When it comes to guaranteed retirement income, advisors are the primary obstacle between affluent investors and products that are specifically designed for that purpose. The current economic climate is making affluent investors feel increasingly uncertain and anxious. In fact, many affirm that their top priority is to ensure they don’t run out of money in retirement. Yet most financial advisors continue to turn to annuities for accumulation objectives including stable returns, downside risk protection and tax deferral, choosing to employ other strategies with different investment products to generate retirement income for their clients. So why the disconnect?

The Financial Advisor Perspective

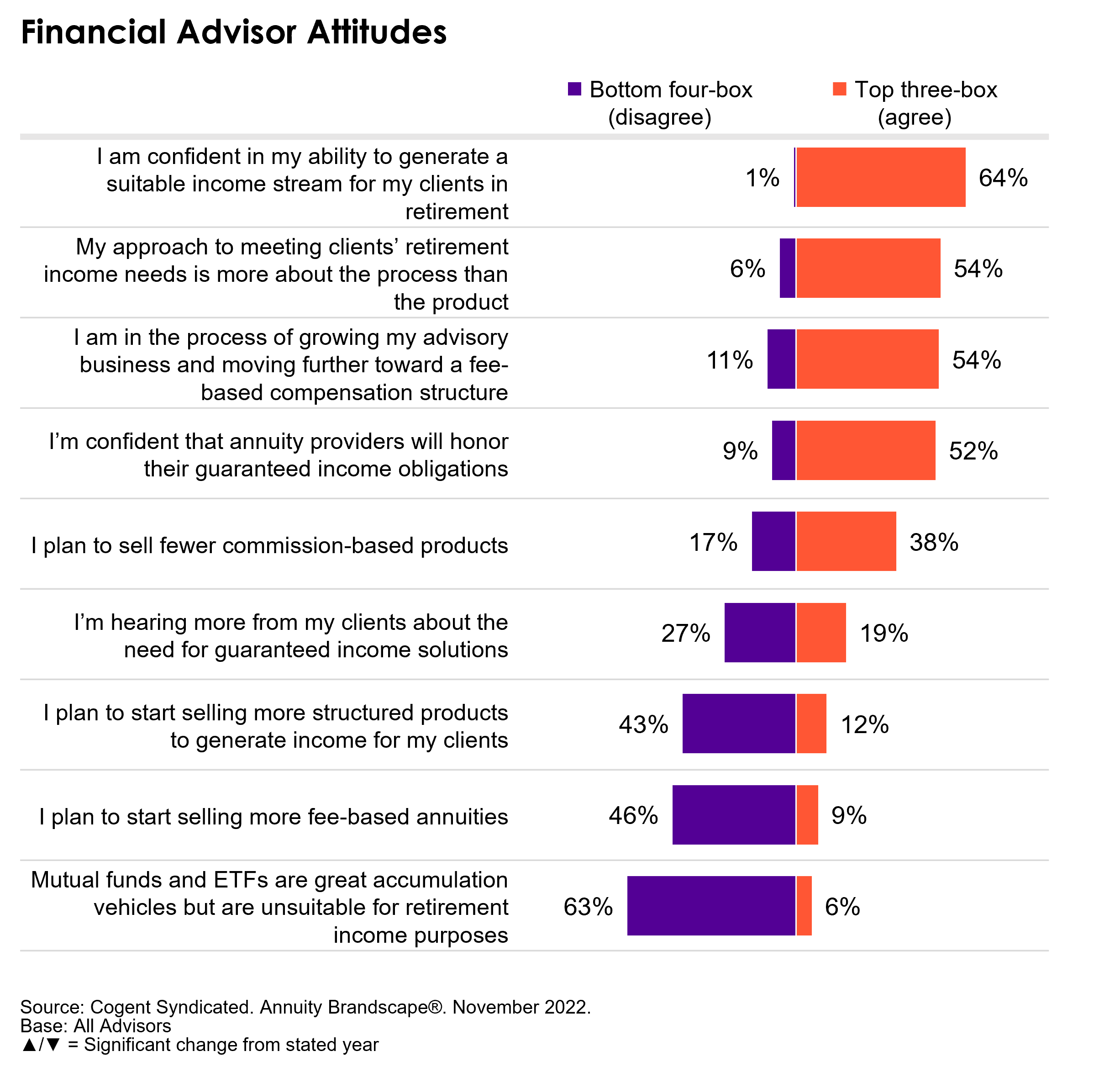

Advisors remain pessimistic about the way the economy is going, with concerns about inflation, an economic slowdown and pending government decisions. Given the current market, fixed and fixed indexed annuities are notably more popular right now than in the past as advisors and their clients seek “safer” investment vehicles as insurance for protecting a portion of their assets. Yet when it comes to retirement income, annuity providers continue to face a formidable challenge in convincing the majority of advisors of the value and benefit of annuity products over solutions advisors could design with other types of investment products.

A majority of advisors do not see the need for or benefit of guaranteed income products for their clients’ portfolios. In fact, two-thirds of advisors are highly confident in their ability to generate income streams for their clients in retirement, seemingly comfortable using mutual funds, ETFs, and other similar investment products. In contrast, just one-fifth (19%) of advisors indicate hearing a need for guaranteed income solutions from their clients.

