As most industry leaders know, winning a spot as the default investment option provider on DC plan lineups can be highly lucrative. The impact it can have on boosting AUM levels can be even more advantageous in the backdrop of SECURE 2.0’s new auto-enrollment and auto-escalation mandates and plan participants’ tendencies to “set it and forget it.”

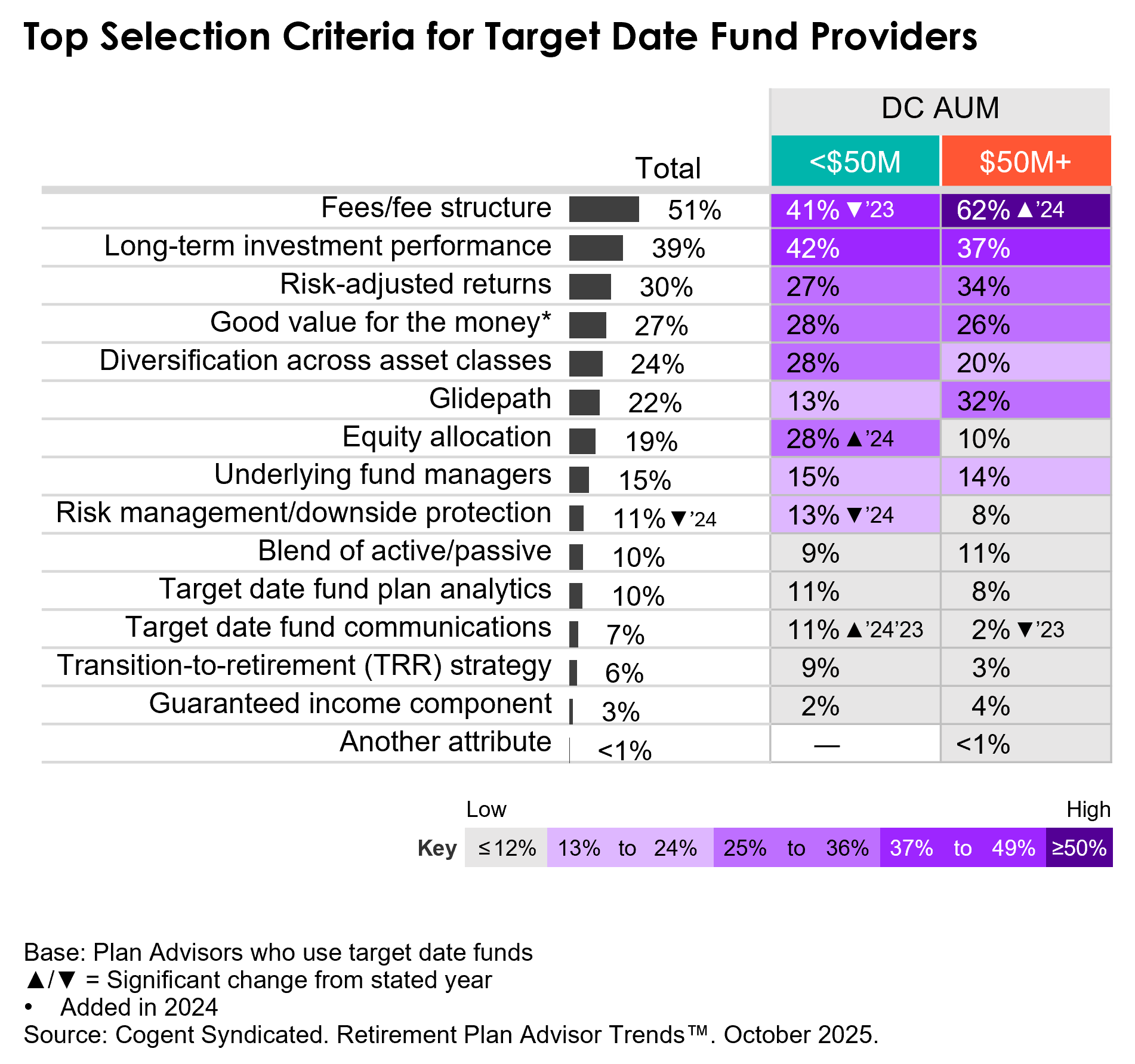

So how do DC investment managers secure the greatest volume of recommendations for target date funds—the most widely used default option—from DC advisors? Luckily, Cogent Syndicated has been tracking target date fund selection criteria for more than a decade in its Retirement Plan Advisor Trends™ study and knows precisely how firms are being evaluated.

Our latest findings reveal fees are increasingly paramount to target date fund provider selection among advisors managing at least $50 million in DC AUM. In fact, more than six in ten $50 million-plus producers are vetting target date fund providers via fees (62%, a notable uptick from 43% in 2024). In contrast, there is less emphasis on target date fund communication within this cohort (2% vs. 9% in 2023).

Interestingly, while still the top criterion, fees are becoming less influential among advisors managing less than $50 million in DC AUM (41% vs. 56% in 2023). There is also less emphasis on risk management within this cohort (13% vs. 27% in 2024). Meanwhile, we are seeing <$50M advisors place greater scrutiny on equity allocation (28% vs. 11% in 2024) and target date fund communication (11% vs. 4% in 2023 and 1% in 2024).

