It’s been three-plus years since I wrote an article on measuring the value of sponsorships, and to this day I still get regular emails and calls about it. Years ago I worked for a large, global CPG company that plowed tens of millions of dollars into high-profile sports sponsorships. While there, I developed a unique interest in the often-ignored measurement of ROI from these sponsorships. Whether it’s due to a lack of research funding because all available dollars were funneled into the campaign, or to potentially protect a pet project of an executive, the area of sponsorships is still often overlooked when organizations measure the effectiveness of their marketing efforts.

The waters of sports sponsorship value are getting even muddier thanks to the changing digital landscape and the ways consumers are choosing, or not choosing, to view media. In 2018, one of the questions our clients most often ask is, “What is the future of sports sponsorships and where should we be spending our money over the next five to ten years?” Telecom providers, some of the largest sports sponsors, are particularly aware that the world is shifting from traditional television to web- and app-based media offerings. What does this shift mean as they look to position their brands in front of fans?

To get a better understanding of the value of sports sponsorship, the telecom research division of Escalent conducted an omnibus study of 2,000 consumers in the US. The study explored awareness of digital and stadium sports sponsorships and the impact they have on brand.

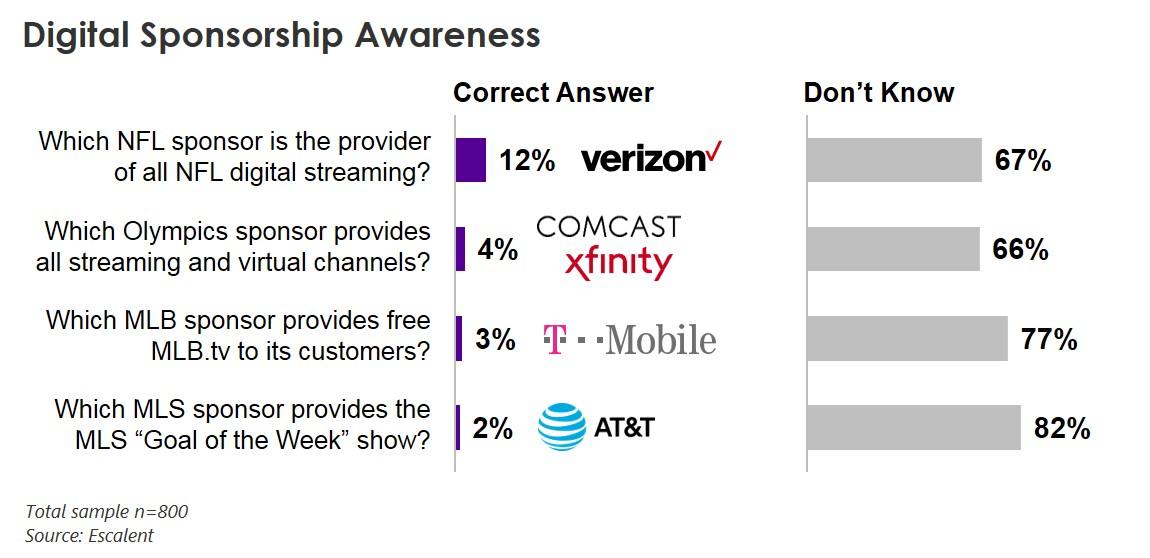

Digital has some way to go

Unfortunately, the news is not great (at least not yet) for the telecom companies that are shifting sponsorship dollars towards digital channels. Our research shows that basic awareness of some of the more visible digital sponsorships is really low, with as little as 2% of consumers correctly identifying the major telecom sponsor. Verizon has the highest awareness (12%) for its sponsorship of NFL streaming, which aligns with its tenure as an NFL sponsor and the larger audiences that the NFL obtains. The other telecom providers have just single-digit awareness of their digital endeavors, with other non-sponsor brands often scoring higher and at least two-thirds of respondents simply not knowing.

How does traditional sports sponsorship stack up?

We measured the telecom sponsorships of four sporting venues, intentionally selecting different sports and different cities:

- AT&T Field, home of the San Francisco Giants (MLB)

- CenturyLink Field, home of the Seattle Seahawks (NFL)

- Spectrum Center, home of the Charlotte Hornets (NBA)

- T-Mobile Arena, home of the newly formed Vegas Golden Knights (NHL)

The first measure of any sponsorship study—awareness—produced some interesting results. Nationally, sponsorship awareness levels are fairly low, with AT&T Park scoring highest with awareness amongst 1 in 5 US consumers. But get down into the host cities where the venues are actually located, and everything changes—94% of consumers in Seattle know who the sponsor of their NFL stadium is, and even in Las Vegas, where the T-Mobile Arena only opened two years ago, 4 out of 5 residents are aware who the sponsor is.

From Awareness to Emotional Value

But awareness is just the starting point. The real value of sponsorship research is in understanding whether the sponsorship creates an emotional and behavioral change within its target audience. Our research provided some remarkable findings regarding the linkages between the sponsorships and the perceptions of that brand’s place in their community, and how traditional sports sponsorships drive emotional value that digital sponsorships will struggle to replicate.

To see all the findings of the research, take a moment to download our newest white paper, The Emotional Value of Sponsorships. Learn about the additional value that these four major telecom brands are realizing from their sponsorship investments, and to get a checklist for choosing the sports venue that will deliver your brand the greatest ROI.

Click below to download your copy of The Emotional Value of Sponsorships.