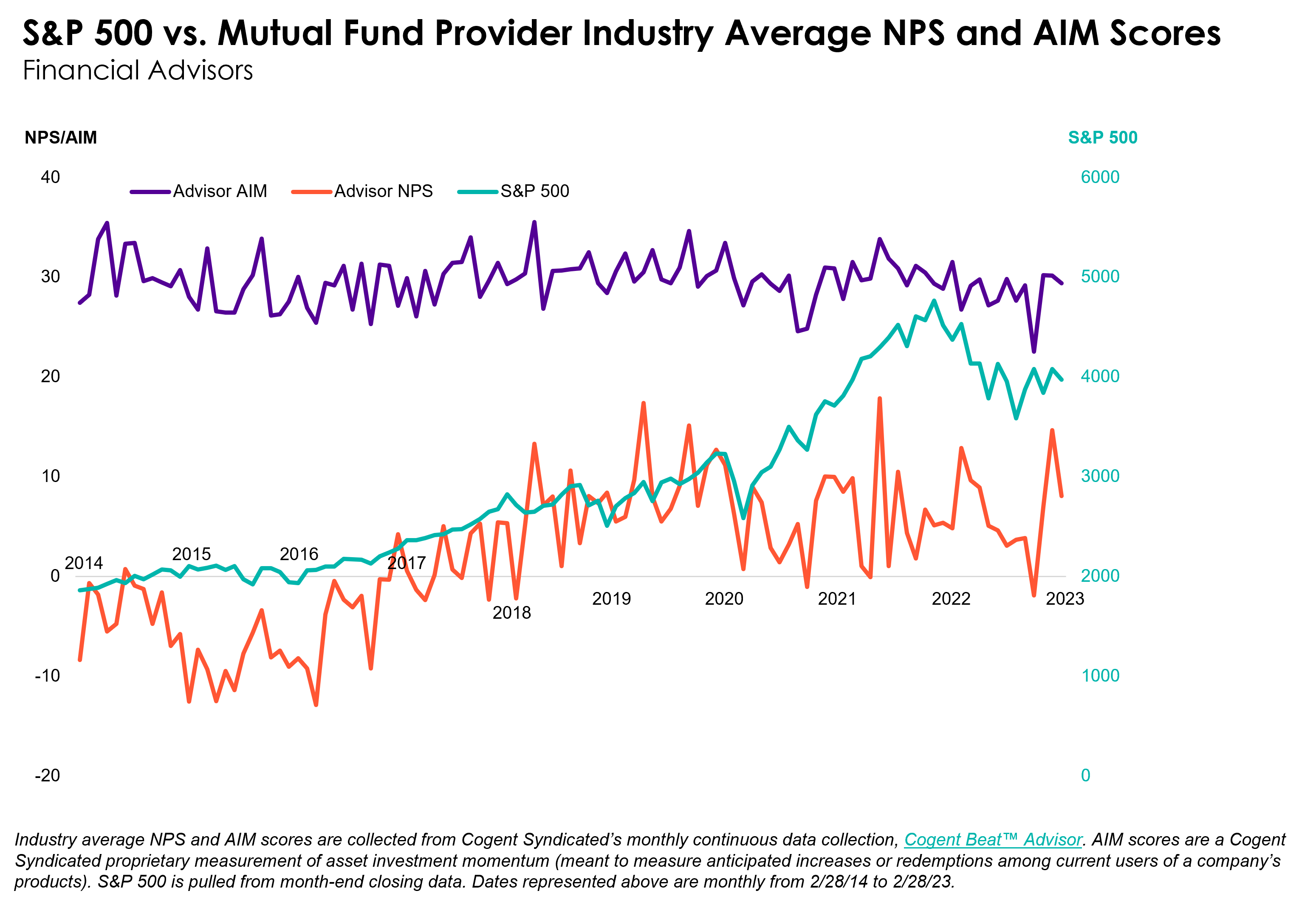

Of course, providers within this industry can’t hang their hats on NPS alone. While NPS gives an indication of customer loyalty, it doesn’t help firms uncover what builds loyalty and what’s holding them back. That’s why Cogent Syndicated examines the drivers of loyalty along with Asset Investment Momentum™ (AIM) scores and other key brand metrics to serve as additional measures of client loyalty in our Advisor Brandscape and Investor Brand Builder reports.

AIM gauges the net effect of expected increases and redemptions for each firm and then indexes the results to 100. Scores from 1 to 100 indicate positive momentum while ratings from -100 to 0 signal negative or flat momentum. When we compare Cogent’s industry average AIM scores among advisors with the S&P 500, we can see there is little to no correlation to the S&P 500, and investor AIM scores show a weak correlation to the S&P 500. With this evidence that asset investment momentum is less impacted by market movements, we believe that AIM should be considered as an additional measure of long-term commitment along with NPS.

Cogent’s 2023 Advisor Brandscape will be available at the end of June 2023. Contact us to learn more.

* The NPS trademark is owned by Frederick F. Reichheld, Bain & Company, and Satmetrix.