Editor’s Note: Cogent Syndicated’s annual Advisor Brandscape® report has just published—read on for a sneak peek at the introduction to the report.

While advisors are feeling bullish in their market outlook, they continue to feel uneasy about broader economic conditions, with geopolitical events, the upcoming US election and inflation persisting as concerns. Advisors are turning to low-cost ETFs for core holdings while increasing their use of alternative investments and actively managed US investment strategies in the hopes of capturing higher returns and providing further diversification amid a rapidly changing investment environment.

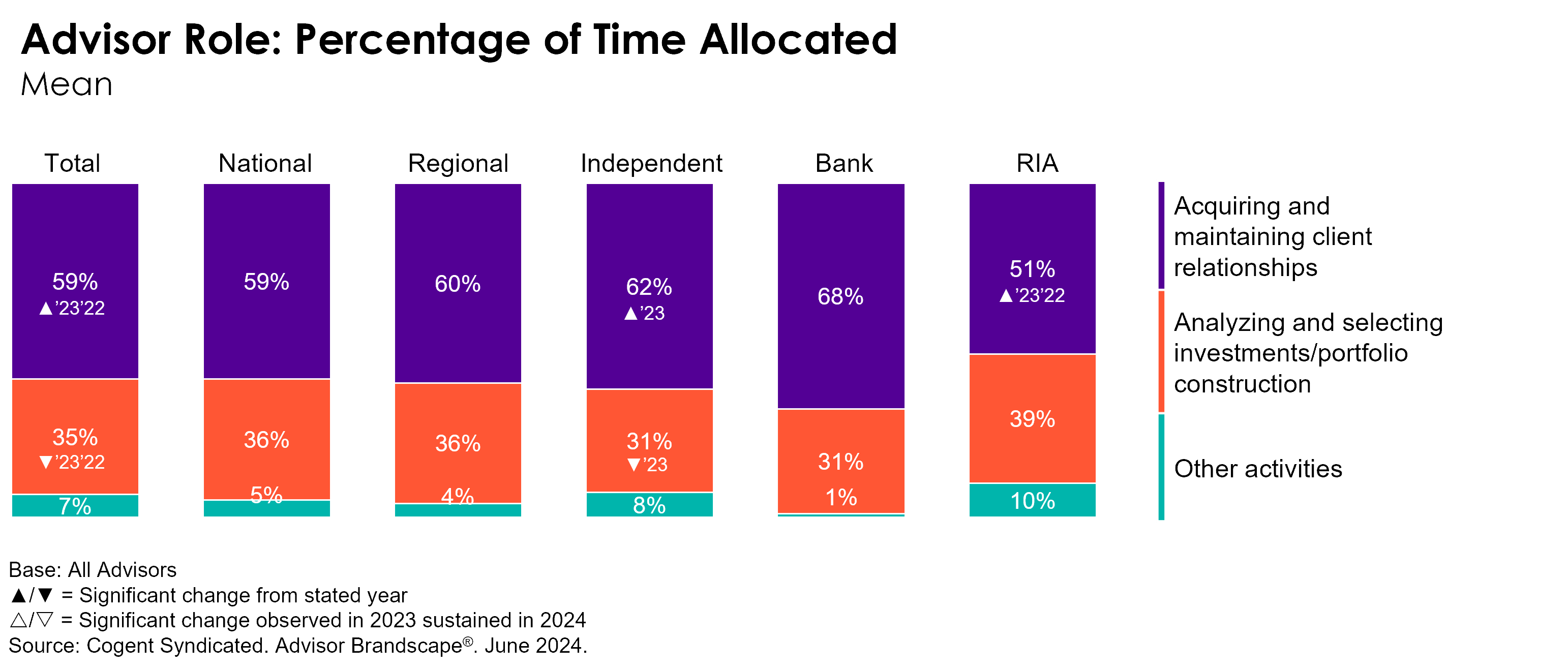

Advisors’ roles are evolving to meet the complex challenges of their clients, with more of advisors’ time being spent on client engagement and holistic financial planning and less on portfolio construction and investment selection. In fact, this year’s Advisor Brandscape® report from Cogent Syndicated shows that advisors are spending 59% of their time, on average, acquiring and maintaining client relationships (up from 56% last year), with Independent advisors and RIAs primarily contributing to the overall increase in focus in this area.

As the industry prepares for the greatest wealth transfer in history, advisors are reaching out to their clients’ family members to discuss a wide range of financial issues including investment advice, retirement planning, estate planning, tax planning as well as other financial planning basics. Asset managers have an opportunity to support advisors with client educational materials related to those expanding needs, in addition to delivering tools, services and insights that aid advisors in the investment process so they can spend more time demonstrating their value to clients.

Asset managers are increasingly focused on promoting a single corporate brand that aligns products and capabilities under one brand name, giving firms flexibility to extend into other areas. This allows firms to focus resources on communicating a clear, consistent message for how they deliver value and create an emotional connection with clients that goes beyond product offerings. The challenges and desired outcomes in shifting to a unified, global brand vary by firm; however, communicating trust and guidance is paramount in the advisor market. Few firms outside of the largest asset managers earn strong associations in advisor-support-related areas, pointing to an opportunity for messaging in this area.

Cogent’s annual review of trends in the US advisor market helps asset managers in defining their unique value proposition as product-related marketing takes a back seat to broader relationship-oriented themes. Our goal, as always, is to help firms understand the marketplace, define their place in it and identify their best opportunities to compete. To learn more about the Advisor Brandscape® report, click below.