Financial advisors are poised to play a pivotal role as $90 trillion is expected to transfer between generations over the next two decades. As the Great Wealth Transfer unfolds, advisors have an opportunity to help families transition assets across generations efficiently and with minimal disruption. While advised affluent investors (defined as those who work with advisors) are not significantly different from their self-directed peers in terms of gender, assets, marital status or income, the former stand out in one crucial way: preparation.

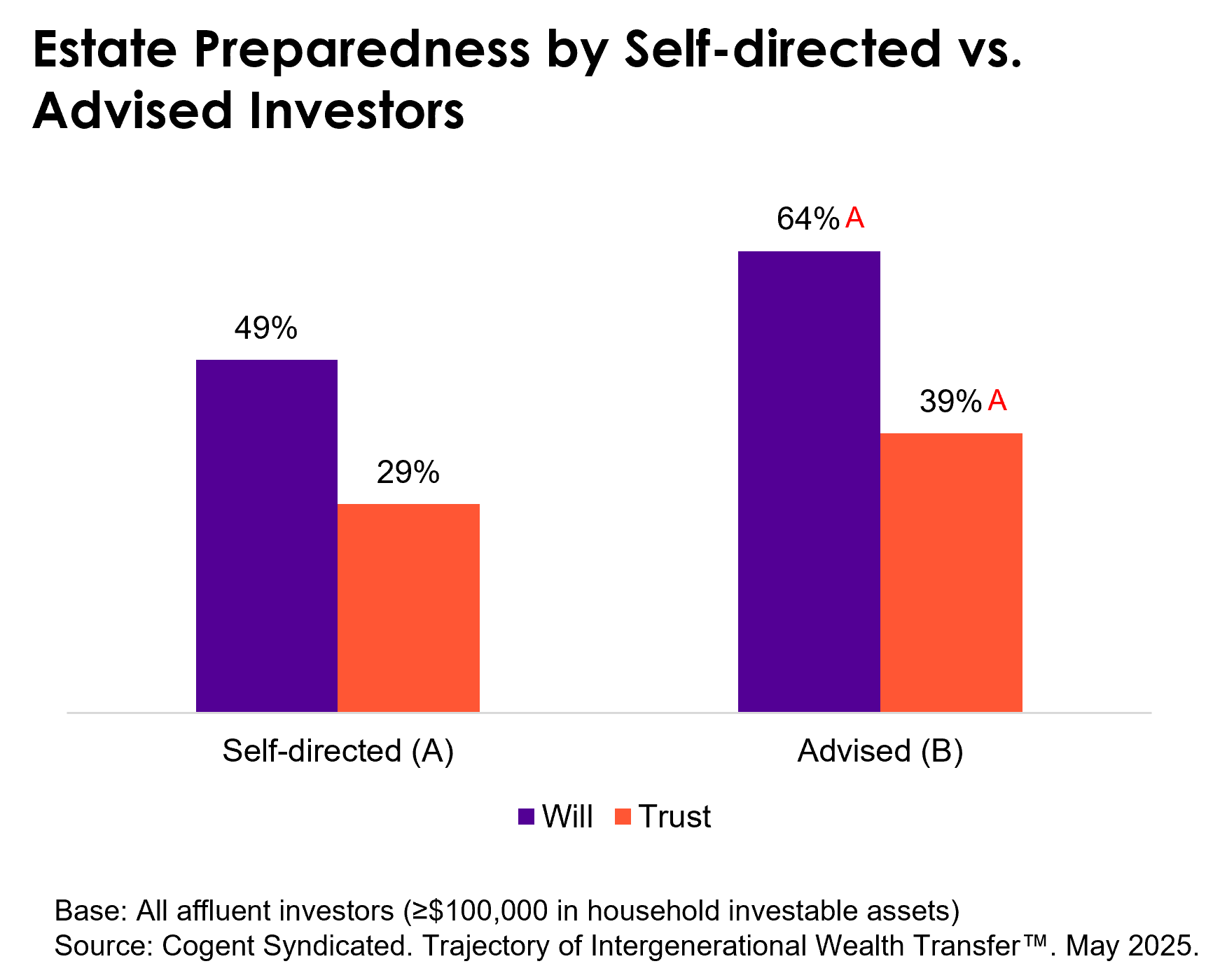

According to Cogent Syndicated’s new Trajectory of Intergenerational Wealth Transfer report, affluent investors working with advisors are much more likely to have essential estate planning tools such as wills or trusts in place, ensuring smoother transfers and preservation of more wealth by reducing probate fees and taxes.