The Affluent Investor Perspective

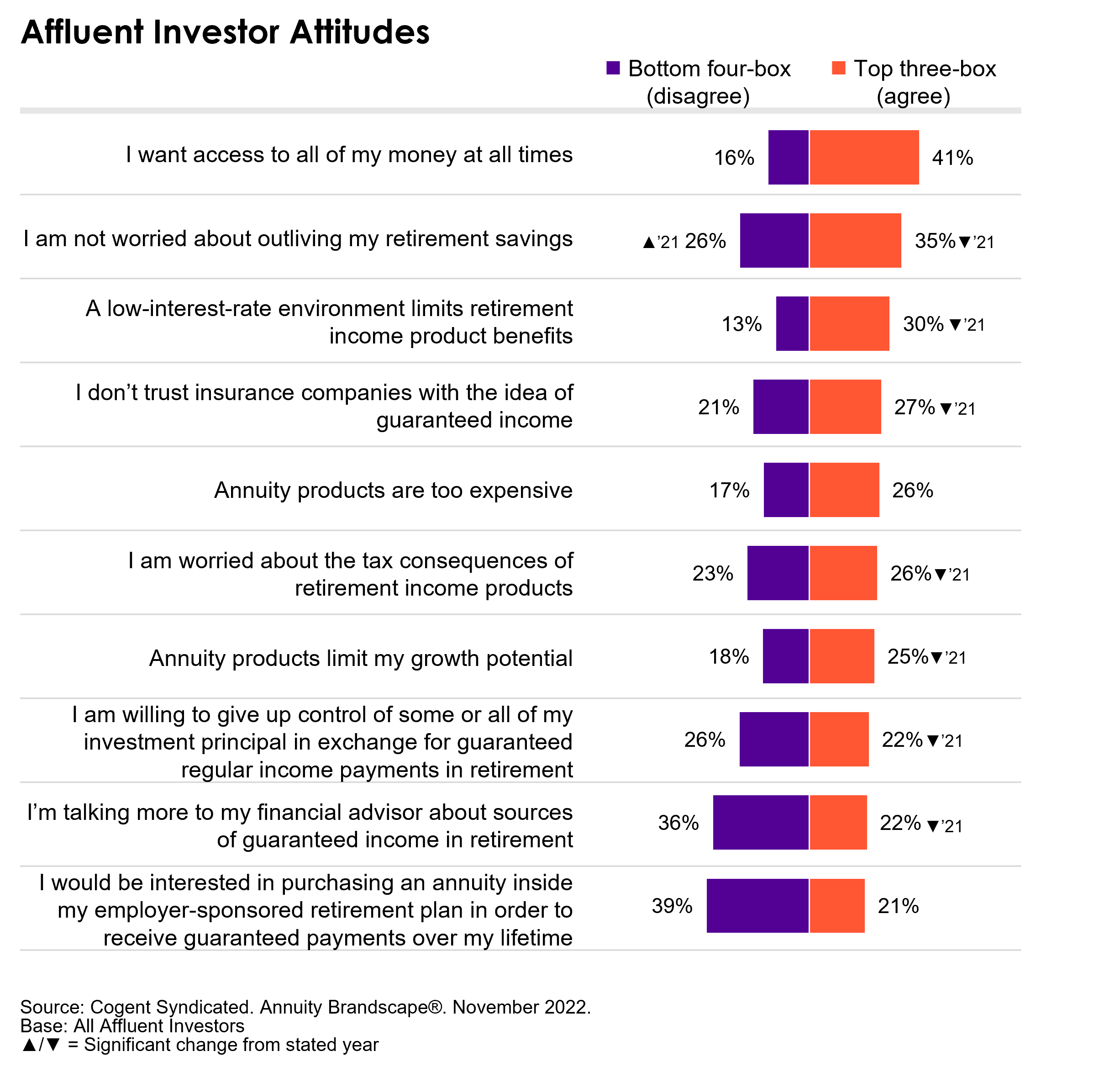

Inflation continues to be the leading concern of affluent investors with respect to their investments and financial health, followed most closely by government/administration oversight and stock market volatility. Affluent investors are also increasingly concerned about outliving their retirement savings. In fact, across all generations, affluent investors seek assurance that they won’t run out of money in retirement. Positively for the annuity industry, fewer affluent investors express distrust in insurance companies or concern about the tax consequences and growth potential of annuity products this year. That said, the trade-off of giving up control of principal in exchange for guaranteed income payments remains a tough sell for many.

From multiple perspectives, the climate is ripe for annuity providers to shine. Rising interest rates make product guaranteed rates more attractive, market volatility increases the appeal of downside risk protection, the inherent need for a guaranteed income stream for life is becoming more relevant, and the ever-present benefit of tax-deferral should be the icing on the cake. In order to succeed, annuity providers need to address the barriers to purchase head-on with a clear understanding of not only their competitive standing versus other insurance carriers, but also the expanding landscape of substitute investment products that are competing for potential assets.

As the demand for retirement income solutions accelerates, Cogent Syndicates’s Annuity Brandscape® report provides a holistic view of the annuity landscape. To learn more about the report, click below.