After a family member returned from a mission trip abroad, I recently found myself in the stomach upset aisle at a nearby Target. My family is a relatively healthy bunch with solid constitutions, so this aisle was an unfamiliar space. I had consulted a variety of resources to inform my decision as to which product would ease the distress happening in my home—these sources varied from WebMD, mayoclinic.org and a call to the on-call nurse at the office of my loved one’s physician. Armed with some solid advice, I stood in front of a vast offering of products that promised to ease symptoms and curb the duration of the distress. Once I narrowed in on the product I felt would best aid my loved one, I had to make a decision… national brand (NB) or private label (PL)?

Sure, the NB is very familiar to me but it’s also expensive. What if it doesn’t work? I’ll be right back in this aisle tomorrow and I’ll be out $15 dollars—not a ton of money to some but if the product doesn’t ease the symptoms, the money spent will be wasted. So next I examined the PL product that was available right next to the NB and available at a fraction of the cost. While I might be saving money with the PL product, what if it doesn’t work because it doesn’t have the same quality of ingredients as the NB? I can’t be the only person standing in a pharmacy aisle overwhelmed by all the offerings.

Perhaps I’m overthinking it? But overthinking is what we researchers do, so I decided to dig deeper to better understand how PL impacts consumer perceptions and preferences of NB.

In an effort to find more information, I read Daphne Howland’s article for retaildive.com titled Private Labels Outpacing National Brands that mentioned a study from the Private Label Manufacturers Association (using data from Nielsen). Ms. Howland mentioned that PL availability at mass retailers, club stores and the like rose 33.2% over the past five years. That’s astonishing given that NB products gained less than 1% in the same time frame. With the influx of PL (and a relatively flat trend in new NB SKU entries), it’s no wonder that consumers can be overwhelmed.

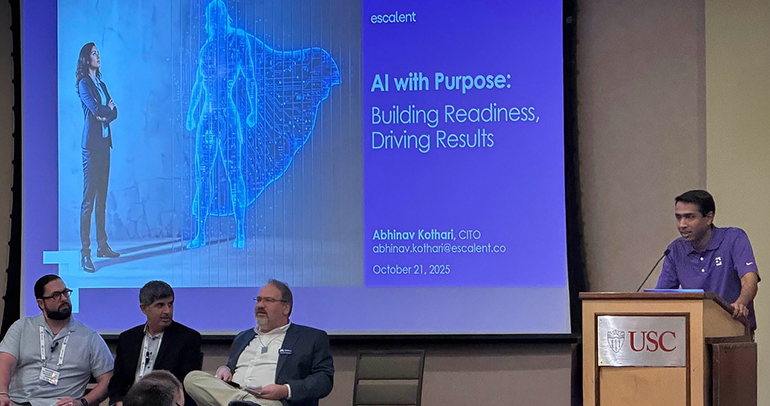

So now more questions, but I’m lucky that I work for a company that believes in self-funded research. At Escalent (formerly Market Strategies and Morpace), we have a deep understanding of the consumer health space, so I was confident that with a little digging, I would have a dataset that could help satisfy my curiosity.

I found just the research I was looking for. My colleagues conducted a self-funded qualitative study aimed at understanding some basic ideas behind perceptions of what drives NB versus PL use so that consumer healthcare manufacturers can better strategize further research and tactics. Here are the key takeaways from that study:

- Most consumers are aware of both NB and PL products regardless of categories.

As I stood in the pharmacy aisle, I saw many familiar NB products (and their PL counterparts), familiar either because they are well-known brands or because of the research I had done prior to entering the aisle. Because the brand names were known to me, familiarity, which often helps a product grab attention on a shelf, was of secondary importance to me.

- Experience with PL is broad and consumers are comfortable with PL offerings.

I have purchased many PL products in the past. My experience is that they have similar efficacy and save me a few dollars. However, I can understand the hesitation in purchasing a PL product if you had limited experience with PL products in the past.

- The seriousness of the symptoms and familiarity with conditions play a big role in deciding what to purchase.

When you’re in unfamiliar territory in terms of condition and urgency of relief is of utmost importance, then the last thing you want to do is consider NB vs. PL—you just need to pick one and move on. As I think back, I was not willing to risk poor efficacy (regardless of NB or PL) just to save money.

- Consumers believe that while the products inside the box are the same, and in some cases, even from the same manufacturer, NB products offer “something more” than PL.

- This study also found that most consumers (falsely) believe that NB and PL products are the same in that they are made by the same manufacturer. In their minds, if the products are from the same manufacturer, why pay more for the label on the NB box?

- Perhaps it’s the inherent “something more” which was consistently associated with NB, but what this “something more” is was not easily communicated.

- In this study, consumers tended to identify NB products with being eye-catching, expensive and reliable, and identify PL products with simplicity, being functional, and cost savings. I recognized during my trip that NB products tend to be more colorful and included pictures and creative fonts on the packaging while PL products were much less visually dynamic.

If consumers think PL products are made by NB manufacturers, what can NBs do to be the go-to product for consumers standing in the aisle?

The study identified several factors that heavily influence that decision—brand loyalty, variety of options available to meet the specific need, onset of action (works faster), and trust in the science backed by the NB name.

NBs can encourage preference for their brand over PL products by tackling several traditional marketing levers:

- Strongly consider cost—coupons, sales and competitive pricing.

- Develop messaging for proof of better efficacy. Consumers are well-educated and armed with information. News stories comparing brand to generic are common and consumers are not afraid to do their own research online. Messaging around the benefits of NB may help convince consumers.

- If possible, capitalize on natural ingredients and social responsibility trends. Women, especially mothers, are increasingly concerned about what they are putting into their and their family’s bodies. Chemicals and dyes are becoming taboo while holistic approaches and environmentally friendly solutions are becoming more popular. An added benefit of this strategy is that consumers are willing to pay a premium for products that are socially responsible, such as packaging that will not harm the environment.

Is there an opportunity to do something more? I think so. I consulted various resources prior to my trip to the pharmacy aisle, including asking an HCP for advice—and I’m not alone in taking that step. According to a new self-funded study, 32% of consumers do the same when trying to treat a minor illness and before heading to the doctor’s office for professional help. Consumers like me also find HCP advice to be highly influential when deciding which over-the-counter product to buy. Perhaps this is another avenue for NBs to vigorously pursue so that their brand is the brand that HCPs advocate. I know that if an HCP had said, “try this brand or that brand, as it has the best results for quick relief of symptoms,” I would have had no issues with finding that product and heading home, confident in my purchase.

If you would like to know more about why engaging with HCPs is crucial to your marketing strategy, download HCP Influence: An open opportunity in OTC product marketing.