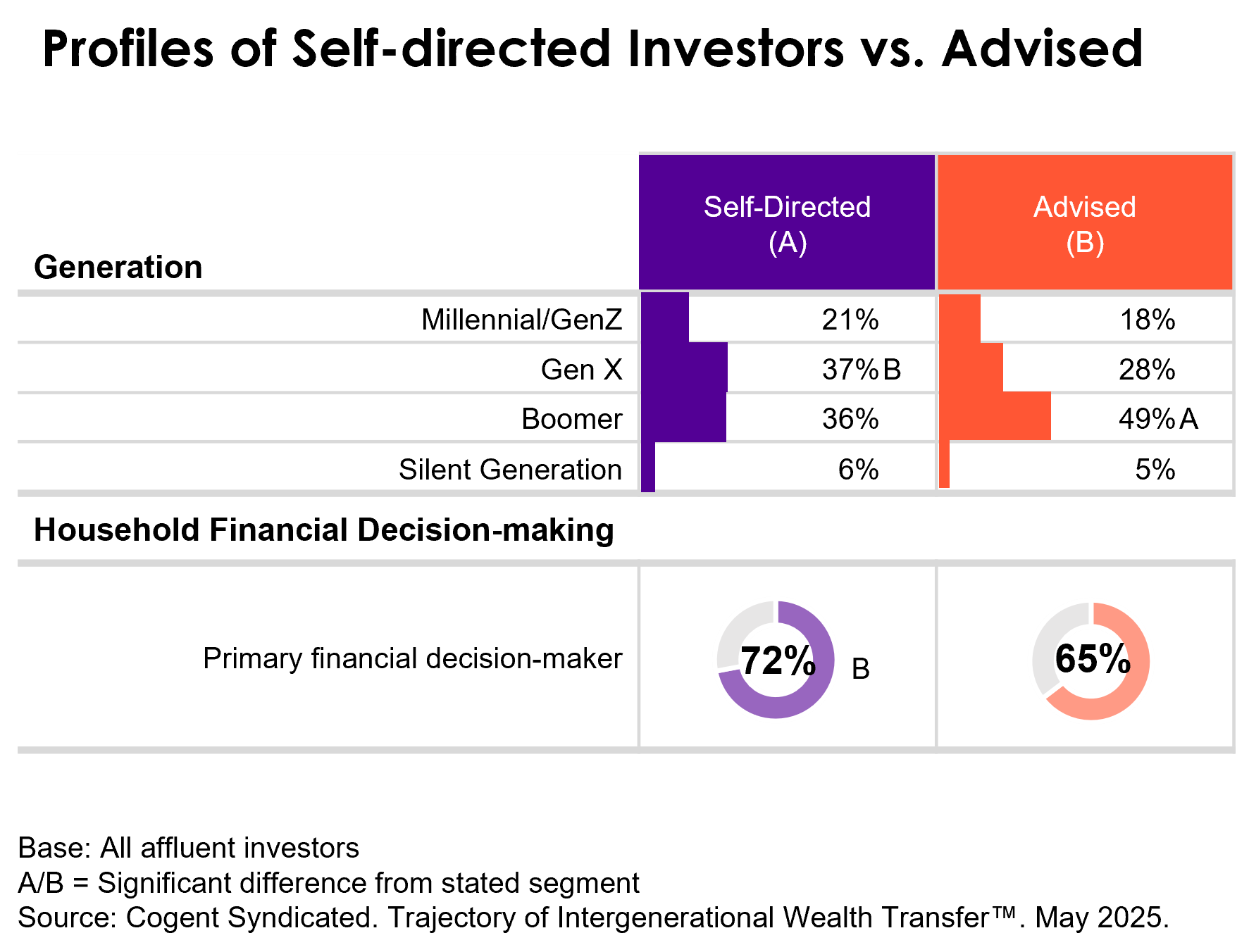

This demonstrates an opportunity for firms to step in and help self-directed investors. But who are they? These individuals—often Gen X and their household’s primary financial decision-maker—may prefer independence, but they can also benefit from professional guidance, especially in complex wealth transfer scenarios.

How Can Wealth Management Firms Reach Self-directed Investors to Offer These Services and Secure Their Financial Futures?

Self-directed investors have a few key characteristics when it comes to communication styles.:

- They prefer digital-first touchpoints (emails, websites).

- They value communication that allows them to stay “in the driver’s seat.”

- They are less likely to have established estate plans than their advised counterparts.

Advisory firms must do a couple of things to effectively reach out to the self-directed population. First, firms must offer tailored digital content that answers questions about trusts, taxes and family legacy planning. Second, firms must create self-serve resources that enable self-directed investors to learn and act autonomously, with options to schedule consultations with advisors if and when these investors are ready.

The Opportunity for Asset Managers in the Great Wealth Transfer

The evolving investment landscape presents a clear opportunity for asset managers. As more wealth moves between generations—often to heirs with different values, investment preferences and technological expectations—firms that adapt their communication and platforms will be best positioned to retain assets and grow relationships with clients.

Three Key Strategies for Asset Managers to Thrive in the Great Wealth Transfer

- Enhance digital engagement: Support both advised and self-directed investors with robust, user-friendly digital platforms to keep their organization top-of-mind across all investor types.

- Personalize communication: Develop segmented messaging and resources that address the needs of investors as they go through the process of creating and maintaining an estate plan.

- Collaborate with advisors: Partner closely with financial advisors to develop estate planning tools, workshops and educational series aimed at multigenerational families.

Ultimately, asset managers who bridge the gap between self-directed control and professional guidance—empowering both investor types—stand to benefit most from the great wealth transfer. Cogent’s Trajectory of Intergenerational Wealth Transfer can equip asset managers with insights, tools and narratives that resonate now to capture assets before they move.

To learn more about Cogent’s Trajectory of Intergenerational Wealth Transfer research, click below.