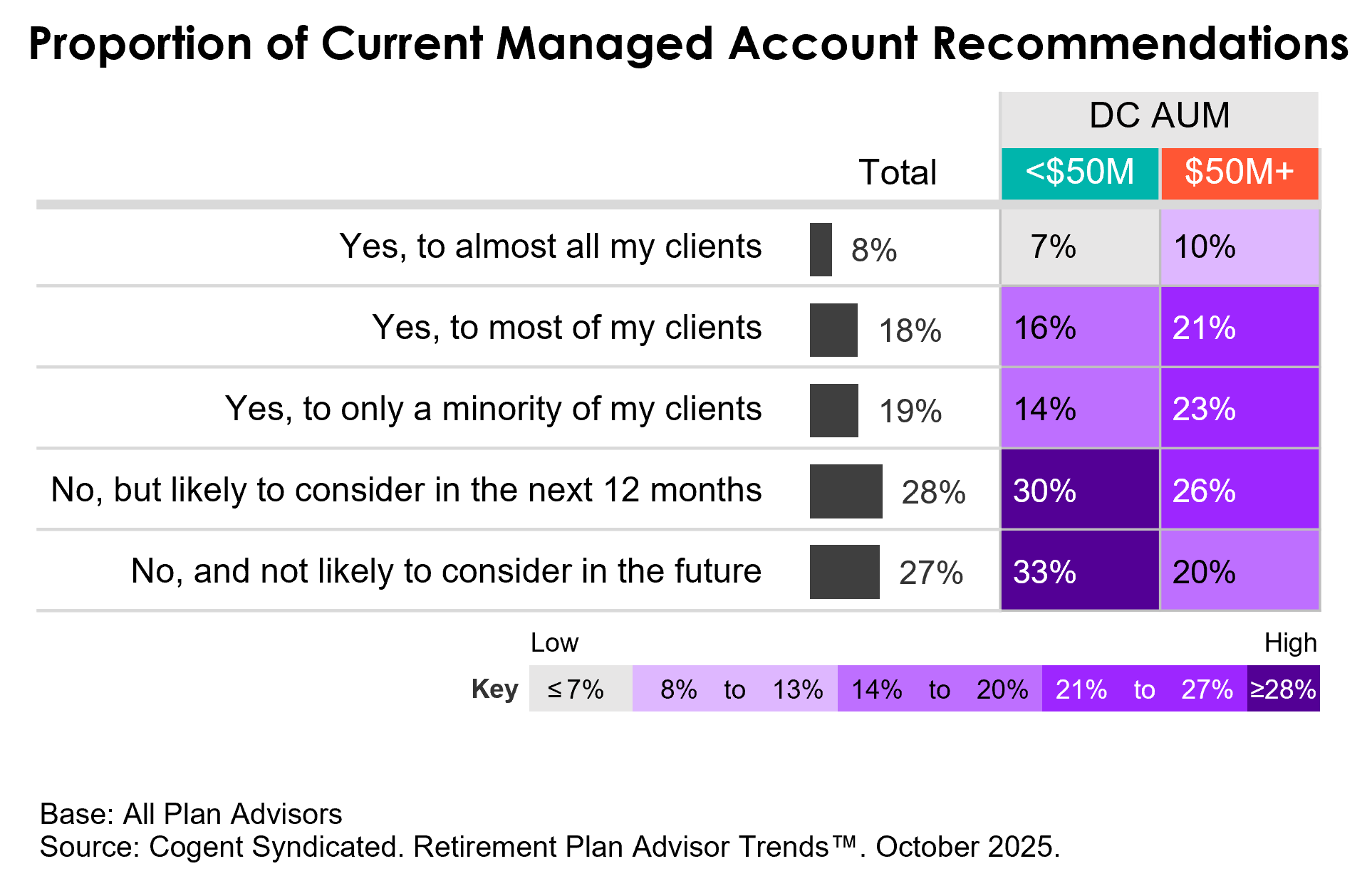

Meanwhile, managed accounts are also gaining traction in the marketplace, with more than half of $50M+ DC advisors (54%) actively recommending managed accounts for plan sponsor consideration in at least some capacity.

In this year’s study, we also thought it would be helpful to ask plan advisors to list the top characteristics they weigh most heavily when recommending managed accounts. As such, when vetting different options, performance and fees garner the greatest volume of unaided mentions, at 46% and 41%, respectively.

“Cost to client. Value the client will receive. Suitability for the client goals.” –Independent, $900M

“Performance. Manager retention. Sticking to mandate.” –Regional, $300M

“Sector exposure, reduced fees, tax-efficiency.” –National, $80M

“Performance. Client risk tolerance. Account value.” –Bank, $2M

Risk management, client account values and participant suitability serve as secondary criteria, with tax-efficiency and customization further mentioned as key factors when selecting managed accounts.

“Customizable, transparent and dynamic.” –RIA, $8M

“Financial acumen. Asset level. Number of participants.” –Independent, $65M

“The options provided are tailored specifically to the participants. The investment menu allows for

adjustments based on market volatility.” –Regional, $20M

“Average participant balance. DIY vs. assisted financial planning. Demand.” –RIA, $135M

While fees and investment performance take center stage, it’s equally vital for firms to understand the myriad of other factors that are also shaping the plan advisor selection process for target date fund and managed accounts and stay on top of the continuously evolving preferences across DC AUM levels and channels.

Cogent Syndicated’s Retirement Plan Advisor Trends report gives firms an in-depth understanding of the attitudes and preferences of the most critical players in the distribution of DC plans to help providers find these and more opportunities to grow market share and strengthen plan advisor loyalty. Click below to learn more.